The United States hit the debt ceiling limit set by Congress on Thursday, prompting the Treasury Department to deploy emergency measures to ensure the federal government can keep meeting its financial obligations.

Treasury Secretary Janet L. Yellen informed Congress that the government would begin using “extraordinary measures” to prevent the nation from defaulting on its debt and urged lawmakers to raise or suspend the artificial cap.

“The period of time that extraordinary measures may last is subject to considerable uncertainty, including the challenges of forecasting the payments and receipts of the U.S. Government months into the future,” Yellen wrote in a letter to Congress. “I respectfully urge Congress to act promptly to protect the full faith and credit of the United States.”

The debt ceiling, which Congress set at around $31.4 trillion in December 2021, is the legal limit the federal government can borrow to pay for expenditures like federal worker salaries, Social Security payments, Medicare benefits, military salaries, and payments to investors who hold U.S. debt.

Treasury officials claimed the measures announced Thursday should enable the government to keep paying its bills until at least early June.

Still, if Congress fails to raise or suspend the debt limit before the Treasury Department’s emergency measures are exhausted, economists warn the federal government would eventually have to default on some of its financial obligations, according to The New York Times.

A default would likely result in interest rate spikes and a drop in demand for Treasuries. Even the threat of default could cause borrowing costs to increase, according to the Committee for a Responsible Federal Budget.

While the U.S. government has never defaulted on its debt before, it came close in 2011, when House Republicans refused to pass a debt-ceiling increase, prompting rating agency Standard and Poor’s to downgrade the U.S. debt rating one notch.

The pressure on Capitol Hill to avoid a catastrophic default comes at a moment of heightened partisanship and divided government. It also foreshadows partisan battles set to dominate Washington in the coming months.

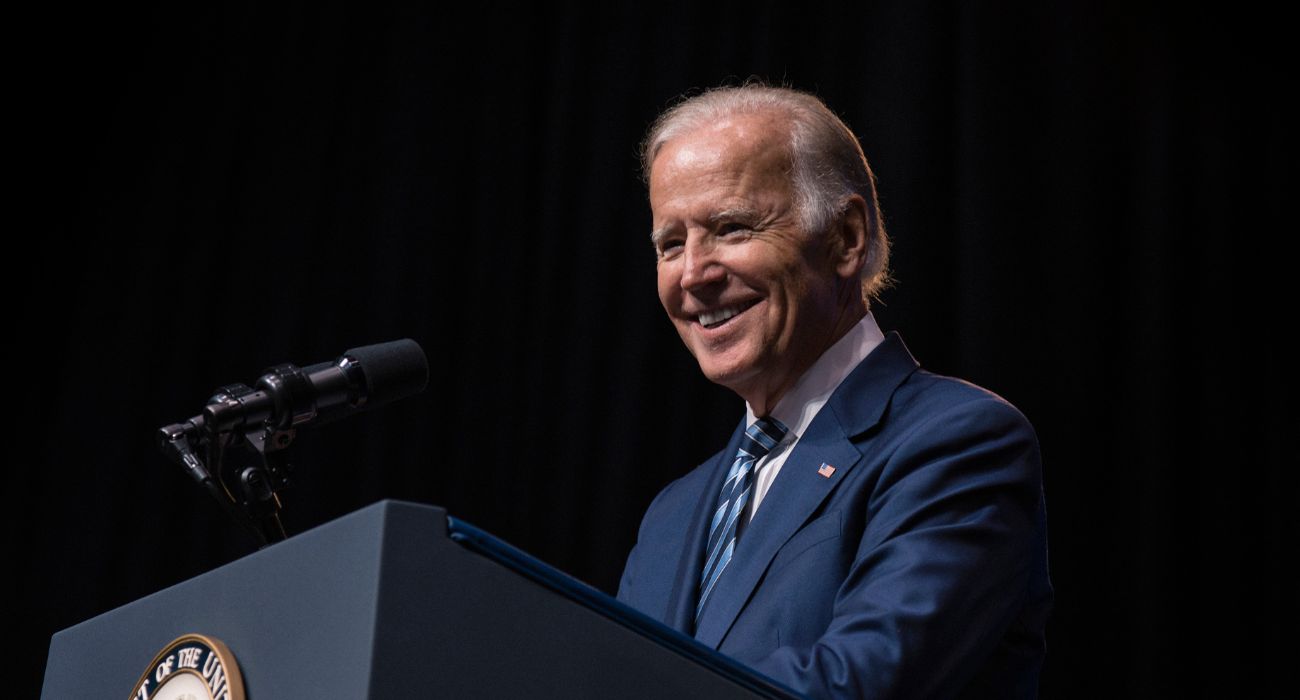

President Biden has said he refuses to negotiate conditions for a debt-limit increase, stating that lawmakers should raise the debt ceiling without conditions attached to meet obligations authorized by previous Congresses.

House Speaker Kevin McCarthy (R-CA) rejected Democrats’ calls for an unconditional debt ceiling increase, demanding instead that federal spending cuts be attached.

“Why wouldn’t we sit down and change this behavior so that we would put ourselves on (sic) a more fiscally strong position?” McCarthy said.

However, McCarthy has also said House Republicans “don’t want to put any fiscal problems through our economy, and we won’t.”

He has also not ruled out raising the debt limit, pointing to a deal struck in 2019 between then-President Trump and Speaker Nancy Pelosi.

“I had a very good conversation with the president when he called me, and I told him I’d like to sit down with him early and work through these challenges,” McCarthy said last week at a press conference.

Rep. Andy Biggs (R-AZ) took a firmer stance in a tweet on Tuesday, writing, “We cannot raise the debt ceiling. Democrats have carelessly spent our taxpayer money and devalued our currency. They’ve made their bed, so they must lie in it.”

The White House on Wednesday blasted Biggs’ “stunning and unacceptable position” and once again rejected calls to reduce spending as part of a debt ceiling deal.

White House press secretary Karine Jean-Pierre reasserted that position, telling reporters that “there will not be any negotiations over the debt ceiling – we will not do that, it is [Congress’] constitutional duty.”