The multi-national investment management company BlackRock has engaged lobbyists to advocate for its interests in the Texas Legislature this session amidst a push by state lawmakers to further restrict assets entrusted to the State of Texas from being invested in companies that practice ESG investing.

Many ESG (environmental, social, and governance) investments are driven by a commitment to force a transition to renewable energy by boycotting the oil and gas industry, which is a major source of funding for Texas public schools and state employee pensions.

BlackRock, which offers its customers ESG investments and asset management, retained the services of three Texas-based lobbying firms: Sampson Public Affairs, Spreen Consulting, and Ancira Strategic Partners, according to the American Accountability Foundation (AAF).

“While we begrudge no individual in making an honest living, and are sure Blackrock pays healthy fees, we believe protecting the conservative Texans livelihoods and pensions ought to be a higher priority,” reads a research memo by the AAF to state legislators dated April 20.

As previously reported by The Dallas Express, controversy over BlackRock’s continued management of billions of dollars in assets for the Texas Permanent School Fund (PSF) Corporation resulted in the abrupt announced retirement of the organization’s CEO after he received criticism from the Texas land commissioner, who sits on the PSF Corporation’s board of directors.

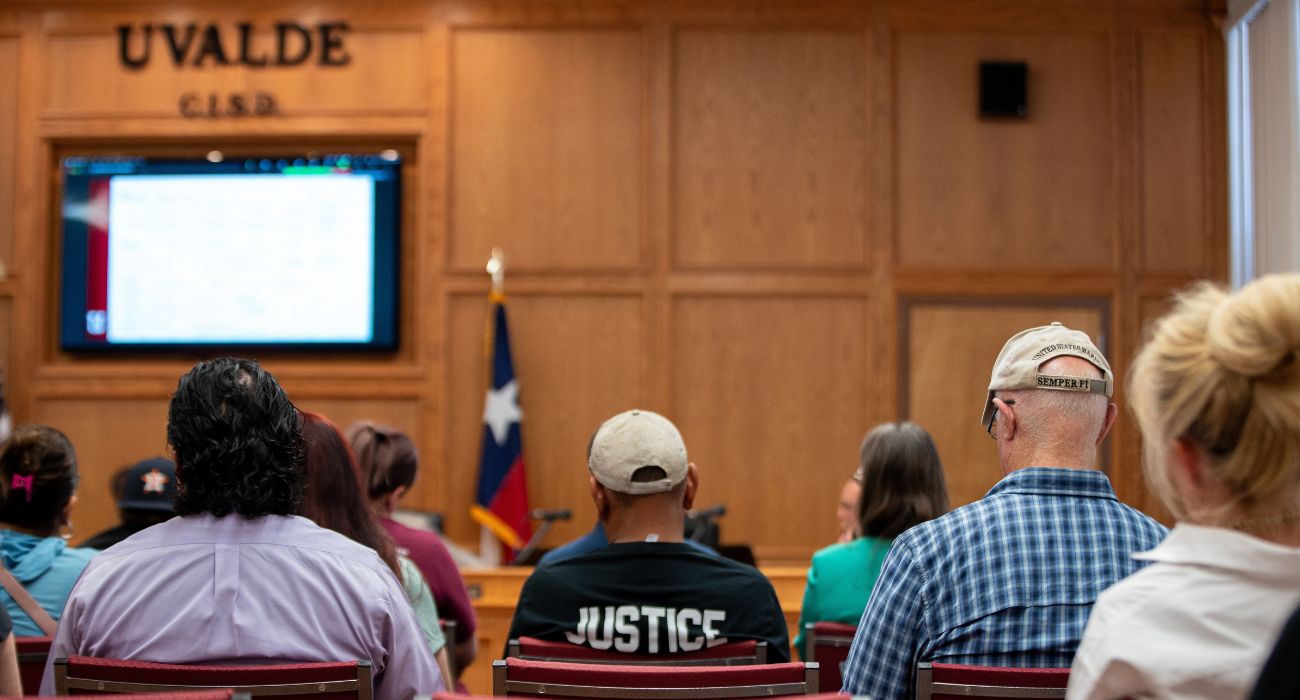

“Oil and gas revenue is the majority of this fund, and voting against oil and gas will hurt the majority of this fund,” Land Commissioner Dawn Buckingham said at a meeting of the board last month, commenting on the PSF Corporation’s seeming trepidation over jettisoning BlackRock entirely, even after Texas Comptroller Glenn Hegar designated the company a boycotter of oil and gas.

Per state law, barring some exemptions, “A state governmental entity [is] required to sell, redeem, divest, or withdraw all publicly traded securities of a listed financial company [designated a boycotter of oil and gas].”

The AAF research memo noted how the three lobbying firms were also representing the interests of companies that have been targeted by ESG investing, suggesting their advocacy could signify a conflict of interest between their different clients.

“We encourage you to send a message to these firms that until they show BlackRock and their oil & gas hating policies the door, don’t come knocking on your door for a meeting whether it is about BlackRock or one of their other clients,” the AAF memo reads.

In response to previous rounds of criticism, BlackRock has defended ESG investing as part of a sound fiduciary strategy.

In a September 2022 response to 19 state attorneys general who raised concerns over the practice, BlackRock claimed, “As prudent risk managers and stewards of our clients’ assets, it is imperative that we seek to understand and assess how these risks and opportunities will impact the companies in which we invest on our clients’ behalf. Consequently, BlackRock encourages companies to provide investors with high-quality, globally comparable climate-related disclosures.”

The letter asserted further that “BlackRock’s belief that climate risk poses investment risk is backed by our publicly-available research.”

Trackbacks/Pingbacks