Former Texas senator and candidate for governor Don Huffines has released a new paper advocating against the practice of taxpayer-funded corporate tax abatements.

The paper was authored by Huffines and Bill Peacock, the policy director for the Huffines Liberty Institute.

Opening with some historical context, the authors explain that “in 2021, under significant political pressure from the left and the right, the Texas Legislature let expire the Chapter 313 ‘economic development’ program that allows Texas school districts to offer property tax abatements to politically connected businesses.”

They go on to claim that “the program did little for expanding economic development. Instead, it filled school district coffers at the expense of taxpayers across the state while littering Texas counties with wind and solar farms.”

Chapter 313 “is an agreement in which a taxpayer agrees to build or install property and create jobs in exchange for: a 10-year limitation on the taxable property value for school district maintenance and operations tax (M&O) purposes.”

The Texas Taxpayers and Research Association clarified, “Chapter 313 allows a school district to offer a temporary, 10-year limit … on the taxable value of a new investment project in manufacturing, and certain environmentally friendly energy projects.”

When the program expired in 2021, Gov. Greg Abbott promised to replace Chapter 313 with incentive programs that would accomplish similar goals.

“Chapter 313 is gone, and that said, there is a desire in the Capitol to make sure Texas does remain No.1 for economic development,” the governor recently suggested, per the Texas Tribune. “We’re working on — and others in the Capitol are working on — to ensure that we will have economic development tools going forward.”

Similarly, House Speaker Dade Phelan (R-Beaumont) previously said, “We’re gonna reestablish the Chapter 313 tax agreements,” per the Texas Tribune.

“It is clear, however, that Texans do not win when tax abatements are granted to these businesses,” Huffines and Peacock claim. “Abatements are simply a transfer of wealth from regular taxpayers to big companies.”

According to the paper, these abatements mean that the individual taxpayer is left to shoulder the burden of taxation while companies picked by the school districts get discounts on the amount of taxes they have to pay.

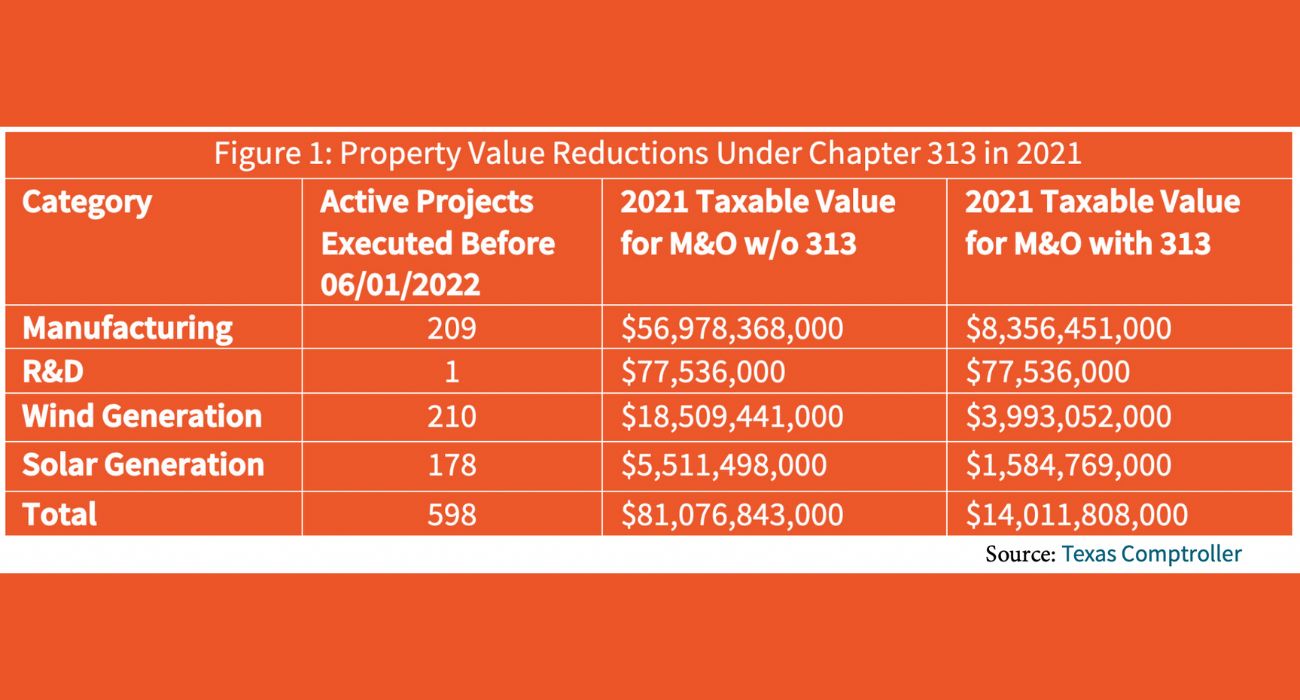

A chart compiled from data provided by the comptroller’s office suggests that Chapter 313 tax abatements allowed businesses to avoid paying over $67 billion in local taxes. Huffines suggests that such a tax break means that individual taxpayers are footing the bill.

The paper concludes, “Tax abatements — giving tax breaks to politically connected businesses — while continuing to raise everyone else’s property taxes to pay for the abatements is theft.”

Huffines added in a statement provided to The Dallas Express, “Of course businesses that have real estate assets need property tax relief! The more real assets a business has, the more they are punished by the government.”

“The solution, however, isn’t picking winners and losers via lobbyists and campaign donations, it is simply eliminating or substantially cutting the property tax burden for all property owners.”

Defenders of Chapter 313 argue that it attracts investment and encourages job creation, thus justifying the cost to state taxpayers, according to a 2016 analysis from the Texas Comptroller’s office.