Although North Texas is one of the nation’s top markets for multifamily house construction, the rate of new apartment permits has begun to slow.

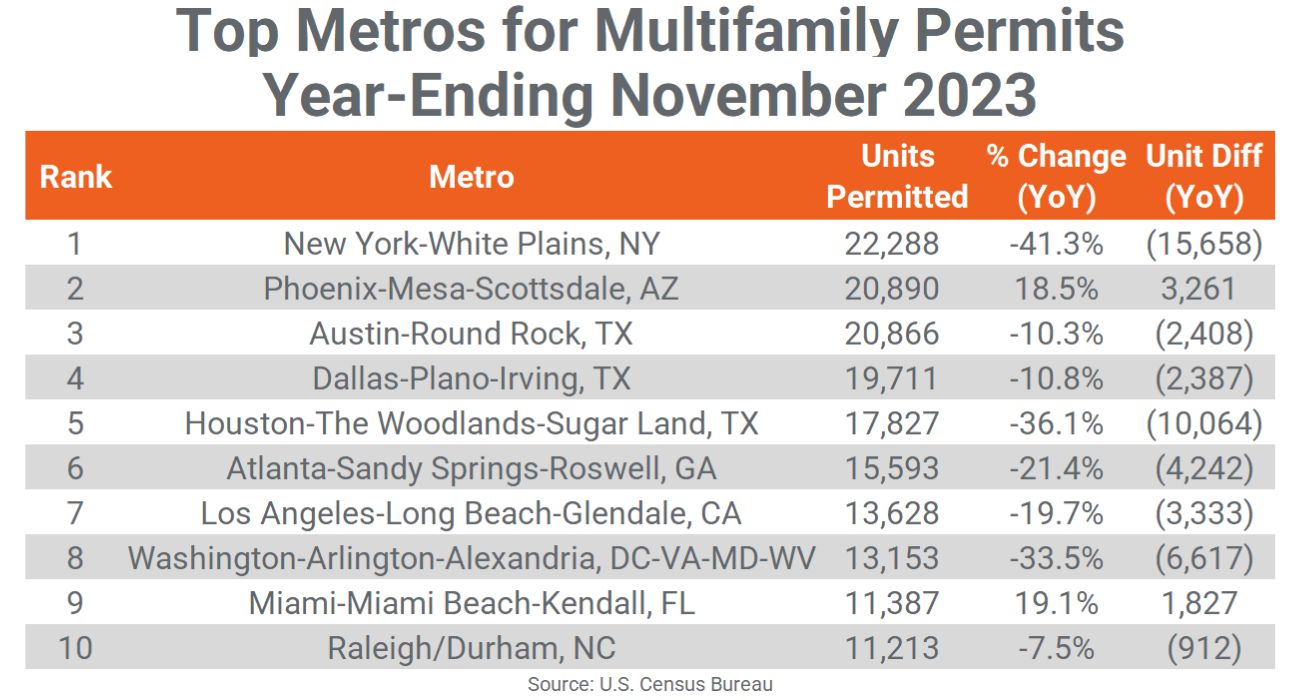

The Dallas-Plano-Irving metro area ranked No.4 in terms of multifamily units permitted through the first eleven months of 2023, according to a recent report from RealPage. While multifamily permits in the Dallas region were up slightly from October, they were down almost 2,400 units compared to November 2022.

“The pace of multifamily permitting is continuing its declining trend that began in mid-2022,” wrote Chuck Ehmann, senior real estate economist at RealPage.

In total, 19,711 units were permitted in the Dallas area between January and November, marking a nearly 11% decrease compared to the prior year’s tally. This trend was seen on the national level, with the rate of apartment permits falling roughly 21% year-over-year.

As previously reported by The Dallas Express, the Development Services Department (DSD) under City Manager T.C. Broadnax has suffered periodic permitting backlogs and various inefficiencies in operations that have cost builders and inhibited various development projects.

Although the greater Dallas-Fort Worth metro area previously ranked No.1 in the country for total construction and No.1 for rental demand during the third quarter, RealPage economist Jay Parsons told The Dallas Morning News that this trend is unlikely to continue.

As the supply of multifamily apartments maxes out in 2024, Parsons said markets will begin seeing a “dramatic plunge” caused by a slowdown in new starts, higher financing costs, and softer fundamentals, as reported previously by The Dallas Express.

“High supply is great news for renters and a hurdle for investors. Renters suddenly have far more options than they’ve had in recent years, and that’s putting downward pressure on rent growth,” Parsons said in a January 4 RealPage report.

Parsons said the big question for 2024 is whether rents will continue to hold flat as completions accelerate.

“Another 671,000 units are scheduled to be completed in 2024, after which supply should thin out dramatically,” he said. “In turn, occupancy and rents should rebound in 2025-26.”