Warren Buffett has been known for being tech-averse, but his reputation is slowly changing. The billionaire investor recently revealed in a U.S. SEC filing that his company, Berkshire Hathaway, has been buying shares of tech giant HP Inc. Buffett has poured more than $4 billion into the PC maker for a stake of more than 11%, or 121 million shares, the latest filing reveals.

While positions of this size are not unusual for Buffett, considering his 20% stake in American Express and 26.6% in Kraft Heinz, technology shares have not been at the top of his list. Since his first investment into Cities Service at age 11, he has flocked to sectors like energy, financial services, and consumer staples.

The famous investor lives by several mantras, one of which has been to only invest in companies that he understands, which for years kept him on the sidelines of some winning names like Amazon and caused him some regrets.

It was not until 2016 that the Oracle of Omaha eventually placed a bet on Apple, and now he owns a 5.6% stake. Apple is one of the largest holdings in the Berkshire Hathaway portfolio, with a stake valued at approximately $161 billion.

In addition to Apple, Buffett has added other technology names along the way, including an ill-fated investment in HP-rival IBM. Over a decade ago, he paid $10.7 billion for 64 million shares of Big Blue before reversing course and exiting his position in the stock by about mid-2018.

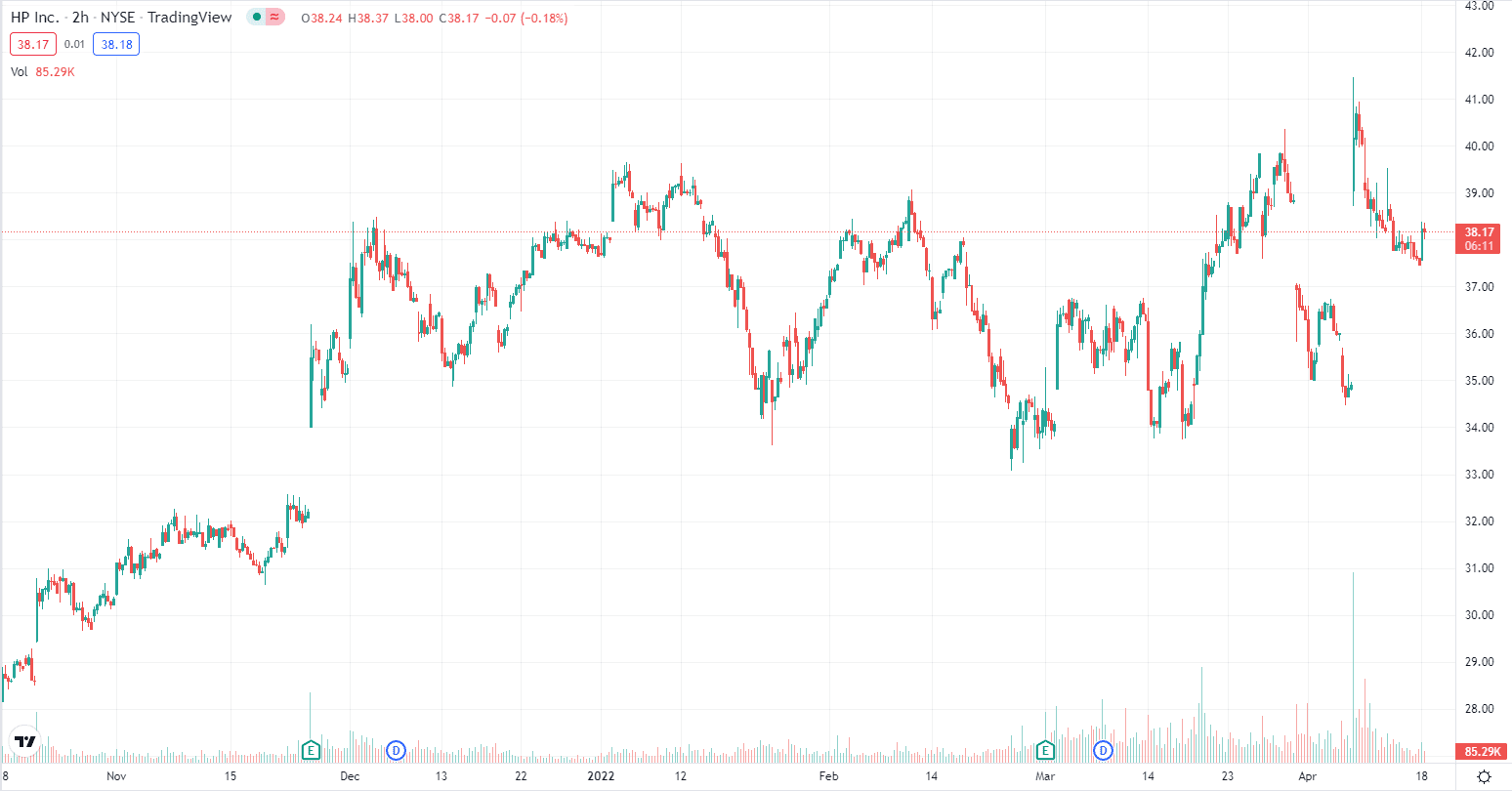

Meanwhile, Buffett is entering HP while the stock is hovering near record-high levels after climbing higher by a double-digit percentage on April 14. Nevertheless, he has a high conviction in the stock. He has become the single biggest shareholder, muscling the likes of BlackRock (10%) and Vanguard (11%) out of the top spots, according to S&P Global Market Intelligence information cited by the WSJ.

HP 6-Month Stock Chart by TradingView

Buffett is a fan of dividend-paying stocks, and HP is one of them. He appears to be in it for the long haul, having stated earlier this year in a shareholder letter:

“We own stocks based upon our expectations about their long-term business performance and not because we view them as vehicles for timely market moves.”

In addition to HP, Berkshire Hathaway’s other investments this year include upping its position in oil and gas company Occidental Petroleum Corp. and purchasing insurer Alleghany Corp.

One tech asset that Buffett is not likely to go near in his lifetime is bitcoin. This year, the leading cryptocurrency based on market cap has been trading a lot like a technology stock rather than a store-of-value like gold.

As investors have fled risk assets in the face of soaring inflation and rising interest rates, bitcoin has gotten lumped into the same category.

When asked about crypto, Buffett has not minced words, describing bitcoin as “rat poison squared” and claiming the digital asset offers “no unique value.”

Buffett recently came under fire in Silicon Valley for his views on bitcoin.

Venture capitalist Peter Thiel came out swinging against bitcoin’s critics, placing Buffett at the top of cryptocurrency’s “enemies list.” According to Thiel, people like Buffett, whom he described as a “sociopathic grandpa from Omaha,” are holding bitcoin back from reaching its full potential. The price of bitcoin is down 13% year-to-date.