Twitter’s second-quarter earnings results missed the mark on the top and bottom lines, with the company suggesting it was at least partially Elon Musk’s fault.

The social media giant fell short on critical metrics, including profits, sales, and user additions. According to Twitter, the culprit was a one-two punch of challenges in the ad business amid a difficult macro environment and “uncertainty” around Musk’s botched attempt to acquire the company.

Analysts expected Twitter to report earnings of $0.14 per share. Instead, the company reported a loss on an adjusted basis of $0.08 per share, representing only the second time ever Twitter has swung to a loss based on this formula. Revenue was a major disappointment, coming in at just under $1.2 billion, 11% below expectations, and representing the company’s most significant sales shortfall in history.

Twitter also fell short on user growth, failing to meet the 238.08 million estimate by several hundred thousand users. Businesses have been tweaking their advertising budgets due to a challenging economic backdrop comprising soaring inflation, rising interest rates, and shifting supply chains.

In addition to a murky ad environment, Twitter’s management blamed “uncertainty related to the pending acquisition of Twitter by an affiliate of Elon Musk.”

Not all market observers agree with the proposed correlation.

For example, New Zealand media publication Business Live said, “It’s a bit rich to blame Musk for Twitter’s weak performance.”

Greg Price, a senior digital strategist at X Strategies whose Twitter account boasts 150,000 followers, suggested it is Twitter insiders who are to blame for moving hell and high water to block Musk from taking the helm of the company because of politics.

Twitter's insiders essentially just decided to screw over their shareholders, crash their stock, and open the company up to massive lawsuits just to prevent Elon Musk from running Twitter in a way that won't rig elections or censor their political opponents.

— Greg Price (@greg_price11) April 15, 2022

Earlier this month, the tech billionaire reneged on his plans to buy Twitter, saying that the company failed to provide transparency on the number of fake bot accounts. Now the matter is tied up in litigation.

The debacle of a deal is in the hands of the court, with a trial planned for October. Twitter is seeking to force Musk to hold up his end of the bargain and buy the company for $44 billion. There is no telling how or for how long the case will play out, fueling uncertainty for all involved.

Musk had secured a consortium of investors to make the Twitter acquisition. Among them was Changpeng (CZ) Zhao, who is at the helm of major cryptocurrency exchange Binance. CZ tweeted he will support “whatever Elon decides,” saying there is a time to lead and a time to follow.

It might be slightly over priced. But will support whatever Elon decides. There is a time to lead, and a time to follow.

— CZ ? BNB (@cz_binance) July 23, 2022

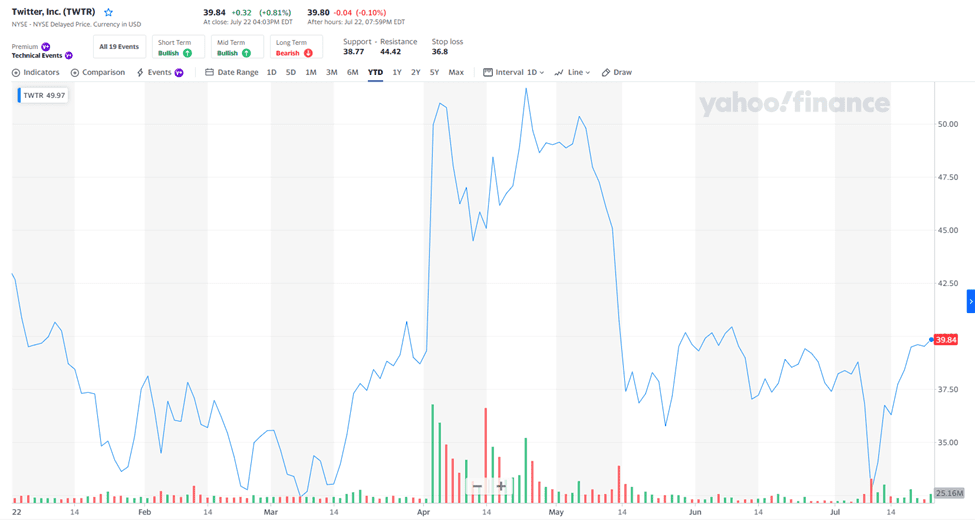

While there is uncertainty about Twitter’s future, the stock is holding its own and managed to eke out a modest gain after earnings. Nevertheless, as of July 22, the stock remained below the $40 threshold and down roughly 7% year-to-date.

Chart by Yahoo Finance

Twitter refrained from providing investors with any guidance on the third quarter. In addition, management canceled its Q2 earnings call, where they traditionally field questions from Wall Street analysts about earnings results.

Musk continues to tweet, but his attention appears to be divested from Twitter drama and focused on developments in his own companies, Tesla and SpaceX.