The United States economy grew more than expected in the fourth quarter of 2023 despite mounting financial pressures on consumers and businesses alike.

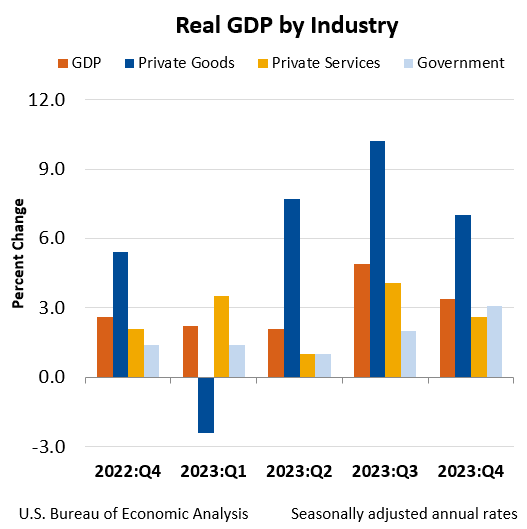

The U.S. economy expanded an annualized 3.4% in Q4 2023, a slight increase from the “advanced” and “second” estimates of 3.3% and 3.2%, respectively, according to the latest Gross Domestic Product (GDP) data from the Bureau of Economic Analysis (BEA).

Final estimates for real GDP “primarily reflected upward revisions to consumer spending and nonresidential fixed investment that were partly offset by a downward revision to private inventory investment,” per the BEA news release.

Although the U.S. economy demonstrated resilience by expanding 3.3% in the last three months of 2023, the pace of growth was slower compared to the 4.9% seen in the three months ending in September.

This deceleration in real GDP from Q3 to Q4 resulted from a downturn in private inventory investment and slowdowns in federal government spending, residential fixed investment, and imports.

Even though data suggests the federal government is spending less, everyday Americans are watching trillions of taxpayer dollars get wasted on programs or sent overseas, as The Dallas Express previously reported.

Despite pork-filled bills, persistent inflation, higher borrowing costs, and ongoing recession fears, the economy remains strong, according to Bill Adams, chief economist at Comerica Bank in Dallas, reported Reuters.

“The economy is in good shape,” said Adams, “It is operating on a more even keel than during the pandemic and its immediate aftermath.”

Even though the March 28 report is good news for the economy, it may push the Federal Reserve to hold interest rates higher for longer. Fed Chair Jerome Powell has stressed the Central Bank’s need to assess additional incoming data before deciding to lower interest rates.

Economic data for 2024 have already shown inflation rebounding higher in January and February. Ultimately, solid growth in Q4 complicates the Fed’s job and increases the likelihood of additional rate hikes, which could be a tipping point for bigger banks and nonbank lenders with looming commercial real estate loan losses.