If U.S. lawmakers fail to increase the country’s borrowing limit, a recession resulting in millions of jobs lost could follow.

A Senate panel will hear this warning from Moody’s Analytics chief economist Mark Zandi on Tuesday, according to The New York Times (NYT).

In a prepared statement before his meeting, Zandi wrote that failing to raise the debt limit could lead to seven million lost jobs and a financial crisis similar to the Great Recession in 2008. If Congress comes to a deal to raise the debt limit, the damage could be limited to a “mild recession” and roughly one million jobs lost, according to Moody’s report.

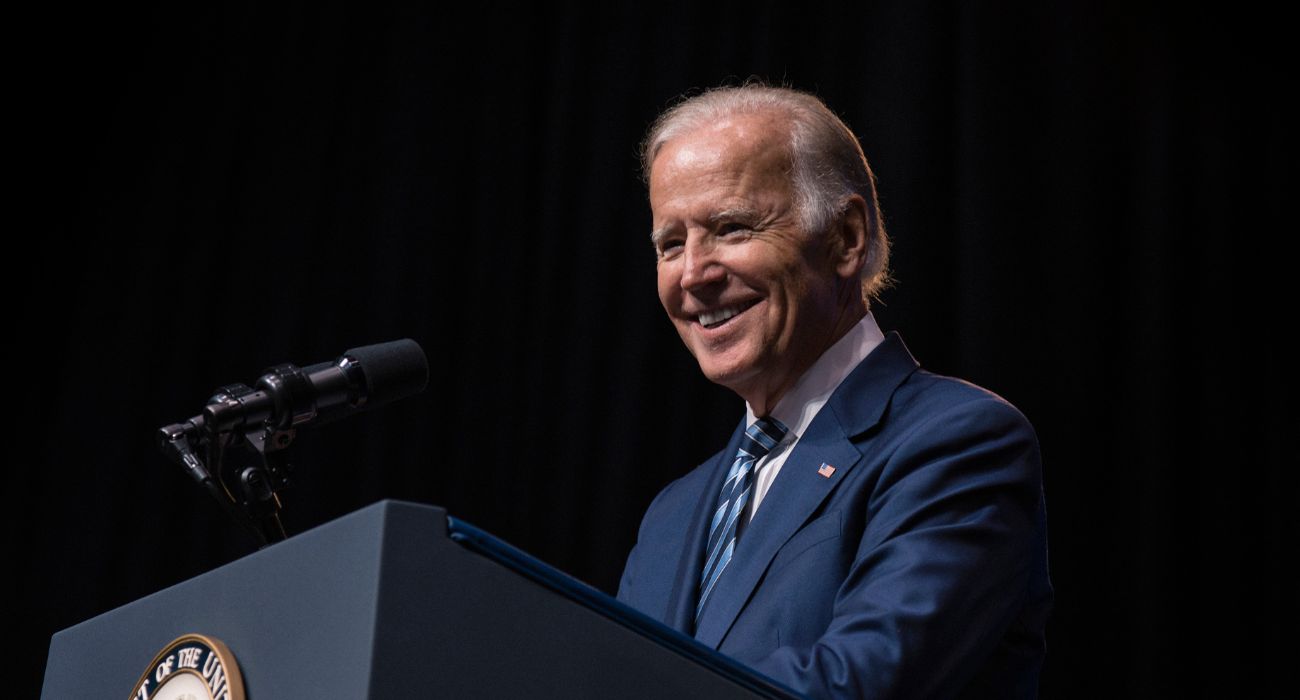

But House Republicans remain steadfast in pursuing a cut in spending from President Biden in exchange for their votes to raise the debt ceiling, according to the NYT.

President Biden will release his budget proposal on Thursday. The proposal is expected to reduce the country’s dependence on borrowed money by increasing taxes on corporations and high-income individuals, according to the NYT.

Still, his concessions will likely not match the level of spending reduction that would result in a balanced budget in the next 10 years, a measure House Republicans are calling for.

House Speaker Kevin McCarthy (R-CA) has called for limits on new discretionary funding, and Rep. Chip Roy (R-TX) has urged for steep cuts in budgetary spending.

“Republicans in the House have seemingly dug in their heels, but they can still back down if they are losing the political fight or the negative prospects of a threatened or actual default are too large,” David A Bateman, an associate professor at Cornell University, told The Dallas Express.

“The easiest off-ramp for them would be to pass legislation allowing the president to unilaterally raise the debt ceiling and then allow Congress to disapprove of this in an inconsequential way,” Bateman said.

Zandi’s report warned what could happen if Biden agrees to concessions to avoid a government default.

The analyst said that if concessions were to come to fruition, it would push the economy into a recession next year and cost 2.6 million jobs, pushing the unemployment rate to around 6%.

Zandi will testify before the Economic Policy Subcommittee, where Senator Elizabeth Warren (D-MA) will hold a hearing on the debt limit and its implications, according to the NYT.

“The only real option is for lawmakers to come to terms and increase the debt limit in a timely way. Any other scenario results in significant economic damage,” said Zandi, per the NYT.

Notwithstanding the debt limit, the economy is already facing recession fears, with the Federal Reserve still in pursuit of checking persistent inflation. The inflation rate was 6.5% in 2022, according to the U.S. Bureau of Labor Statistics.

Senator Warren cited Zandi’s report in a letter to the White House this week and called for the President to stand his ground against Republicans’ calls for spending cuts and instead ask for a debt ceiling increase, the NYT reported.

In January, the U.S. government hit its $31.4 trillion statutory debt limit, according to Reuters.

As for Zandi, he recommends eliminating the debt limit altogether.

“I just think you want to break that cycle once and for all as best you can, because it’s very counterproductive,” he told the NYT.

The debt ceiling is the only thing we have standing between the American taxpayer and Congress’ spendthrift ways. That includes Republicans, most of whom are little better than Democrat Lite, when it comes to spending.

A default could cause millions of jobs (many of them government-paid jobs) and might also finally remove the dollar from the list of world reserve currencies, but it would also make it that much harder for politicians to run endless deficits that will be paid for by our grandchildren.

I agree that we need to take concrete steps to start reducing the debt with the goal of eliminating it, and that needs to happen now! It should be part of this and every budget.

You don’t give congress anymore money until they explain how over 100 billion in Covid relief just disappeared. These people in DC have rapped the citizens of this country!

“$31.4 trillion statutory debt limit”

I’m really old.

I never ever thought that I would see the word “trillion” in the national debt.

It is insanity and not sustainable. Everyone knows this.

I agree.