The massive destruction wrought on Massachusettes’ Vineyard Wind project has raised new questions about the safety and prudence of a similar BlackRock-backed project planned off the coasts of Louisiana and Texas near Port Arthur.

Bonnie Brady of the Long Island Commercial Fisherman’s Association posted several pictures of broken and mangled offshore wind turbines, destroyed by an unknown cause, to her X account on July 20.. The images depict turbines with snapped blades hanging from their mounts. They also show large shards of metal and other debris washing ashore.

Brady directed her post to every East Coast governor and the major presidential contenders, save for Vice President Kamala Harris, who had not yet announced her presidential candidacy, warning of what could happen to the fishing industry.

“Stop the madness while you still can, because when the fiberglass lands on your shores you will (eventually) be out of the job. Ps we will never forget you threw US commercial fishing industries under the bus,” she wrote.

@GovKathyHochul @GovernorVA @GovMurphy @GovJanetMills @GovNedLamont @MassGovernor @GovWesMoore @JohnCarneyDE @NC_Governor @GovernorVA @GavinNewsom @TinaKotek

This will be your legacy; #OSWDestructionByLandAndBySea

Stop the madness while you still can, because when the… https://t.co/N5q11aKzcj pic.twitter.com/xT6AmMcrmS— Bonnie Brady (@mtkblb) July 21, 2024

Her tweets were in response to a video posted by a Nantucket resident, Mary Chalke.

“It is time to shut [Vineyard Wind] down,” Chalke said before later adding, “It is a ticking time bomb.”

As she filmed her video, Chalke stood on the Nantucket shoreline, raising awareness about what she said were sheets of fiberglass that had been blown to shore from the wreckage of the wind farms. She noted that the beach had recently been reopened despite debris still in the air and water. She condemned the project she claims residents were originally told in 2019 was just “experimental.”

Madaket Beach, Nantucket 7/18/24 It’s clear, the experiment is over, the results are in.

@mikerdean22 @ack4whales @mapoli pic.twitter.com/ojWd1dtHAC— Mary Chalke (@ChalkeMary40147) July 20, 2024

Chalke and Brady’s social media posts came just days after a federal court ordered ongoing construction at Vineyard Wind to halt over concerns about the damaged turbines.

This is not the only time questions have been raised about the sturdiness of offshore wind turbines.

A similar event happened in Denmark in 2022, and also when one offshore wind turbine caught fire in England, forcing an evacuation of its crew last year. This comes as expenses to build these energy-producing projects often rise to cost-prohibitive levels.

Yet mechanical fragility and expense concerns are compounded by wind turbines’ chemical dangers. Per- and poly-fluoroalkyl substances — better known as PFAS or “forever chemicals” — are reportedly present in many of the attachments added to turbines. Such chemicals were made infamous because of their potential health hazards to firemen.

BPAs and epichlorohydrin are present in the resin binding most wind turbine blades. A certain amount of these chemicals are shed through erosion every year. Some “33% of that eroded material is BPA, resulting in 45 pounds of PBAs released, into the environment, per turbine, per year,” the Douglas County Rural Preservation Association wrote.

However, American Clean Power, an association of wind and hydroelectric power producers disputes the danger of BPA presented by wind turbines.

Responding to alleged risks regarding BPA and erosion, the organization wrote, “Wind turbine blades’ protective coatings are non-toxic and contain negligible amounts of BPA, and the blades are specifically designed to have high resistance to weathering.”

Epichlorohydrin can poison water and have “detrimental effects on the liver, kidneys, central nervous system [of humans],” according to the EPA.

There are also risks to sea life. “[Epichlorohydrin] is moderately toxic to fish and aquatic invertebrates,” the University of Hertfordshire wrote on its toxin reports page.

This poses dual risks to fishermen and their fish stocks. Port Arthur is Texas’s fourth biggest fishing port and the nearest port to offshore wind farm construction. Commercial fishing is an industry worth almost $250 million in Lone Star State and employs roughly 3,500 people.

Texas weather patterns suggest that damage to these planned turbines is inevitable. Texas has been hit by numerous hurricanes, including Hurricane Ike in 2008 and Hurricane Beryl weeks ago. Lake Charles, the nearest major Louisiana city, was infamously pummeled by Hurricane Laura in 2020.

In a foreboding sign for Texas fishermen, the Department of Interior granted Option M’s owners a bidding credit because of the corporation’s commitment to “establishing and contributing to a fisheries compensatory mitigation fund or contributing to an existing fund to mitigate potential negative impacts to commercial and for-hire recreational fisheries caused by offshore wind energy development in the Gulf of Mexico.”

Brady has been highlighting chemical concerns in recent weeks. She recently appeared before the Town of Nantucket Select Board and grilled Vineyard’s representatives over the chemicals used in the blades’ production. Brady asked, “How many pounds of resin are included in each blade?” and a variety of other questions that would indicate the toxic risks posed by turbine blades. So far, she has not received any answers.

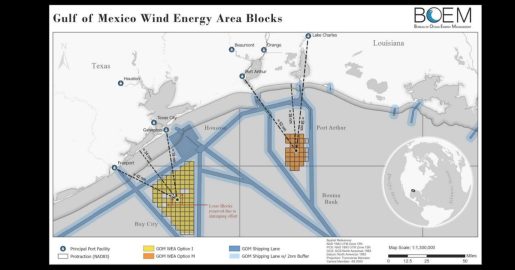

Option M, the Port Arthur area wind farm, and its stalled Galveston-area sister project Option I are efforts pushed by the Biden administration, The Dallas Express previously reported. The administration has promoted the project as a jobs creator and part of a transition to “clean energy.” However, it is unclear how many jobs will come from Option M’s building process since many of the largest turbine manufacturers are not American.

Moreover, like Vineyard Wind, owned by the Danes, Option M is owned by RWE Offshore US Gulf LLC. The company’s largest backers are Qatar Holding (9.1%) and BlackRock (6.3%), according to its shareholder structure webpage.

The destruction of Vineyard Wind’s turbines highlights a struggling Climate 100+ agenda, an initiative by which BlackRock intended to pivot its investments away from fossil fuels toward alternative energy sources before the program was scaled back. While the news cycle is currently highlighting the issues with prominent forms of alternative power, such as offshore wind, the asset manager has struggled to fend off divestments from some of Texas’s largest sovereign wealth funds over concerns about how BlackRock’s left-wing environmental social and governance investment may be discriminating against Texas oil and gas producers, DX previously reported.