(Texas Scorecard) – As the Trump administration ramps up its trade war with China, the Teacher Retirement System of Texas continues funding the Communist regime—in apparent defiance of Gov. Greg Abbott’s divestment order.

While TRS has shed direct investments, indirect investments through commingled funds are still included in the system’s portfolio, and the total dollar amount of these indirect holdings is hidden.

Meanwhile, as state lawmakers debate forcing transparency and divestment on state agencies, Abbott is set to appoint two new TRS board members this year. One of the candidates strongly opposes investing in China.

Investments

TRS manages Texas educators’ retirement fund investments. Its proxy vote records from January 2021 to December 2024 revealed investments in about 500 Chinese companies, located in mainland China and Hong Kong. As of December 31, 2024, TRS reported $133.5 million in direct Chinese securities investments, within a total pension trust fund value of $207.3 billion.

In November 2024 Abbott ordered state pension funds to divest from Chinese firms.

TRS stated that by January 31, 2025, it and its external managers had divested all direct investments in China and Hong Kong companies–except those that are non-traded or regulator-suspended ones–and had removed China from its investment plan in September 2024. Its new strategic asset allocation benchmark no longer includes China or Hong Kong.

But TRS records show proxy votes in more than 10 Chinese companies since January 1, 2025, with five being new investments. A TRS February 2025 report of public equity and fixed-income holdings also showed investments in Chinese funds.

Dr. Marty Lenard, fine arts director at New Braunfels ISD, was surprised by TRS’s new proxy votes for Chinese companies, interpreting Abbott’s order as requiring divestment without new investments. “It is very interesting why there would be new companies that TRS would have proxy votes for,” he wrote in an email to Texas Scorecard.

In 2025, Abbott will appoint two new TRS board members from a list of candidates, Dr. Lenard among them, voted on by government-school employees.

A TRS spokesperson admitted to Texas Scorecard that the system still holds indirect investments in China and Hong Kong through commingled funds, where TRS is one of many investors. A direct investment is akin to owning a single stock, while indirect investment through pooled funds would likely occur through participation in a mutual fund. In the latter, the investor doesn’t choose the mix of stocks held by the fund.

As such, TRS wrote that the system lacks control over specific investments in these funds. “The recent proxy votes you have identified fall into that category,” a TRS spokesperson wrote on April 1. “Where TRS has the ability to instruct the manager how to vote shares in commingled funds, we do instruct them according to our proxy policy.”

In his November order, Abbott wrote to state investment agencies, “To the extent you have any current investments in China, you are required to divest at the first available opportunity.” His office didn’t respond when asked to clarify whether this applies solely to direct investments.

Texas Scorecard inquired if TRS could invest in commingled funds that exclude regions like China and Hong Kong. A TRS spokesman replied it is pushing the industry to create such products, but none are “commercially available yet.” When asked for the total amount of indirect investment in China and Hong Kong via commingled funds, TRS cited an exception in the Texas Public Information Act (552.143) allowing it to withhold “certain investment information.”

Fort Worth Attorney Tony McDonald noted that TRS is choosing to withhold this information; the law does not mandate it be withheld. “Just because the PIA permits a governmental body to withhold record[s] does not absolve them of their choice to hide the information from Texans,” McDonald stated.

Security Risk

Year after year of threat assessments reveal China, the state, to be at odds with the U.S., making investments in the global superpower tantamount to funding the enemy and underwriting human rights violations in the process.

The U.S. State Department deemed the Chinese Communist Party, which rules China, “the central threat of our times.” The 2025 Annual Threat Assessment of the U.S. Intelligence Community labeled China a national security threat and highlighted China’s economic warfare, which aims to make nations dependent on the communist regime.

Investments by state pension funds like TRS have been weaponized against Americans. Roger Robinson, a Reagan administration alum, reported in 2025 for State Armor that investments from U.S. state pension funds into China, totaling $68 billion, are bankrolling that country’s military growth and human rights-abusing firms.

A deep dive into three of the 18 Chinese firms in TRS’ recent proxy votes exemplifies the deep ties Chinese companies have with the CCP.

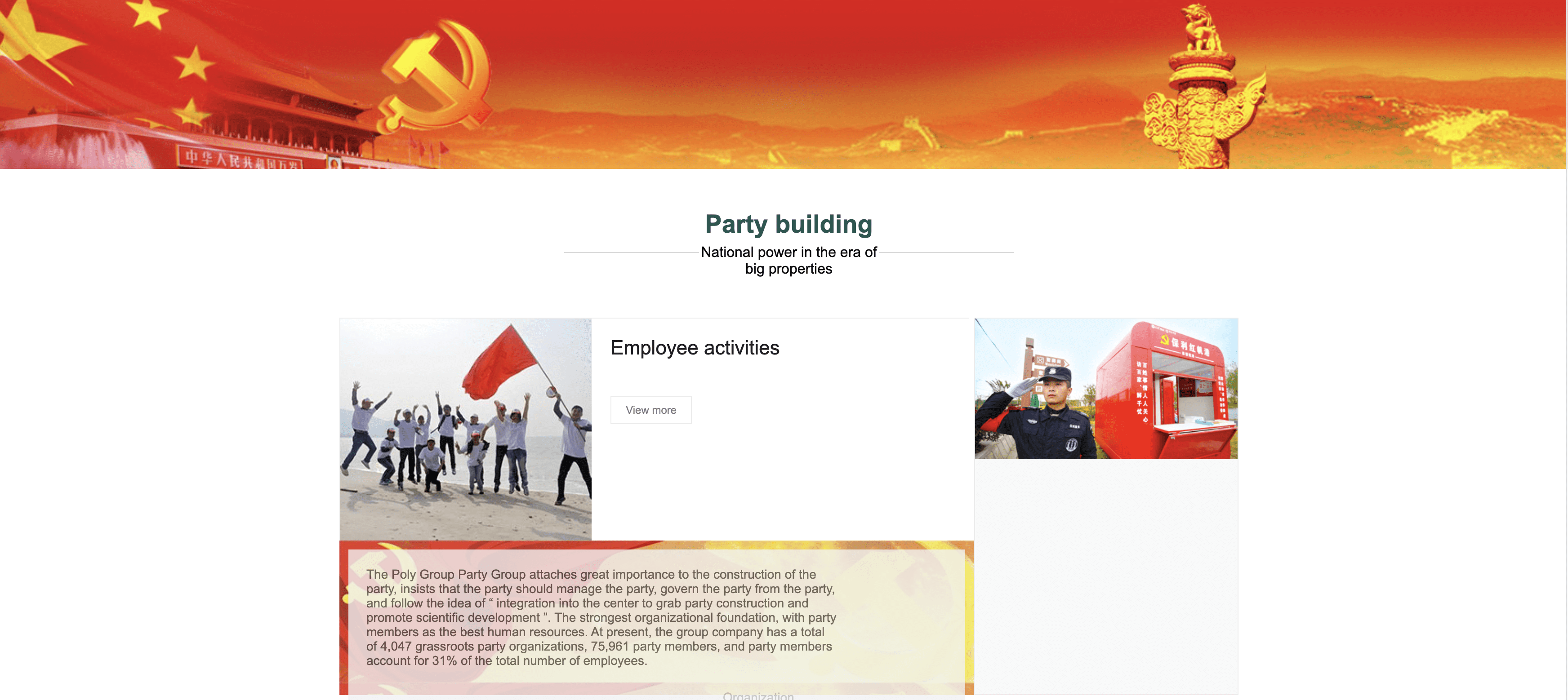

Take the Hong Kong-based Poly Property Services for example.

One section of the real estate company’s website is dedicated to CCP promotion.

Source: Poly Property Services.

The company boasts that 31 percent of the company’s employees are CCP members.

That’s not all Texas educators’ retirements are funding.

Medical

Two of the new companies that showed up in TRS proxy votes are medical firms.

The 2025 threat assessment warns against healthcare ties with China, citing lax safety and environmental standards, plus its grip on pharmaceutical production, enabling potential export halts to gain leverage in trade or security clashes.

First of the latest TRS medical investments is Remegen, a biologic drug developer targeting autoimmune diseases, cancer, and eye conditions, led by CCP insiders. Chairman Weidong Wang, a national congress member since 2018, boasts the title “Outstanding Builder of Socialism with Chinese Characteristics.” CEO Dr. Fang Jianmen, honored by the CCP Central Committee, is a teacher and a supervisor at Tongji University—a key defense lab with covert security ties, per the Australian Strategic Policy Institute.

The second company is Lepu Biopharma, a biopharmaceutical business. The CCP has a significant tie through one of the company’s “strategic investors”: China Reform Holdings Corporation, a state-owned enterprise.

Energy

Xinte Energy, a Chinese firm pushing shaky solar and wind energy, is a fresh TRS investment. It flaunts CCP influence, vowing to “carry on [the] CCP’s soul” and obey Chinese Premier Xi Jinping.

A 2021 report flagged Xinte for potential involvement in China’s Uyghur slave labor camps. The company didn’t respond to questions from the media at the time. In July 2022, Reuters reported U.S. Democrat lawmakers questioned Xinte’s exemption from import bans under the Uyghur Forced Labor Prevention Act, enacted to counter China’s forced Muslim labor camps.

Responsive Measures

Despite China’s aggression, Robinson uncovered U.S. state retirement systems funneling cash into sanctioned Chinese military firms and rights abusers, often cloaked in secrecy. He urged state lawmakers to force instant disclosure of these investments—including ETFs and index funds—if governors and top officials obstruct transparency.

There’s movement along these lines in Texas. According to Texas Policy Research, State Sen. Bryan Hughes (R–Mineola) introduced such a measure (Senate Bill 667) that, in its current form, would ban all state government entities from investing in “certain Chinese-affiliated entities.”

Texas Policy Research’s analysis lauds the measure for its bold stand on economic sovereignty and transparency-boosting safeguards.

TRS Board Election

TRS’ China investments are part of a pattern. In October 2024, a Texas A&M and University of Texas firm was found to have invested endowment funds in Chinese companies. Abbott’s divestment order followed this revelation.

TRS is overseen by a board of directors whom Abbott appoints. This year, he will appoint two board members from a list of candidates voted on by Texas government-school employees.

Three candidates are running this year: Dr. Ismael Gonzalez III of Gregory-Portland ISD, Dr. Marty Lenard of New Braunfels ISD, and Dr. Pete Pape of Leander ISD.

“To take this further, I believe that investments should be made in businesses that are legally able to operate in Texas,” he wrote. He referenced a May 2012 report about how TRS lost $99 million by investing in casinos.

Dr. Pape also replied, “While I generally advocate for flexibility in portfolio diversification to maximize returns, I also recognize, in certain circumstances, strategic restrictions serve the greater good of our state and nation.” He added, “If elected/selected to serve on the TRS board I would vote in a manner that would ensure TRS is in compliance with approved legislation.”

Dr. Gonzalez didn’t provide a comment. Government-school employees can vote online or by mail for the three candidates, with ballots due May 5.

Abbott’s office didn’t respond to a request for comment, nor did State Rep. Cole Hefner (R–Mount Pleasant), who has publicly positioned himself as a hawk on China.

Citizens wishing to conduct a deep dive may view our list of Chinese companies that we compiled from TRS’ proxy votes.