Netflix’s stock (NFXL) has seen better days. After reporting a sharp decline in subscribers in the first quarter, something it has not done in over a decade, shares of the content streaming company sank 35%.

The sell-off resulted in $50 billion being erased from Netflix’s market cap, giving the company the dubious distinction of being the single worst performer in the S&P 500 index year to date (YTD).

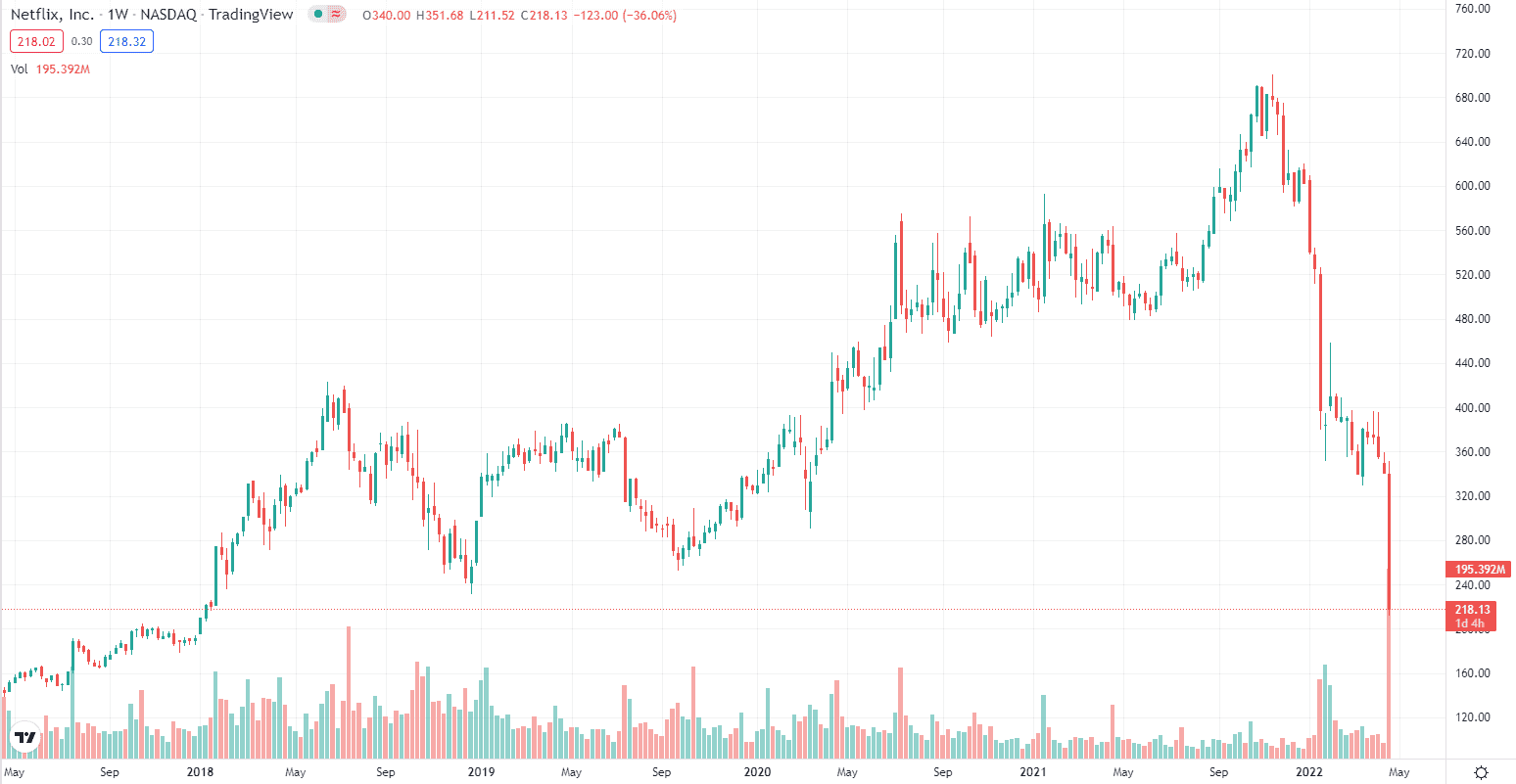

NFLX 5-Day Chart | Image by TradingView

Netflix lost 200,000 subscribers in Q1, a far cry from the 2.5 million net subscribers it planned to add. The tech company was hit hard by its exposure to Russia, where it lost 700,000 members. The bleeding is not over, as Netflix forecasts the loss of another 2 million net subscribers in Q2.

Netflix investors were not the only ones licking their wounds after the earnings call. Wall Street analysts have misjudged NFXL shares, with nearly a dozen of them having to backpedal and lower their rating on the stock, including Bank of America, Wells Fargo, and Jefferies, the latter of which leaped from a “buy” to a “sell” rating. Bank of America called the loss of subscribers nothing short of “shocking.”

Among the investors fleeing the stock is shareholder Pershing Square. Bill Ackman, the founder of the activist hedge fund, revealed in a letter that the fund sold its Netflix holdings which it had bought in recent months.

According to the letter, Pershing’s exposure to Netflix knocked four percentage points off the fund’s YTD returns. That loss might be enough to cause Ackman to call it quits in NFLX shares, but he also expounded upon the reasons for his decision.

The activist investor pointed to the overhaul in Netflix’s subscription model, in which the company would more aggressively target non-paying users. In addition, Netflix is adopting an advertising model that will take a year or two to fully realize, which adds to the uncertainty around subscriber growth, revenues, and margins. Despite what Ackman described as a simple business model, Netflix as an investment is too rich for Pershing Square’s blood.

According to an opinion piece in The Wall Street Journal, content streaming’s boom days from the pandemic are history. Now that the lockdowns are a thing of the past, consumers are spending less time watching streaming content and more time living their lives.

In addition, sky-high inflation has eaten into people’s budgets, causing them to be more choosy about subscriptions or abandon them altogether.

The days of Netflix’s streaming monopoly are over, with players like Disney+, Hulu, and Amazon, to name a few, all vying for a piece of the pie. Netflix was among the companies to recently increase its prices, now charging a monthly rate of $15.49 to access its content.