Housing inventory in Fort Worth crept slightly higher in August.

Fort Worth saw its housing inventory steadily climb, with the volume of homes on the market in August hitting its highest level in 2023, according to a recent housing report by the Greater Fort Worth Association of Realtors (GFWAR).

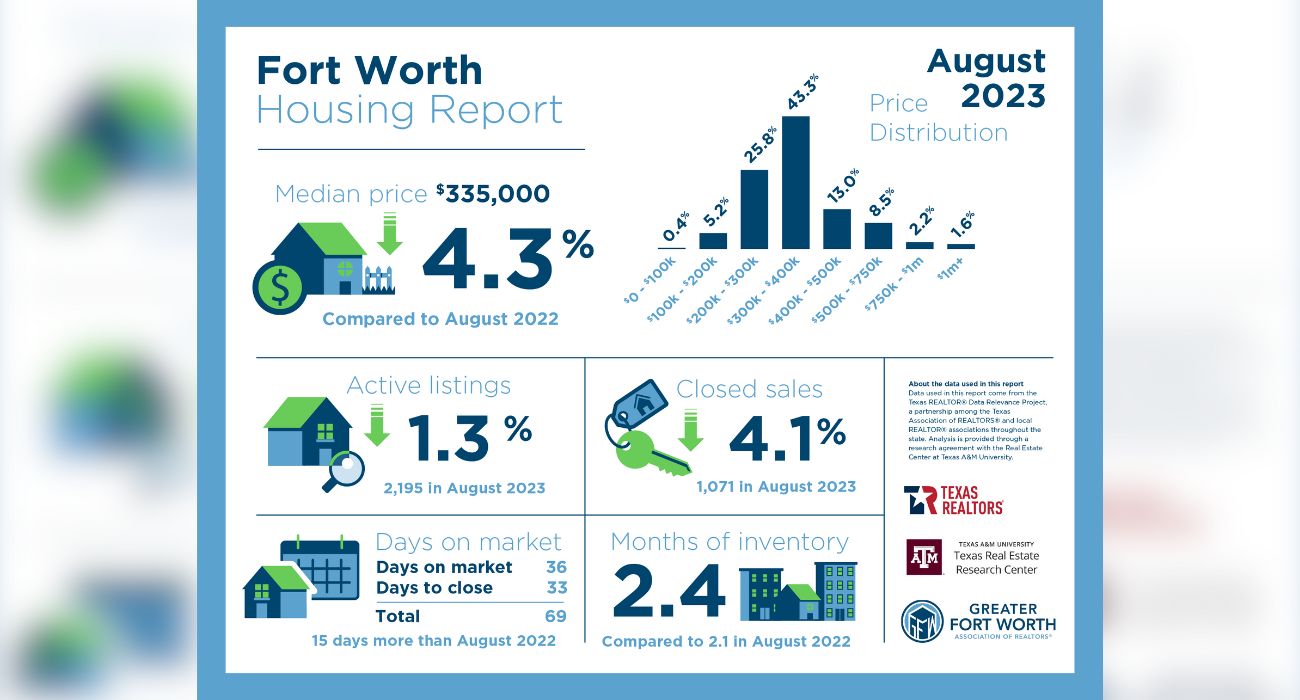

As of August, Fort Worth had approximately 2.4 months of inventory, a slight increase from the 2.1 months in August 2022 but well below what the Texas Real Estate Research Center (TRERC) at Texas A&M University considers a balanced market.

According to TRERC, a balanced market has about 6.5 months of available inventory.

In addition to the low housing inventory, Fort Worth had just under 2,200 active listings in August 2023, an annual decrease of 1.3% compared to August 2022.

Even if homebuyers are fortunate enough to find a decently-priced listing, the report notes that the next hurdles buyers have to overcome are tied to mortgage rates and general housing affordability.

Despite the slight uptick in the city’s housing inventory, higher mortgage rates in the U.S. have limited the options available to Fort Worth homebuyers, according to GFWAR President Bart Calahan.

“Until mortgage rates start to come down, buyers are going to continue to be limited in their price range and therefore their options,” Calahan said in the report. “Home sellers are also feeling restricted, as they consider swapping a loan with a low rate for a much higher one.”

The median home price in Fort Worth was $335,000 in August, and although prices have dropped 4.3% year over year, the report explains that mortgage rates at or above 7% are leading to skyrocketing mortgage payments.

Homebuyers will continue to see higher costs until the Federal Reserve decides to lower its Fed Funds rate, according to Jessica Lautz, deputy chief economist at the National Association of Realtors.

“These higher rates will continue to exacerbate housing inequality and limit the number of first-time and minority buyers,” she said in the report.

Mortgage rates are not anticipated to drop lower any time soon, according to the Fed’s most recent “dot plot” or Summary of Economic Projections published Wednesday. Fed participants are currently projecting one more rate increase in 2023 and a cumulative 50 basis point rate cut in 2024.

The Dallas Express reached out to GFWAR for comment on the August housing report but did not hear back by the time of publishing.