City Manager T.C. Broadnax’s proposed budget for the upcoming fiscal year includes a property tax rate cut for the eighth year in a row, yet the property tax payments of Dallas residents continue to climb year after year.

As previously reported by The Dallas Express, the proposed $4.6 billion budget for fiscal year 2023-24 would reduce the property tax rate.

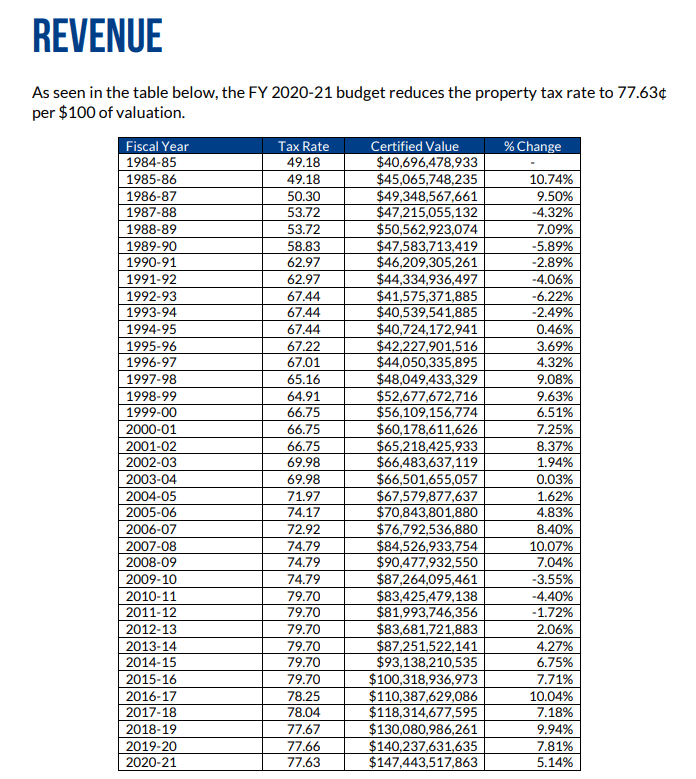

Council members were briefed on the budget on Tuesday in a presentation by Chief Financial Officer Jack Ireland and Budget and Management Services Director Janette Weedon. The budget proposal suggests reducing the property tax rate by $0.0065 from $0.7458 to $0.7393 per $100 valuation.

Despite the City having lowered its property tax rate for eight consecutive years, Dallas residents continue to make larger property tax payments every year due to skyrocketing property value estimates.

Tuesday’s presentation noted that property values in Dallas have increased by a total of $18.8 billion compared to FY23-24. The total property value for FY23-24 is $198.3 billion.

Most of the funds from property taxes are directed toward school districts, but the amount the City collects in property taxes has risen significantly over the past several years.

In FY22-23, the City accounted for $1.3 billion in property tax revenue — $132 million more than the previous year, which was $107 million more than FY20-21, which was $56 million more than the year before that.

The total value of property in Dallas continues to rise, and Dallasites continue to pay more and more in property taxes despite the City passing “property tax relief” year after year.

As previously reported by The Dallas Express, a study earlier this year found that Dallas had the highest five-year property tax increase of any major city in the United States.

In 2016, Dallas residents paid an average of $2,851 in property taxes. By 2021, that figure grew 63.8%, with Dallasites paying $4,671 in property taxes on average.

Mayor Eric Johnson has repeatedly stated that property tax reform is one of his highest priorities.

As part of the proposed City budget, officials are also recommending increasing the over-65 disabled exemption from $115,500 to $139,400 in addition to the 20% homestead exemption — the largest exemption permitted under Texas law.

Note: This article was updated on Friday, August 11 at 12:36 p.m. to correct a mathematical error.