(Candy’s Dirt) – The Central Appraisal Districts for Collin, Dallas, Denton, and Rockwall counties released certified property values on Wednesday, and — shocking no one — the numbers are on the rise.

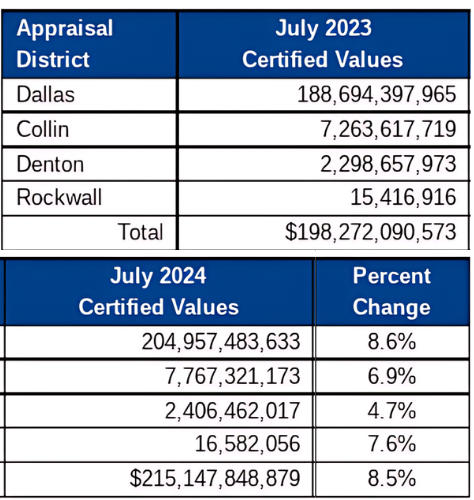

In a memo to council members this week, Dallas Chief Financial Officer Jack Ireland said the new total certified value is $215.1 billion, — $16.9 billion or 8.5% more than last year.

The figures will be used as Dallas finalizes its property tax rate recommendation and builds the City Manager’s Fiscal Year 2024-25 proposed and Fiscal Year 2025-26 planned budgets.

Certified Property Values by County

Year-end certified property values in North Texas

Of the $16.9 billion rise in total property value, $5.1 billion stems from new construction. This means that of the 8.5% overall growth in Dallas, 2.5% comes from new construction and 6% from reappraisals, according to Ireland. Read Ireland’s July 24 memo in its entirety.

Budget Hearings Set For August

Ireland said his staff is working with the Dallas County Tax Office to calculate the no-new-revenue tax rate and voter-approval tax rate, which are both based on the certified values.

A no-new-revenue tax rate, or effective tax rate, is the rate at which a taxing authority (such as a city or county) would collect the same amount of property tax revenue in the current year as it did in the previous year, without considering new construction or improvements. It’s supposed to keep the tax revenue neutral, allowing for revenue stability without increasing the tax burden on existing properties.

A voter-approval tax rate, or rollback rate, is the maximum property tax rate that a local government can set without requiring voter approval. If a city or county proposes a higher rat, it must be approved by voters in an election.

“Additionally, we are reviewing the property value detail and state law requirements related to the property tax rate,” the CFO said. “As a reminder, our revenue increase from reappraisal will be capped at 3.5% regardless of growth in value because of state law.”

The Dallas City Council adopted a $4.62 billion budget last year after much debate about the property tax rate and how to address a massive deficit in the Police and Fire Pension Fund. Ultimately the council lowered the tax rate for the eighth consecutive year, from 74.58 cents to 73.57 cents per $100 assessed valuation.

A budget workshop is set for Tuesday, Aug. 13. Budget town hall meetings are scheduled in each City Council district beginning Aug. 15.