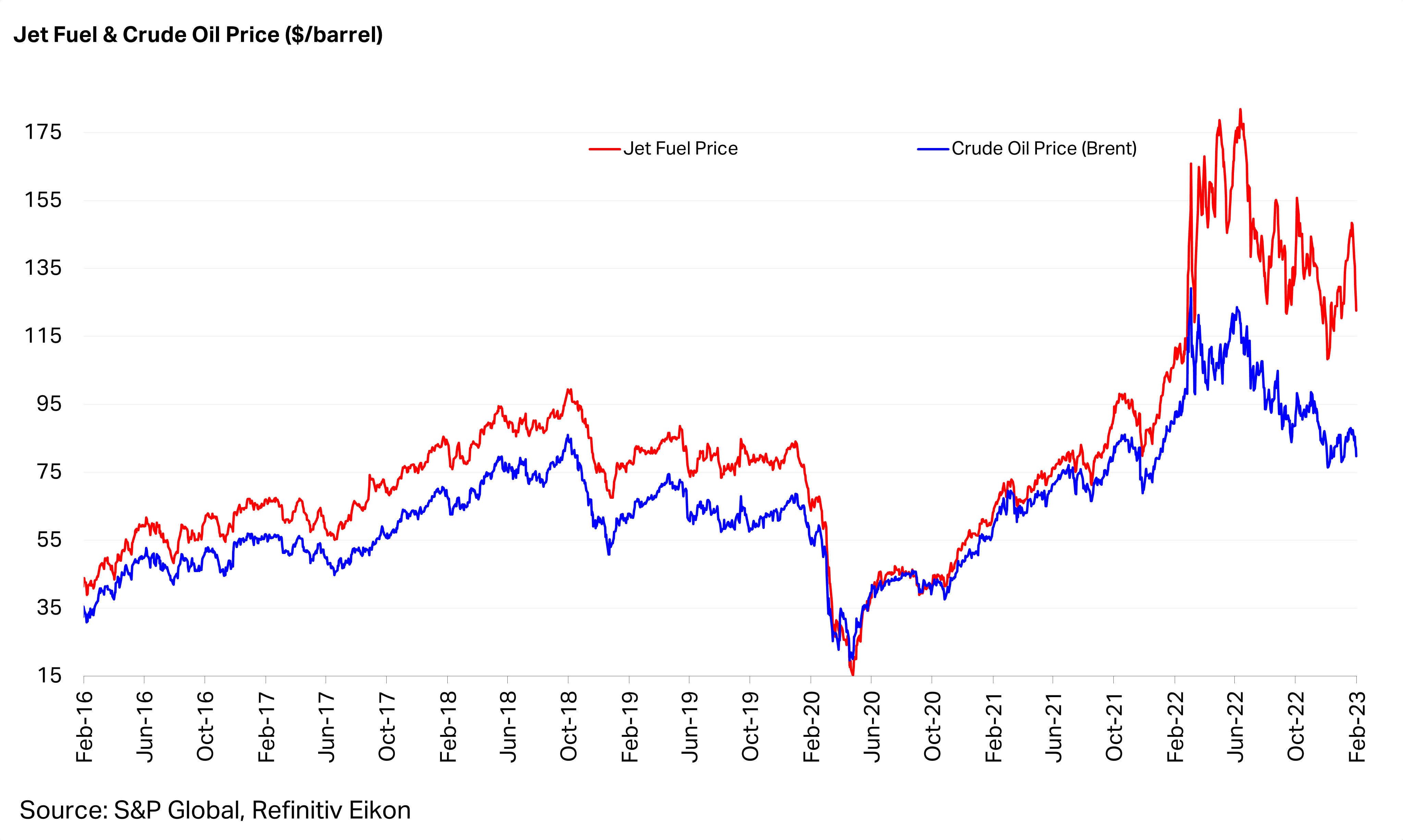

Global jet fuel prices have increased sharply since a year ago, propelled by a mix of growing global travel demand and China lifting its COVID-19 travel restrictions.

The Jet Fuel Price Monitor (JFPM) is a joint initiative by S&P Global Commodity Insights and the International Air Transport Association (IATA) that tracks the average price of aviation jet fuel paid within specific regional refineries.

Also referred to as the Jet Fuel Price Index, the JFPM provides the latest price data from Platts, a leading source of benchmark prices for commodities and energy markets.

The global average price of jet fuel on February 3 was $122.63 per barrel (bbl), a 9.8% increase from the same time in 2022. Although jet fuel prices are up nearly 10% on the year, the price of fuel actually fell 16% from the week before. Still, the average price of jet fuel year-to-date as of February 3 was more than $12/bbl higher, at $134.87/bbl.

North America currently accounts for 39% of global jet fuel consumption, a higher percentage than all other regions, including Asia and Oceania (22%), Europe and the Commonwealth of Independent States (28%), Middle East and Africa (7%), and Latin and Central America (4%), data from the index show.

In North America, jet fuel consumption has risen 18.9% year-over-year since 2022. At its current pace, North America consumes more jet fuel than all other regions combined. The next region behind North America in terms of consumption was Asia and Oceania, with an annual increase of 6%.

In contrast, decreasing jet fuel consumption was registered in Latin and Central America. This region has seen a 1.8% decrease since the same time last year.

Jet fuel accounted for only 6% of the growth in oil demand in 2022, according to Rystad Energy statistics cited by the WSJ. Notably, the slump in oil demand throughout 2021 and 2022 correlated with China’s zero-COVID policy, which restricted Chinese citizens from leaving the country.

In comparison, jet fuel is projected to account for 44% of oil-demand growth for 2023, per the WSJ.

As The Dallas Express previously reported, these rules have now been relaxed, resulting in carriers like American Airlines resuming their non-stop flights between China and the United States.

Despite the rebound in travel demand, not all regions are recovering equally.

Asia significantly lagged behind the rest of the world in terms of travel recovery, having reached only 78% of its pre-pandemic demand, Antoine Halff, co-founder of Kayrros, told The Wall Street Journal. By comparison, North America has reached 96% of its pre-pandemic demand, he said.

As demand for jet fuel steadily rises, so too has the cost of airfare.

Since its mid-year low in 2020, due to the onset of COVID-19, jet fuel consumption rose from roughly $15/bbl to a June 2022 high of around $175/bbl.

Gary Simmons, chief commercial officer at San Antonio-based Valero Energy, told investors in a recent earning call reported by Reuters that refining outages at plants along the Gulf Coast have driven the price increase across the United States.

“Overall, we expect jet demand to increase significantly this year,” he said.

The Dallas Express reached out to Valero Energy for a more in-depth forecast for 2023 but had not received a response at the time of publishing.