The Lone Star State is known for its low cost of living, which could be why over half of all Texans are stressed about inflation — particularly by the rising cost of food and shelter.

According to a new research report by the Federal Reserve Bank of Dallas, 52% of Texans are highly stressed about inflation compared with 47% of residents nationwide.

The main reason cited for Texans’ elevated inflation stress was that “prices of necessities such as food and shelter rose at a somewhat faster pace in the state,” which can be especially taxing on those living below the poverty level. Indeed, as inflation chomps away at the purchasing power of Texans, low- and moderate-income households are feeling the “most stressed,” the data shows.

For instance, approximately 67.9% of Texans earning less than $25,000 annually reported high inflation stress compared to 66.2% nationally. This was the same for Texans earning between $25,000-$35,000, where 61.2% reported elevated stress compared to 60.6% nationally.

“Texas is known for its relatively low cost of living, a characteristic that has attracted a large inflow of new residents, especially from coastal U.S. states during the pandemic. However, as consumer prices have since climbed at a faster rate in Texas and surrounding states than nationally—food and shelter increasing even more—Texans are feeling especially stressed about rising prices,” the authors of the report state.

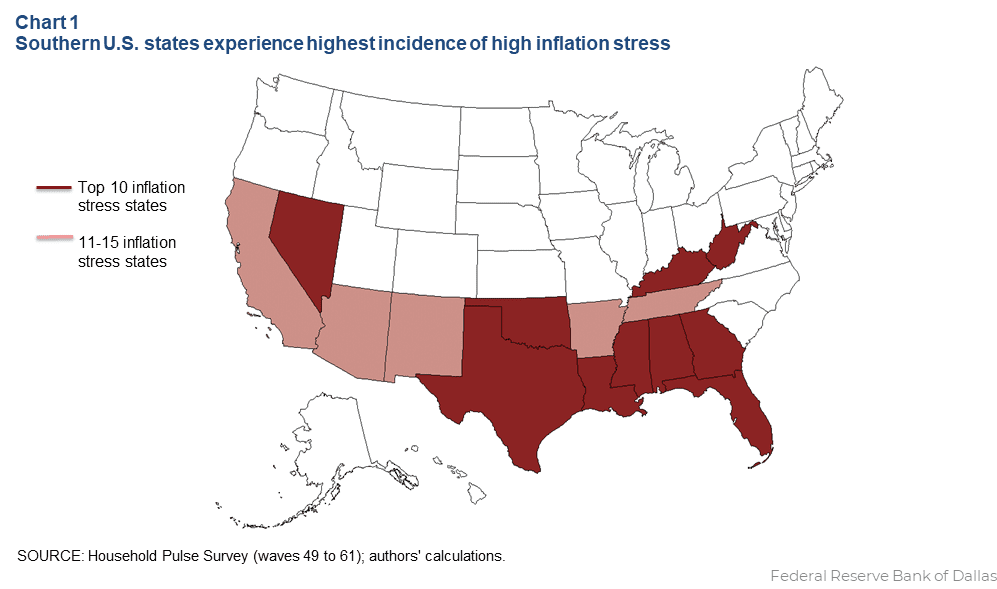

The Fed researchers based their analysis on the latest results of the Census Bureau’s Household Pulse Survey, a questionnaire launched during the height of the pandemic to gather various household data such as employment, inflation, expenses, housing, and childcare availability, among others.

In general, the survey results show that states in the nation’s southern region currently face the highest incidence of inflation stress and that the top 15 most-stressed states are all adjacent to one another.

Of the nation’s top stressed states, Texas – with 52% – ranks sixth, behind Alabama (53%), Louisiana (55%), and Mississippi (57%). The District of Columbia (30.3%), Minnesota (36.4%), and Vermont (36.9%) have the lowest rates of inflation stress, per the report.

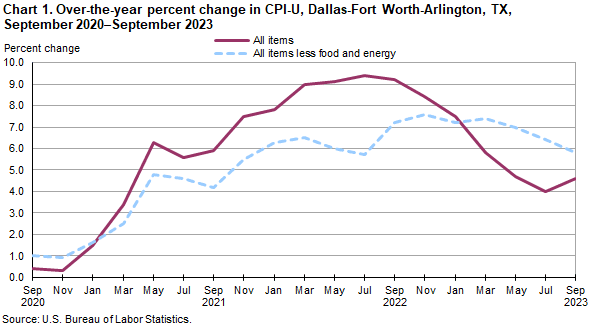

While inflation nationally has dropped from its 9.1% peak in June 2022, it held steady at 3.7% year over year in September, evidence that the Federal Reserve’s goal to lower inflation to 2% is far from over, as previously reported by The Dallas Express.

If more than 50% of Texans are stressed about rising inflation and increasing shelter costs, a percentage of DFW residents are more than likely feeling the stress, too. While inflation in the Dallas-Fort Worth-Arlington metroplex has fallen from its high of 9.4% in July 2022, it rose to an annual rate of 4.6% in September, according to the latest results from the bi-monthly Dallas-Fort Worth-Arlington consumer price index.

“A 1.7% increase to prices paid for shelter was the largest contributor” to local inflation in September, noted Michael Hirniak, assistant commissioner for Regional Operations at the U.S. Bureau of Labor Statistics, per a press release on the metroplex data.