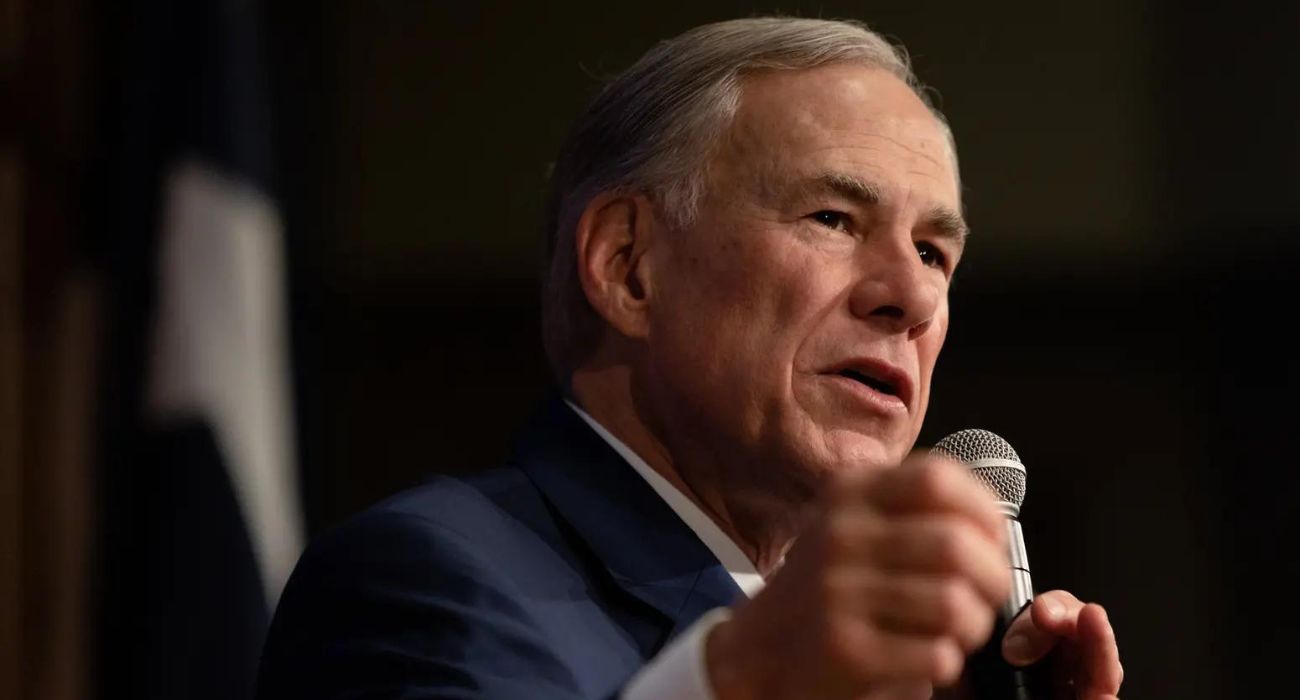

Texas Gov. Greg Abbott has announced a second special session of the Legislature for the purpose of delivering property tax relief, despite the first special session failing to reach a compromise.

Abbott issued the declaration on Tuesday afternoon as the initial special session expired. The Texas House, led by Speaker Dade Phelan (R-Beaumont), had refused to convene, having passed its version of property tax relief shortly after the original special session was called, as reported by The Dallas Express.

The next special session technically began at 3 p.m., June 27, according to Gov. Abbott’s declaration.

Abbott requested that the Legislature pass “Legislation to cut property-tax rates solely by reducing the school district maximum compressed tax rate in order to provide lasting property-tax relief for Texas taxpayers.”

Additionally, he requested that the House and Senate advance “Legislation to put Texas on a pathway to eliminating school district maintenance and operations property taxes.”

In a statement provided to The Dallas Express, Abbott said, “We achieved a great deal during the 88th Legislative Session that I have signed into law, including laws to provide more than $5.1 billion for border security, hold rogue district attorneys accountable, and add $1.4 billion to make schools safer, but the job is not done.”

“I am bringing the Texas Legislature back for Special Session #2 to provide lasting property tax cuts for Texans,” Abbott continued. “During the five-month regular session, the Texas House and Texas Senate both agreed on cutting school district property tax rates, while the House wanted to add appraisal caps and the Senate advocated for increased homestead exemptions.”

“The Special Session #1 agenda was limited to the only solution that both chambers agreed on — school property tax rate cuts,” he added. “After yet another month without the House and Senate sending a bill to my desk to cut property taxes, I am once again putting the agreed upon school district property tax rate cuts on the special session agenda.”

“Unless and until the House and Senate agree on a different proposal to provide property tax cuts, I will continue to call for lasting property tax cuts through rate reductions and working toward eliminating the school property tax in Texas,” he concluded. “Special sessions will continue to focus on only property tax cuts until property tax cut legislation reaches my desk.”

Abbott and the House have disagreed publicly with the Texas Senate, led by Lt. Gov. Dan Patrick, regarding the most effective approach to reducing property tax for Texans.

As reported by The Dallas Express, while the House adjourned early in the first special session and refused to negotiate, the Senate passed what Lt. Gov. Dan Patrick called “the largest tax cut in world history.”

At the same time, the House stood up a new select committee to evaluate property tax proposals, potentially signaling a compromise in the future.

While both Abbott and the House have favored property tax relief proposals focusing solely on the compression of the maintenance and operation taxes levied by local schools, Patrick and the Senate have leaned toward plans that include increases in homestead exemptions and appraisal caps.

In response to Gov. Abbott’s call, Lt. Gov. Patrick said in a statement provided to The Dallas Express, “Over the last week, there have been many discussions between the Texas Senate and House to find a deal on the largest property tax cut in Texas history.”

“In today’s statement, the Governor said that during the regular session, the House and Senate both agreed on cutting school district property tax rates,” Patrick continued. “He is correct. However, he did not mention that during the regular session, both the House and Senate also unanimously voted for a $100,000 homestead exemption.”

“The Senate will continue to support cutting the tax rate through compression. We will insist upon a homestead exemption, giving homeowners a $1,250 to $1,450 annual tax cut as opposed to receiving only $740 without a homestead exemption,” he explained. “We will pass the same bill that we passed to the House last week that cuts school property taxes for the average homeowner by nearly 43%, almost double the tax cut one would receive with only compression.”

“Regarding the call to pass legislation to eliminate school property taxes all together [sic], to do so would require increasing the sales tax dramatically, which clearly has no support from the legislature or the people,” Patrick claimed. “The only other pathway is using current sales tax dollars, which can never be achieved.

“The Governor mentions that cutting the tax rate is a lasting tax cut. It is not. As soon as sales tax flattens or declines in any year, property tax rates would skyrocket. The only tax cut that is lasting is a homestead exemption, which is locked into the Texas Constitution.”

“Gov. Abbott’s call for a new special session is a renewed opportunity for the Texas Senate and House to deliver vital property tax relief as quickly as possible,” Patrick concluded. “The Texas Senate will continue to fight for homeowners, and we look forward to working with the House to pass property tax relief legislation in the coming weeks.”