The Republican-controlled House of Representatives will vote on a bill that would abolish the Internal Revenue Service (IRS) and eliminate the national income tax, replacing it with a national sales tax.

The Fair Tax Act, introduced by Rep. Buddy Carter (R-GA) would eliminate national personal and corporate income taxes, as well as death, gift, and payroll taxes.

It would replace the current tax levying system with a plan that Carter claims would simplify the tax code and end the need for the IRS — which was slated to hire 87,000 new workers.

“Instead of adding 87,000 new agents to weaponize the IRS against small business owners and middle America, this bill will eliminate the need for the department entirely by simplifying the tax code with provisions that work for the American people and encourage growth and innovation,” Carter said in a press release.

“Armed, unelected bureaucrats should not have more power over your paycheck than you do,” he added.

Carter initially submitted the bill in January 2021, but it did not gain traction. The original co-sponsors included several other Republican congressmen, including Reps. Andrew Clyde (R-GA), Jeff Duncan (R-SC), Thomas Massie (R-KY), and Gary Palmer (R-AL).

“As a former small business owner, I understand the unnecessary burden our failing income tax system has on Americans,” said Rep. Duncan in a statement. “The Fair Tax Act eliminates the tax code, replaces the income tax with a sales tax, and abolishes the abusive Internal Revenue Service. If enacted, this will invigorate the American taxpayer and help more Americans achieve the American Dream.”

Rep. Bob Good (R-VA), another co-sponsor, asserted that it would bolster the U.S. economy since “it encourages work, savings, and investment.”

The vote on the bill was agreed to in a deal between House Speaker Kevin McCarthy (R-CA) and the House Freedom Caucus, who extracted concessions in exchange for supporting him in his quest for the speakership last week.

Freedom Caucus Chairman Rep. Scott Perry (R-PA) was also among the bill’s co-sponsors.

However, political pundits suggest that the Fair Tax Act has little chance of becoming law as it would not have enough support in the Democrat-controlled Senate.

This comes soon after the Republican-led House voted 221-210 along party lines on a bill to rescind most of the $80 billion of taxpayer funds allocated to the IRS by Democrats in the Inflation Reduction Act of 2022.

The Democrat-controlled Senate has expressed its intent to ignore the bill rescinding the additional funding.

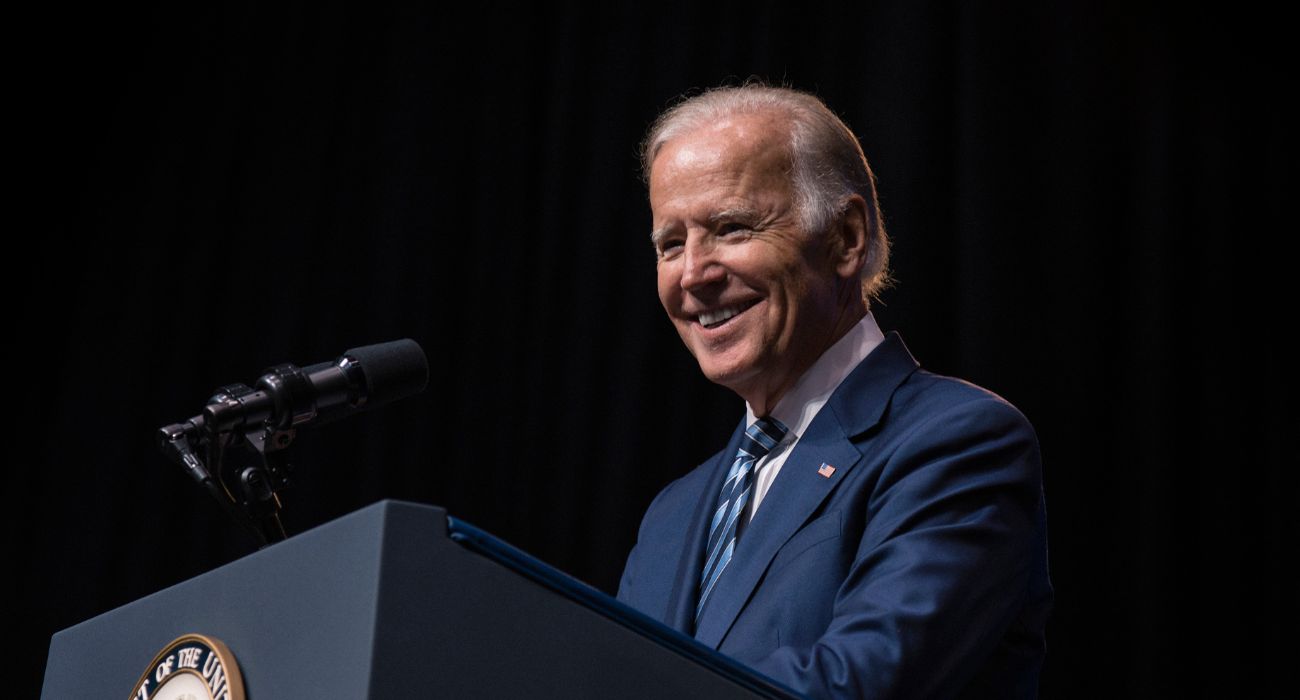

The White House slammed House Republicans for the bills targeting the IRS, with President Biden alleging that “their top economic priority is to allow the rich and multi-billion dollar corporations to skip out on their taxes, while making life harder for ordinary, middle-class families that pay the taxes they owe.”

But new data from Syracuse University’s Transactional Records Access Clearinghouse (TRAC) suggests that the IRS disproportionally targets low-income taxpayers rather than millionaires and billionaires.

“The taxpayer class with unbelievably high audit rates — five and a half times virtually everyone else — were low-income wage-earners taking the earned income tax credit,” the report stated.

“[T]hey are easy marks in an era when IRS increasingly relies upon correspondence audits yet doesn’t have the resources to assist taxpayers or answer their questions,” it continued.

The GOP is not serious about addressing citizen’s needs. They are anti american.

Whatever!!!!!!!!!!!!!! That’s a LIE! Who’s the ones kneeling at sporting events bc they hate America?!?!? Sure ain’t the GOP. Geeeez, get off the juice comrade!

kneeling was not a display of hate. stop the false narrative

Neither is the confederate flag.

Wait, can you please tell ANY of the OVER 100 NFL Players that took knees political affiliation? Or, are you just guessing like you were taking yiur math test in school and forgot to study. See, I know political affiliation of SOME. Hence why I ask

Did you read the part above about the IRS disproportionally targeting low-income wage-earners taking the earned income tax credit, or do you only believe what Biden and the big spending Dems say?

Exactly. Because the upper crust can afford high paid lawyers (that they can probably claim on their tax return). The government knows the low income workers haven’t a prayer and no protection. I like what McCarthy said, “We’re here to help Americans, not go after them”.

“Freedom Caucus” is not serious; last week the House was falling down, and this week it’s major overhaul of the tax code…no big deal.

Numerous studies and financial experts have proven that a national sales tax would produce as much revenue, be more fair on everyone, improve the overall economy, and be more difficult to cheat. Example – our own state of Texas has a sales tax with no income tax, and we have a powerhouse economy with a surplus of revenue. And don’t kid yourself about who pays the taxes – businesses and corporations don’t pay taxes, you do. Their tax is built into every product you purchase. And don’t believe the false talking point about the wealthy not paying their fair share – according to IRS data for 2019, the top 1% income bracket paid 38.8% of all federal taxes, the top 50% income bracket paid 97% of all federal taxes, and the bottom 50% of income earners paid just 3% of all federal taxes. And unless you work for the IRS, do you know anyone who likes the IRS or doing their annual income tax. Not even IRS agents understand all 76,000 pages of the overly complicated IRS tax code! Finally, it would be really nice if you could participate in an objective dialogue of facts regarding a topic rather than just name calling.

Right on, Jim! But you (and Jesus Enriquez, the writer) didn’t mention some key features of the FAIRtax. The FAIRtax (HR25):

Can you cite the source for a few of the “numerous studies and financial experts” mentioned?

Thank you, Thank you, Thank you!!!!!! Let’s keep our tax code simple, straight forward and fair to everyone!

Voting for it when it has no chance of passing is one thing voting for it when there’s a chance of it actually making it into law is another. They did that with Obamacare countless times.

This is interesting and I would like to see more about it. I wonder how much they could collect and where it would come from exactly. I wish we didn’t have political parties so it wouldn’t be party connected and our voted officials would answer to the people that elected them and not the party.

You can read the bill (HR25) at Text – H.R.25 – 118th Congress (2023-2024): FairTax Act of 2023 | Congress.gov | Library of Congress. Compared to most legislation, it’s a pretty easy read.

Since it was first introduced (in 2009?), the FAIRtax has been claimed to be “revenue neutral”; that is, taxes collected under the FAIRtax would equal taxes that might have been collected under existing tax laws.

As to party affiliation, this life-time Republican helped man a booth at the 2010(?) Democratic Party of Texas convention. One gentleman listened with interest as I talked to him about the FAIRtax and seemed about to become a supporter when he asked who had proposed it. When I said a Republican from Georgia, he literally turned on his heel and walked away. He must not have been a Bulldogs fan.

I’m just happy to see Trumps organization just fined $1.6 Billion for tax fraud over 15 years, and NOW, just days after his whole organization gets busted for tax fraud, the GOP wants to abolish the IRS. Coincidence? I highly doubt it. I mean, it has to pass the House (GOP Lead) and the Senate (Dem lead). Good luck!!!

The IRS disproportionately targets mid to lower income because the wealthy have tax accountants, strategists and lawyers to ensure their client is adhering to the tax laws. It’s the low to middle income that are a target-rich environment.

A consumption tax (sales tax) should keep staple-goods exempt and then it creates a fair tax. Democrats are unlikely to vote for this as it eliminates their ability to funnel funds to pet projects while kneecapping their ability to over-tax the wealthy (1%) who already pay 39% of all taxes.

Here’s a better idea: make the billionaires and millionaires pay their fair share of taxes, so we the common people aren’t unduly burdened. Even Warren Buffet has said that he pays less per capita in taxes than his secretary does, and he admitted it is grossly unfair.