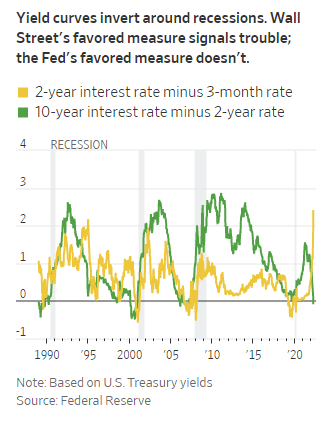

The economic signs are pointing toward a possible recession — again. The yield on the 2-year Treasury note surpassed that of the 10-year note, creating what is known as an inverted yield curve. Economists take this bond market set-up to hint that a downturn could be around the corner.

Last Thursday, the 10-year Treasury yield dropped to 2.331%, just as the 2-year Treasury yield climbed to 2.337%. On Friday, the scenario resurfaced when the 2-year yield hovered at 2.4% while the 10-year yield fell to 2.38%.

Though the yield inversion did not last long, it was enough to place analysts on high alert.

A yield inversion, which until now hasn’t occurred in 3 years, does not mean that a recession is imminent. Some economists believe the spread is only reliable if it remains consistent for some time; thus far, the curve has dipped in and out of this territory.

Nevertheless, based on the historical precedence, the economy’s chances to skate by this time are slim. Bespoke Investment Group places the odds of a downturn in the face of an inverted yield curve at greater than 66% in the next year and over 98% in the next two years.

The last time the spread flipped negative was 3 years ago, before the pandemic-fueled recession of 2020.

Banks provide a relevant example of how the yield curve, which marks interest rate movements, is a harbinger of future economic activity. This course reflects the difference between the cost of money for banks and what these financial institutions earn from issuing loans. If banks earn less than they make, their profit margins squeeze, and loan activity crawls, creating a ripple effect on the economy.

The Federal Reserve had already begun its campaign for tighter monetary policy. Still, now that the bond market is pointing toward a possible recession, some market participants suggest the Fed should change tactics.

Cathie Wood, founder and CIO of ARK Invest, believes hiking interest rates at this point would do more harm than good, saying the Fed is “playing with fire.”

Yesterday, the yield curve – as measured by the difference between the 10 year Treasury and 2 year Treasury yields – inverted, suggesting that the Fed is going to raise interest rates as growth and/or inflation surprise on the low side of expectations…which will be a mistake. https://t.co/5QNZeDWTn4

— Cathie Wood (@CathieDWood) April 2, 2022

Wood gauged the state of the economy by U.S. consumer sentiment, which she explained has fallen below pandemic levels to resemble the fear that gripped Americans during the 2008-2009 era. It is also a stone’s throw away from the mood of the 1980s when the economy dealt with a double whammy of soaring inflation and rising interest rates.

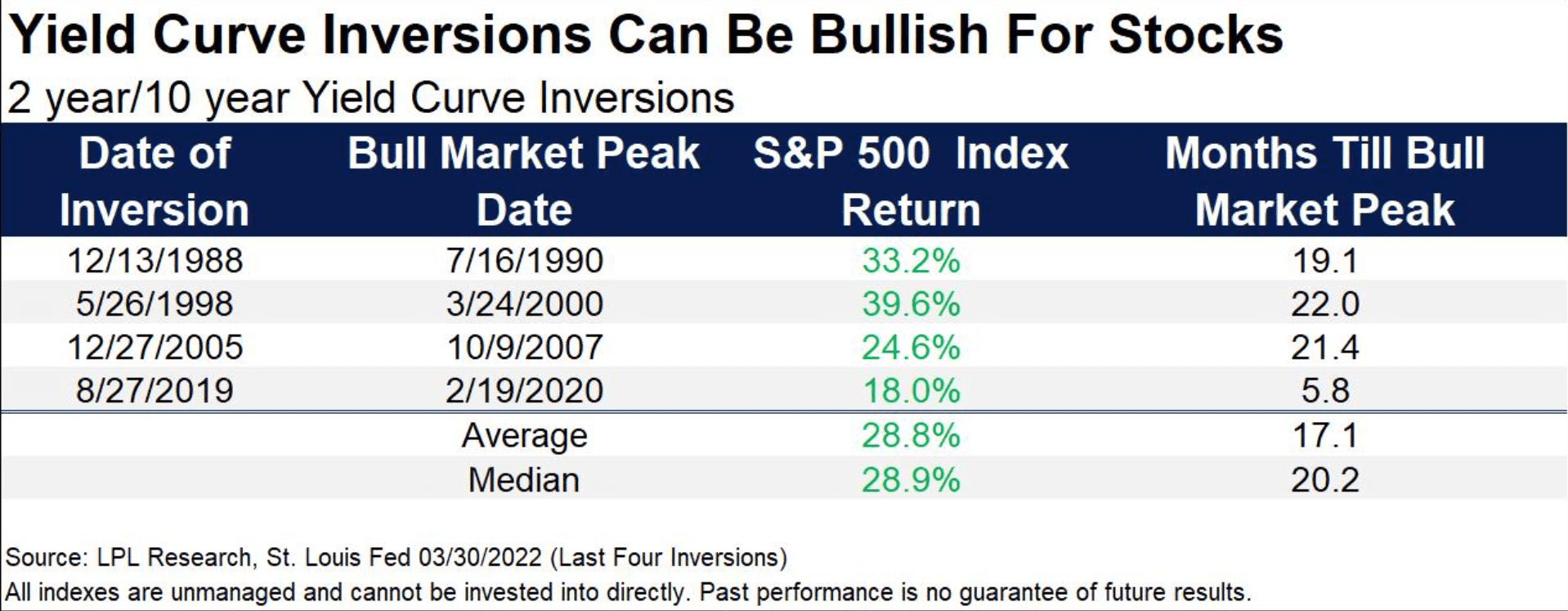

In contrast, the chief market strategist at LPL Financial, Ryan Detrick, sees the glass as half full.

“Beware some of the narratives taking place right now,” he warned.

Detrick explained that the last four times the spread between the 2-year and 10-year notes turned negative, the curve had ultimately paved the way for a bullish stock run.

The S&P 500 ended up rallying for close to a year and a half in these cases, gaining an average of 28.8%.