The city of Dallas saw increased competition among apartment renters over the last 12 months but failed to make the list of the top 20 most competitive markets due to more robust rental activity on the East Coast, according to a new report from RentCafe.

To develop its Rental Competitivity Index (RCI), RentCafe, a nationwide apartment search website, analyzed apartment data from Yardi Systems in 134 U.S. markets. The data was pulled directly from market-rate large-scale multifamily properties of at least 50 units.

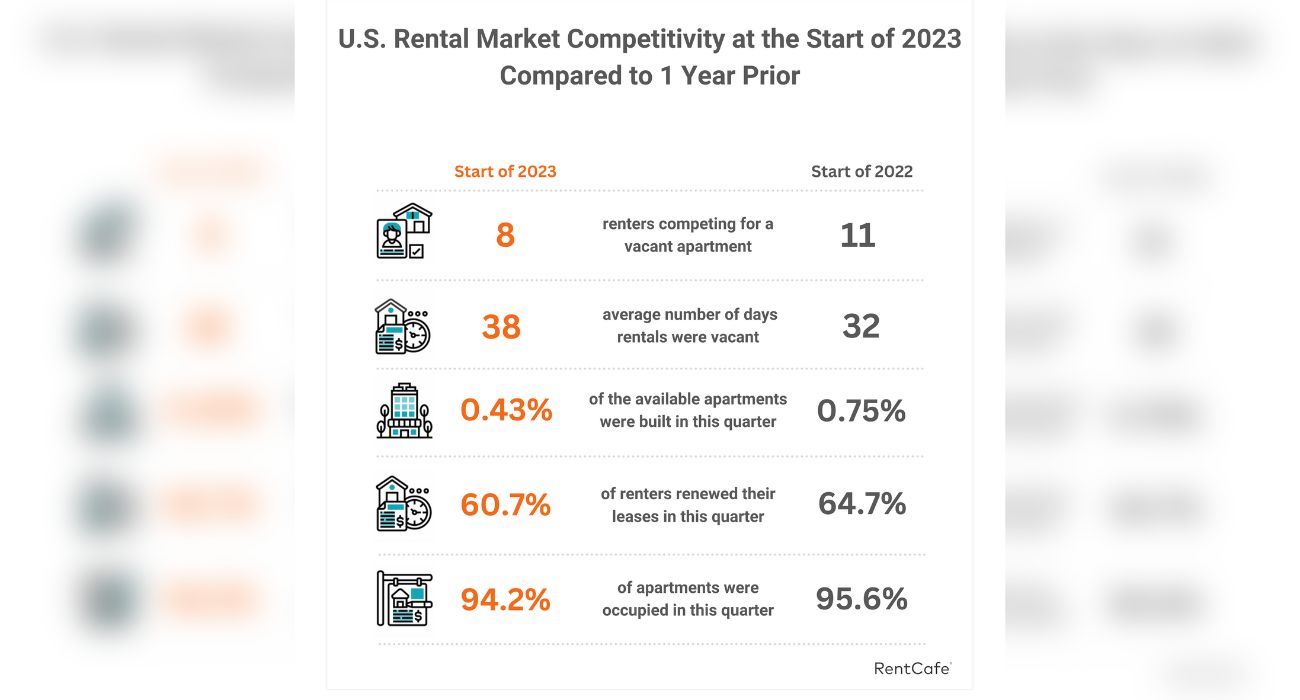

The RCI ranges from zero to 126, with a score of 60 indicating a moderately competitive rental market. The score is calculated by assigning a weighted average to the following metrics: average vacant days (15%), occupied apartments (30%), prospective renters (15%), lease renewal rate (30%), and share of new apartments (10%).

Dallas’ rental competitive score rose to 58 at the start of 2023, up from 46 a year earlier and two points shy of the national average of 60.

While rental competition in Dallas fell short of the national average, the city’s score rose 26% year-over-year, data show.

The Dallas market has many benefits to it that facilitate the rental process for prospective apartment seekers, according to Doug Ressler, manager of business intelligence at Yardi Matrix. The market research firm tracks data on multifamily, student housing, office, industrial, and self-storage properties across the country.

“In Western markets, in general, you have much more progressive land, zoning, and permitting than you do in, say, the Northeast,” Ressler told The Dallas Express. “Texas, for instance, is very progressive in terms of deducing or incenting the migration patterns of not only people but businesses.”

In addition to being business-friendly, the Lone Star State doesn’t seem to over-regulate land covenant restrictions like many places in the Northeast do, Ressler claimed.

A number of macroeconomic factors also influenced rising rental competition in Northeast markets, according to the report. These include rapid inflation, interest rate hikes, high home prices, and increased living costs.

“The warm, business-friendly Sunbelt states have long been highly coveted renting spots, particularly during the pandemic,” RentCafe said in its report. “However, the start of 2023 saw a pivot to markets located in the Northeast, and as a result, eight of the country’s top 20 hottest renting spots are in the Northeast.”

On average, apartments across the U.S. filled up within 38 days, with eight prospective renters per apartment during the start of 2023. The national occupancy rate came in at 94%, with the renewal rate hitting a robust 61% amid a mere 0.43% uptick in new apartments.

North New Jersey (115) was the hottest rental market in the U.S. based on its RCI score, followed by Miami-Dade County, Florida (112), and Harrisburg, Pennsylvania (111). Northern Jersey’s competitive score was nearly double the national average due to the severe housing shortage in the area and an influx of affluent newcomers, the report says.

“With the housing market slowing down at the end of 2022, the nation’s large rental hubs — where demand is strong, but the supply of apartments is insufficient — saw the biggest increases in competitivity year-over-year,” Joanna Truscan, senior communications specialist at RentCafe, told The Dallas Express.

“For instance, Silicon Valley, Western Los Angeles, and Suburban Chicago had an average of 10 to 12 prospective renters competing for each vacant apartment. Meanwhile, in Manhattan, Chicago, and Washington, D.C., between 55% and 65% of renters decided to stay put and renew their leases, especially as no new units were built recently,” Truscan said.

In terms of Dallas’ rental market, the average number of vacant days rose from 30 in 2022 to 37 in 2023, more in line with the national average of 38 days, data show.

During this time, the number of prospective home buyers fell from 11 to 8, with the percentage of occupied apartments declining from 95.3% to 93.9%. The lease renewal rate in Dallas remained unchanged at 60.2%, while the share of new units on the market fell from 0.7% to 0.5%, according to the report.

Dallas saw a flood of new rental units being scooped up after hitting the market throughout 2022, while secondary and tertiary markets experienced a shortage of new units. Now that supply has increased, there is a lot more demand associated with these markets, Ressler told The Dallas Express.

Ressler suggests it is partly due to migratory patterns remaining in place following the pandemic.

“People are still working from home so they don’t have to commute. So, [renters] are looking for areas and locations that not only fit their lifestyles but also, you know, fit their pocketbook,” he said.