Last week, the Organization of Petroleum Exporting Countries (OPEC) agreed to reduce oil production by a substantial 2 million barrels per day starting next month.

The news comes amid an already strained global energy market driven partly by Russia’s invasion of Ukraine and subsequent sanctions against the former by Western nations.

The announcement pushed oil prices higher, with West Texas Intermediate futures appreciating almost 1%.

U.S. Treasury Secretary Janet Yellen claimed OPEC’s decision will be detrimental to the world’s economy, particularly developing countries.

She told the Financial Times, “I think OPEC’s decision is unhelpful and unwise — it’s uncertain what impact it will end up having, but certainly, it’s something that, to me, did not seem appropriate, under the circumstances we face.”

Early in the COVID-19 pandemic, the oil conglomerate dropped output considerably, implementing a record cut of 10 million barrels per day in response to plummeting demand.

Since then, OPEC has slowly increased production levels, but next month’s scheduled drop marks a course reversal.

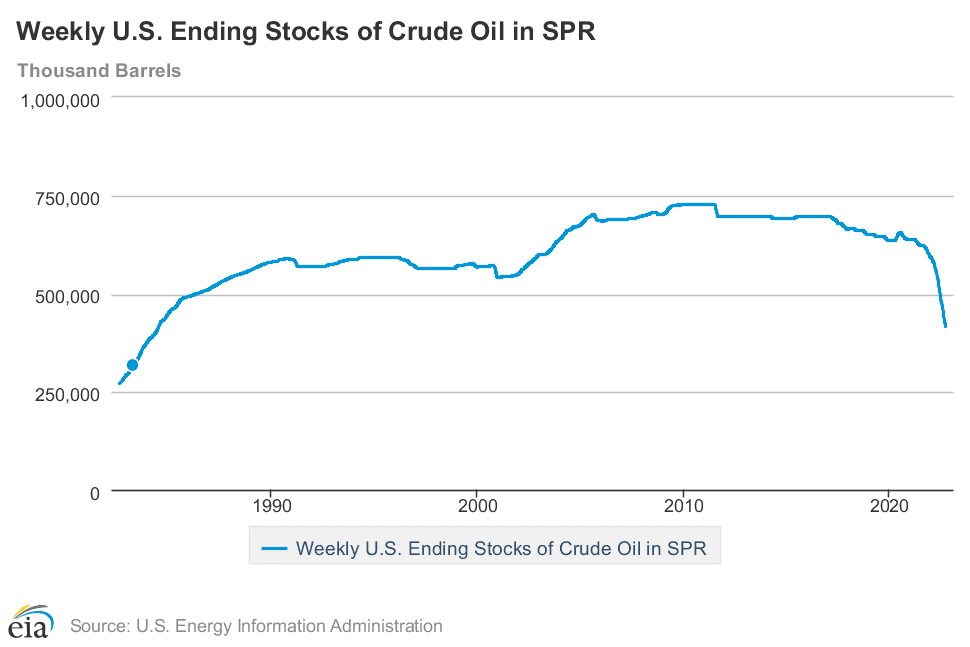

Reacting to OPEC’s move, the Biden administration claimed it would drain an additional 10 million barrels of oil in November from the country’s Strategic Petroleum Reserves (SPR), which held only 416.4 million barrels of oil at the end of September, the lowest level in nearly four decades.

The reserve serves as a massive emergency store of federally-owned crude oil. It provides the U.S. government with a tool to soften disruptions by strategically releasing oil in the energy market.

According to the White House, OPEC’s action is “a reminder of why it is so critical that the United States reduce its reliance on foreign sources of fossil fuels.”

While many countries and companies have accelerated efforts to ditch fossil fuels, recent challenges call into question how realistic these goals are, as previously reported in The Dallas Express.

Balancing a reduction in domestic oil consumption with the country’s energy demands poses a specific challenge to Biden, according to Matthew Continetti of the American Enterprise Institute.

At a time when the administration is seeking to secure energy sources for the United States, detractors can point to the cancellation of the Keystone XL pipeline and other similar actions from the administration as inconsistent with current policy.

Soaring gas prices at the pump earlier this year have only entrenched the problem. While prices retreated some from their highs, the latest move by OPEC will not help lower them.

In a statement delivered by the White House, Biden said he was “disappointed by the shortsighted decision by OPEC+ to cut production quotas while the global economy is dealing with the continued negative impact of Putin’s invasion of Ukraine.”