(Candy’s Dirt) – My husband Walter and I paid $65,000 for our first home in northwest Dallas 45 years ago. Today that home is valued at $528,000. About 40% of this city is zoned for single-family housing, and less than 5% is zoned for multifamily. Single-family homes are the power engine for the Dallas economy.

So why do we want to blow up the city’s biggest bank?

Dallas is currently undergoing a long-overdue update of its comprehensive land use plan, “Forward Dallas 2.0 – June 2024. The plan, required by state law, is under review by the City Plan Commission, and a public hearing is set for Thursday.

In my opinion, this document was conceived on theoretical principles to increase density in Dallas, though our city’s population has been dwindling lately. This plan is almost ready to be put in the oven pending a blessing from the (current) Dallas City Council. But before we grease the pan, ForwardDallas needs to include a firewall for our single-family neighborhoods.

No doubt, homes are no longer affordable in Dallas. The fact that our starter home was $65,000 in 1980 but more than half a million dollars today means your average starter couple on a scant salary ($70,000) cannot afford to buy here unless they have a trust fund — a sentiment I heard at the recent NAREE conference.

We are landlocked. Dallas grew up fast these last four decades and outgrew its britches and boundaries. Theoretically, if you cram more housing options onto what is now single-family-zoned property, you will get more housing that buyers can afford. No.

In real estate, because of demand, it doesn’t work that way.

When a single-family home is sold and is replaced by a higher density dwelling, it doesn’t create affordability. Dividing a property up for smaller lots or more homes leads to a higher appreciation of the overall land. Congratulations, you’ve made existing homes even less affordable.

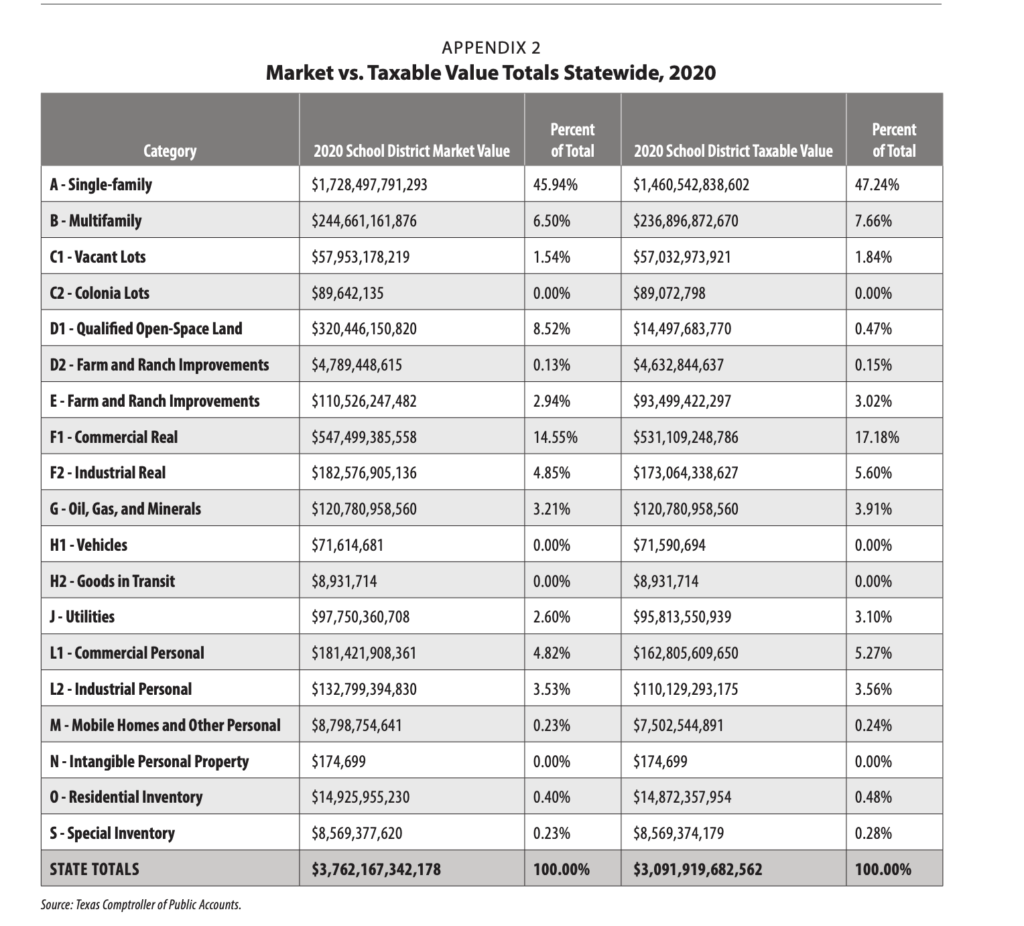

Approximately 47% of the state’s taxable value for school districts comes from single-family homes.

One problem I have with ForwardDallas as it is written today is that families are already moving out of the city. Dallas County lost 5,000 residents between 2020 and 2023, and if we mess too much with our single-family ‘hoods, more may soon follow.

Plus, as higher property taxes (which are based on rising values) push homeowners out of their homes, institutional investors snatch up properties and inflate rents via algorithms (see ProPublica’s story on Richardson-based RealPage). When the City of Austin allowed additional dwelling units on one’s property by right, 53% of the 2,000 accessory dwelling permits filed were in East Austin’s working-class neighborhoods. About 80% of those are owned by LLCs; 80% are NOT OWNED by families.

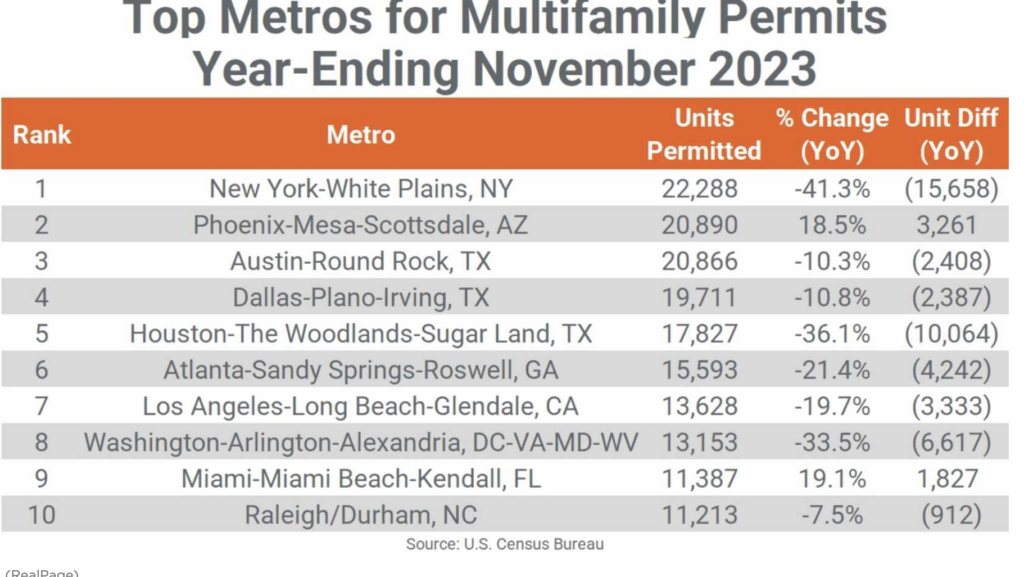

D-FW Is the Nation’s Top Apartment Building Market

We already have plenty of multifamily living opportunities. Dallas-Fort Worth has led the nation in apartment building for years with more than 70,000 units under construction. More than 26,000 units were delivered last year, and this year’s crop will be an estimated 41% increase over the burgeoning six-year average. More than $6.8 billion in D-FW apartments were traded in the first nine months of 2023 — the most of any U.S. market.

The Dallas metro area ranked No. 4 in the country for multifamily units permitted in 2023. In 2022, there were 10% more permits issued.

Cramming more multifamily in single-family neighborhoods also brings collateral damage — more cars, more pressure on infrastructure, and more demand on city services like police, fire, schools, and sanitation. If more multifamily is built in areas sorely deprived of deferred capital repairs, this could lead to more infrastructure problems including flooding or water washes during heavy storms.

Former City Council Member Sandy Greyson addressed the effect of density at a recent neighborhood meeting in North Dallas:

“Developers always tell you that young, single people will live in their apartments,” she said. “Happens for two years, then the families move in. When we opened Anne Frank Elementary on Celestial in 1987, the school was overcrowded two years after the construction of all those apartments on Montfort.”

Anne Frank Elementary School had problems with overcrowding just two years after a large number of apartments were built nearby.

Some claim building more multifamily units could actually help lower property taxes for homeowners. (It might, for a minute). But commercial owners are slick. Most commercial property owners use paid consultants to aggressively contest and lower their property taxes with. But many homeowners don’t protest their taxes, let alone hire consultants.

Then there is that argument I hear so frequently, mostly on the devil that is NextDoor where everyone is an expert. “ForwardDallas is not a zoning document. It’s a blueprint. It has no weight or bearing on existing zoning. You can still go to the City Plan Commission and fight it.”

Jack D. Kocks, GOP Precinct 2047 chair and a housing activist, addressed this at several neighborhood meetings.

“They say ForwardDallas has no bearing on existing zoning, but there will be a corner somewhere, in a single-family neighborhood, that will be developed into a multiplex and no one will notice,” Kocks said. “Pretty soon another property will become available in the same neighborhood, and the buyer will want to build a multiplex. They will point to that corner property to obtain the rezoning.”

The pro-ForwardDallas folks counter that it’s a statement of intent, a way to guide city growth in the future when we are out of here. As our City Hall reporter and news director April Towery told me after covering so many meetings, “They hear you, they know what you are saying. But they truly believe this is the way forward for Dallas.”

ForwardDallas 2.0

In almost perfect harmony, Harvard’s Joint Center for Housing Studies churned out a July report that says traditional zoning induces segregation:

“Restrictive zoning and NIMBY [Not in My Backyard] attitudes have left nearly a third of neighborhoods across the country with few options for renters. The concentration of rental housing in some neighborhoods and the exclusion of rental options from others reinforces enduring patterns of residential segregation by race and income. There’s fewer places to rent in the ‘burbs and higher-income, white neighborhoods.”

The study is almost a blueprint of ForwardDallas: mix up more neighborhoods based on diverse backgrounds of income, cultures, color, race, etc.

Just because a Harvard study cited examples doesn’t mean we should upend our thriving single-family-home neighborhoods. And we should study this carefully in other cities before taking the plunge, like Austin, which is fast becoming a petri dish for progressive politics. The connection between zoning intensity and density is less clear-cut than reformers suggest. In fact, there are many places in the country that already have relatively lax zoning, and yet density hasn’t happened. The best example is Houston, which has no citywide zoning.

Single-family zoning has been called exclusionary for a long time. Rather than multifamily, why not simply help more marginal citizens acquire homes?

Equity is not filling neighborhoods with high-end apartments. Equity is helping those who cannot afford homes acquire them and build wealth. I suggest we look closely at what Houston and Fort Worth are doing with Land Trust programs. We could encourage government programs for first-time homebuyers. Kendall Scudder, newly elected to the Dallas County Appraisal District Board, told me that he and his wife had recently purchased a home from the money they saved from having their student loans forgiven. I could totally see a bipartisan program that forgives loans as long as you buy a home within three years.

We Need Affordable Housing But in the Right Places

Finally, aesthetics really matter. We need to protect our single-family neighborhoods and it’s respective architecture that chronicles the history of our city. From the Tudors and Dilbecks of East Dallas/Lakewood and the bungalows and Georgians of Oak Cliff, to the Midcentury Moderns of the Disney Streets and the Frank Welch mansions of Park Lane, and all those strong, sturdy ’50s and ’60s Ranch homes in between. Those homes, those neighborhoods, are our architectural city treasures. They are the shoulders of our city.

Dallas homeowners are concerned and rightly so about the future of their single-family neighborhoods with ForwardDallas. If you don’t clearly say — in fact, shout — that single-family homes should be roped off and protected, somewhere down the road, they may become fodder.

Candy Evans is the founder and publisher of CandysDirt.com, a Dallas-Fort Worth real estate news site staffed by a team of journalists and editors.