Across Texas, local governments are in the final stages of deciding how they will spend taxpayers’ money in the coming year and are setting property tax rates to pay for that spending.

Savvy taxpayers are paying attention.

While the time to protest property tax appraisal values has passed, now is taxpayers’ last chance to impact the size of their tax bills for the year, as cities and counties hold final budget and tax rate hearings in September.

Property tax bills are a product of both appraised values and tax rates set by local governments. Taxes are driven by spending, so the way to keep citizens’ tax bills in check is to limit local government spending.

School districts account for the biggest share of Texans’ property tax bills (about 60 percent), but most have already set their tax rates for the year.

Cities and counties still take significant amounts of property taxpayers’ money, though, and they’re taking final votes on new budgets and tax rates this month.

Some have acknowledged the devastating financial impact of COVID-related shutdown policies on their residents and adjusted their budgeted spending so property tax bills stay flat (though not lower, which would bring real relief). Others are using the economic downturn as an excuse to raise tax burdens on citizens, despite huge influxes of federal relief funds to local governments.

Senate Bill 2, the property tax reform passed in 2019, lowered how much local governments can raise residents’ property taxes without a public vote, from 8 to 3.5 percent for cities and counties. Most are staying below that Voter Approval Rate.

SB 2 also reduced the number of public hearings a city or county is required to hold on a tax hike, from two to one. And officials can adopt the tax increase at the same meeting as the public hearing—effectively disregarding anything citizens say at the hearing.

Even within generally conservative Collin County, just north of Dallas, suburban cities are taking different approaches, while the county government continues to rely on a growing tax base to fund budget growth.

Collin County

Hearing & Vote: Monday, September 13

For the sixth year in a row, county officials budgeted based on the taxpayer-friendly No New Revenue rate.

Formerly called the Effective Tax Rate, the NNR collects the same overall revenue from properties taxed the previous year, keeping tax bills stable even as property values rise (though individual results vary).

Allen

Hearing & Vote: Tuesday, September 14

Allen city officials initially budgeted based on a property tax rate above the NNR—in other words, a tax hike.

But the city’s three newest council members ran on a platform of maintaining city services without raising property taxes—and citizens are holding them to their campaign commitment.

Residents didn’t wait until this month’s public hearing (on the same day the tax rate will be approved) to weigh in.

Instead, they showed up at the August 24 Allen City Council meeting and used the time allotted for citizens’ comments to explain why the city should adopt the No New Revenue rate instead of raising taxes.

“We could use a break,” Karla Gant told council members, echoing a sentiment shared by many others.

“We’re still rebounding from COVID shutdowns,” said Daniel Rodriguez, adding that senior citizens and unemployed residents are being taxed out of their homes.

“It’s been a hard year. We’ve tapped out all of our resources,” said Selina Martin. “Instead of looking to us to dig deeper into our pockets, the city can dip into your reserves.”

Several noted the city already has resources to fund items budgeted in excess of the NNR. And resident Jeff Lytle pointed out that even small tax increases compound over time.

More than a dozen citizens, many with the recently formed activist group We the People Allen, spoke in favor of the NNR; another 14 at the meeting registered written support.

Earlier this year, WTPA members actively campaigned for the three new fiscally conservative council members, and they have continued to stay informed and engage with local officials on key issues such as spending and taxes.

The Allen council is expected to present an amended budget at next week’s hearing.

McKinney

Hearing & Vote: Tuesday, September 7 – City council raised taxes

The McKinney City Council has already raised residents’ property taxes for this year.

According to the tax-hike ratification ordinance passed Tuesday, “the City Council finds that it must ratify the increased revenue from property taxes” because the council chose to adopt a budget based on higher property taxes.

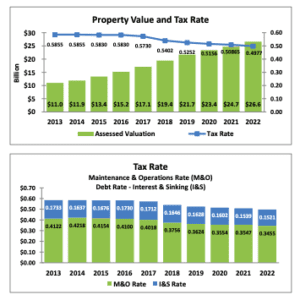

Yet looking at charts in the city’s budget proposal, taxpayers might have thought their taxes were going down, because they showed decreasing tax rates.

“Just because our tax rate is lower, it does not mean we pay less in property taxes,” said resident Bridgette Ann, who publishes the local government watchdog site McKinney Citizen to Citizen. “As long as our property values keep going up and our tax rate does not lower enough to offset the property value increase, we’ll be paying more in taxes.”

The average McKinney homeowner’s city property tax bill will go up $71 (4 percent), to $1,863. Since 2012, the city’s average property tax bill has gone up $649—a 53 percent tax increase over nine years, despite falling tax rates.

Plano

Hearing & Vote: Monday, September 13

For a third year in a row, Plano city officials budgeted based on the No New Revenue rate.

As in Allen, Plano’s city council has shifted over the past few election cycles as voters elected pro-taxpayer members who campaigned on maintaining city services without raising taxes.

Before then, the average Plano homeowner’s city property tax bill had skyrocketed by 40 percent over five years. Like McKinney, prior Plano councils had lowered tax rates, but not enough to offset rising property values.

Frisco

Hearing & Vote: Tuesday, September 21

The Frisco City Council also budgeted based on a property tax increase that will rake in an additional $13.5 million in revenue (a 9.6 percent increase).

The proposed tax rate will raise the average Frisco homeowner’s city property tax bill by $111 (6 percent), to $1,971.

Other cities and counties across the state, including major urban areas in the Dallas-Fort Worth metroplex, are also finalizing budgets and tax hikes this month.

Little time is left for citizens to protest their local officials’ excessive spending and taxing plans for the year.

How Texans Can Impact Local Spending and Taxes

- Elect fiscally responsible local officials

- Communicate with officials early in the budget process to make your priorities known

- Participate in public hearings

- Stay engaged with local officials throughout the year

- Encourage neighbors to do the same