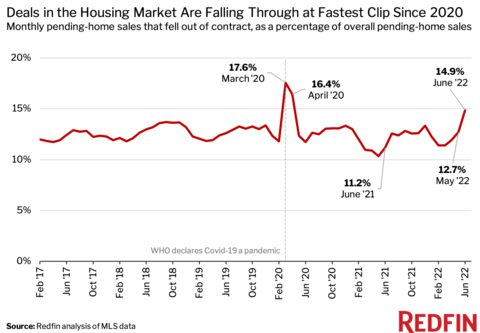

The housing market is feeling the heat from the rising interest rate environment. U.S. homebuyers have begun abandoning deals at a pace that rivals early pandemic levels. In June, close to 15% of homes under contract were nixed, as 60,000 sale agreements came crashing down, a report by real estate firm Redfin reveals.

According to the National Association of Realtors, the higher cost of borrowing money has weakened demand for new homes, slowing the pace of sales and dampening price growth.

Consumers are walking away from the American Dream after failing to lock in lower rates before the rising rate environment. In some cases, would-be homebuyers have seen their debt-to-income ratios climb higher, meaning they can no longer afford the mortgage payments for which they have been seeking approval.

Cancellations have not hovered near this level since the start of 2020, surpassing 2021’s cancellation rate of about 11%. In addition, homebuilders say contracts for new homes under construction are increasingly being nixed. Consumers are being hit with a one-two punch of rising interest rates and soaring inflation, undermining their confidence in the current economy.

The latest Consumer Price Index showed a 9.1% jump in inflation in June versus year-ago levels, rivaling early 1980s levels and placing a greater burden on consumers at the gas pump and grocery store. Below is a chart by Redfin illustrating the “monthly pending-home sales that fell out of contract,” reaching 14.9% last month.

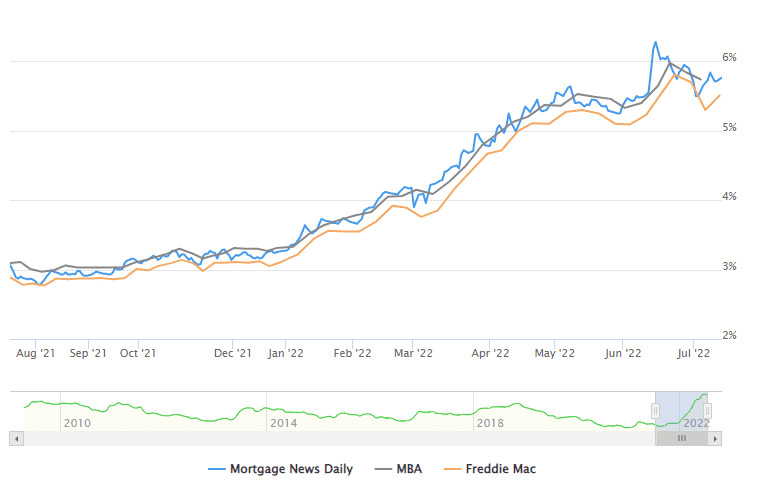

The average 30-year fixed mortgage rate has soared from 3% in early 2022 to 6% by mid-year. It has since retreated to approximately 5.77%, as per Mortgage News Daily. Below is an illustration of the average 30-year fixed mortgage rate over the past 12 months, as per Mortgage News Daily.

Source: Mortgage News Daily

When the pace of deals fell at the start of the pandemic, the downturn did not persist, and the housing market recovered. However, this time around, Americans might not be returning to the housing market so quickly. Real estate investor Graham Stephan warned consumers in a tweet that mortgage rates are only going higher, pointing to estimates for them to reach the 8-10% range in the next two years.

Before buying a home, be aware that mortgage rates are predicted to reach 8-10% in 2023 and 2024!

— Graham Stephan (@GrahamStephan) July 13, 2022

In northern Texas, there is a trend of new-build housing deals getting shuttered, according to real estate pro Cliff Freeman of the Cliff Freeman Group.

He told NBC DFW, “What’s happened in the last seven months is that we have seen people buying houses at $300,000, now only able to afford homes that are 20% less. Some down to $240,000.”

However, Freeman sees the light at the end of the tunnel, saying he does not believe the real estate market is in for a repeat of the 2008 housing crisis. While there is a shift taking place, Freeman says the number of mortgage foreclosures will not be “catastrophic” like the Great Recession.