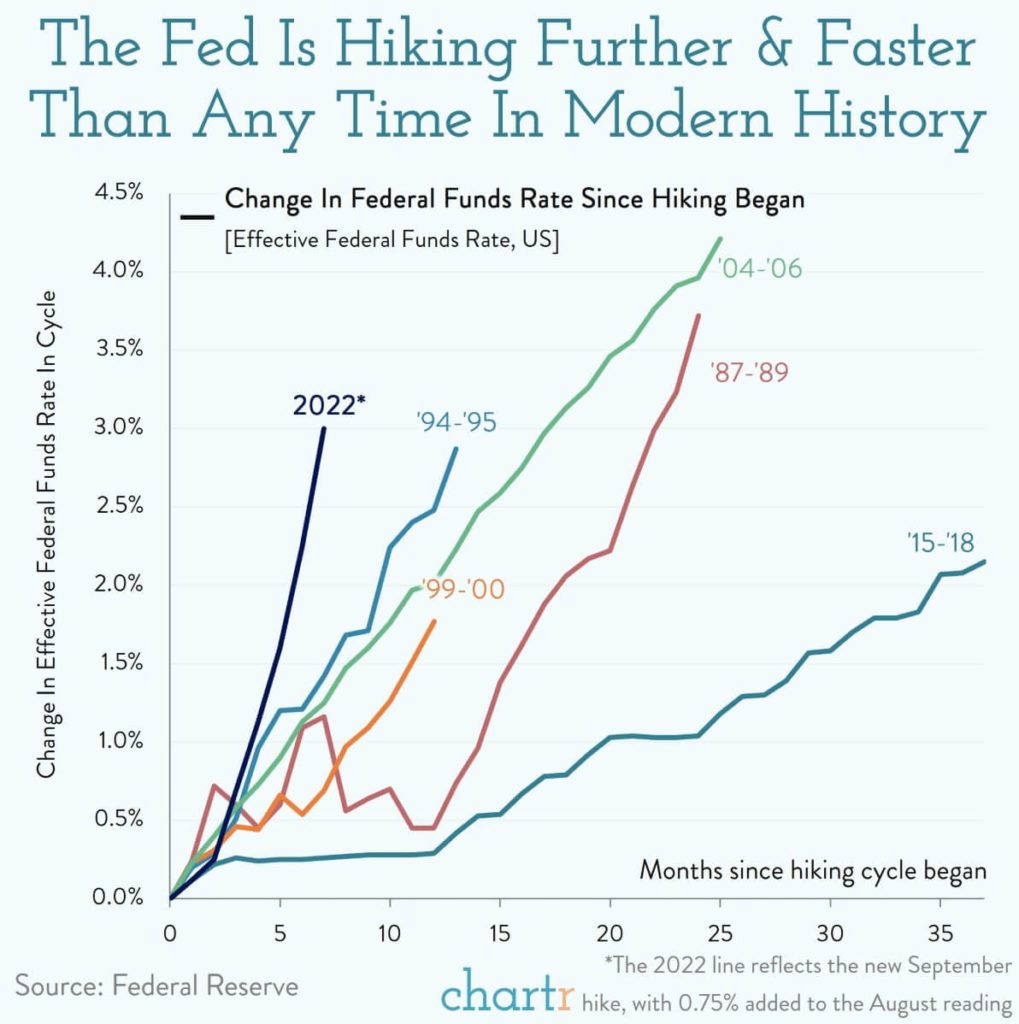

The economy in 2022 has been characterized by a slumping stock market, surging inflation, and the most aggressive interest rate tightening in history. Several executives from some of the most prominent American companies recently opined on the current environment. Outlooks ranged from fearful to optimistic, but one theme permeated most opinions: uncertainty.

Goldman Sachs CEO David Solomon believes more confidence in the economy’s direction is needed.

According to Solomon, in speaking with other CEOs, “they tell me that they are rethinking business opportunities and would like to see more certainty before committing to longer-term plans. As we head into the fourth quarter, my sense is that the outlook will remain unsettled, though economic performance will vary by region, and also expect volatility to persist as markets continue to digest these factors.”

One of the most prominent CEOs in the world has been increasingly vocal about government policy regarding the economy.

Last week, Tesla CEO Elon Musk accused the Fed of failing to look forward, claiming, “The Fed’s decisions make sense if you are looking out through the rear-view mirror, but not if you look out through the front windshield. And they should look out the front windshield.”

American Express Chief Executive Stephen Squeri is less concerned than Musk.

Squeri believes American Express is prepared for a potential downturn but is not necessarily concerned one will materialize, saying, “We’ve got our recession playbook… and we’ll pull that playbook lever if we need to pull it, but to pull it at this particular point in time doesn’t make any sense.”

While there was hope Russia’s invasion of Ukraine would be short-lived when it kicked off early in the year, its persistence moving into November continues to raise concern among many CEOs.

Nasdaq Inc. Chief Executive Adena Friedman underscored that fact, stating that “we continue to find ourselves amid an uncertain macroeconomic and geopolitical backdrop.”

While concerned, AT&T Inc. Chief Executive John Stankey is not terribly worried.

“We’re seeing bad debt start to return back to pre-pandemic levels. Certainly, we’ll have to watch that if the economy sours further… but I see nothing right now that would suggest we’re out of pattern on anything,” he remarked on October 20.

United Airlines Chief Executive Scott Kirby has been encouraged by the company’s trends.

Kirby said, “There has been a permanent structural change in leisure demand because of the flexibility that hybrid work allows. With hybrid work, every weekend could be a holiday weekend. That’s why September, a normally off-peak month was the third strongest month in our history. People want to travel and have experiences.”

Tractor Supply Chief Executive Hal Lawton thinks the Fed’s interest rate tightening will only modestly slow surging prices.

Lawton believes “inflation will remain at elevated rates through at least the first half of next year. And I think that’s reasonably consistent with the overall kind of macro-U.S. outlook as well.”

As S&P 500 companies continue to reveal Q3 earnings this season, the consequences of this year’s challenging market environment will become more apparent.

Chart showing current increase compared to previous cases | Graphic by Chartr

November’s Federal Reserve meeting is expected to generate yet another interest rate hike, which would weigh heavily on economic growth prospects. Still, certainty around the decision to continue raising rates – and for how long – remains a mystery.