Tesla’s first-quarter earnings are out, and Elon Musk’s winning streak continues. The electric vehicle (EV) maker beat Wall Street’s estimates on the top and bottom lines.

Overall revenue was nearly $18.8 billion, compared to the expected $17.8 billion. Tesla’s auto revenue skyrocketed 87% versus year-ago levels to about $16.9 billion, while gross margins in the same division soared to nearly 33%, an all-time high. Earnings came in at $3.22 per share, compared to estimates of $2.30.

Musk says that demand for Tesla vehicles is outpacing supply. In some cases, waitlisted customers will not have their new EVs delivered until 2023. Nevertheless, while the supply chain issues that the auto industry has faced for the past two years are likely to linger for the rest of 2022, analysts say that the worst of the chip constraints appear to be in the rearview mirror.

Another challenge was the shutdown of production at the Shanghai plant due to an outbreak of COVID-19. Those setbacks were offset by the opening of Tesla’s newest gigafactory in Austin, Texas, and a plant in Berlin, Germany. Meanwhile, the Shanghai facility has begun to come back online, which should salvage Q2 and tee Tesla up to produce 1.5 million-plus vehicles in 2022, Musk says.

Musk has turned his attention to robotaxis, which he believes are the future. Production on Tesla’s robotaxis, which bypass the need for a steering wheel and brake pedals, is set to begin in two years. Musk expects they will be a “massive driver of growth” for Tesla.

According to Musk, robots are the future of Tesla, even more so than cars. Tesla is behind the Optimus robot program, which the billionaire predicts “will be worth more than the car business and worth more than full self-driving.”

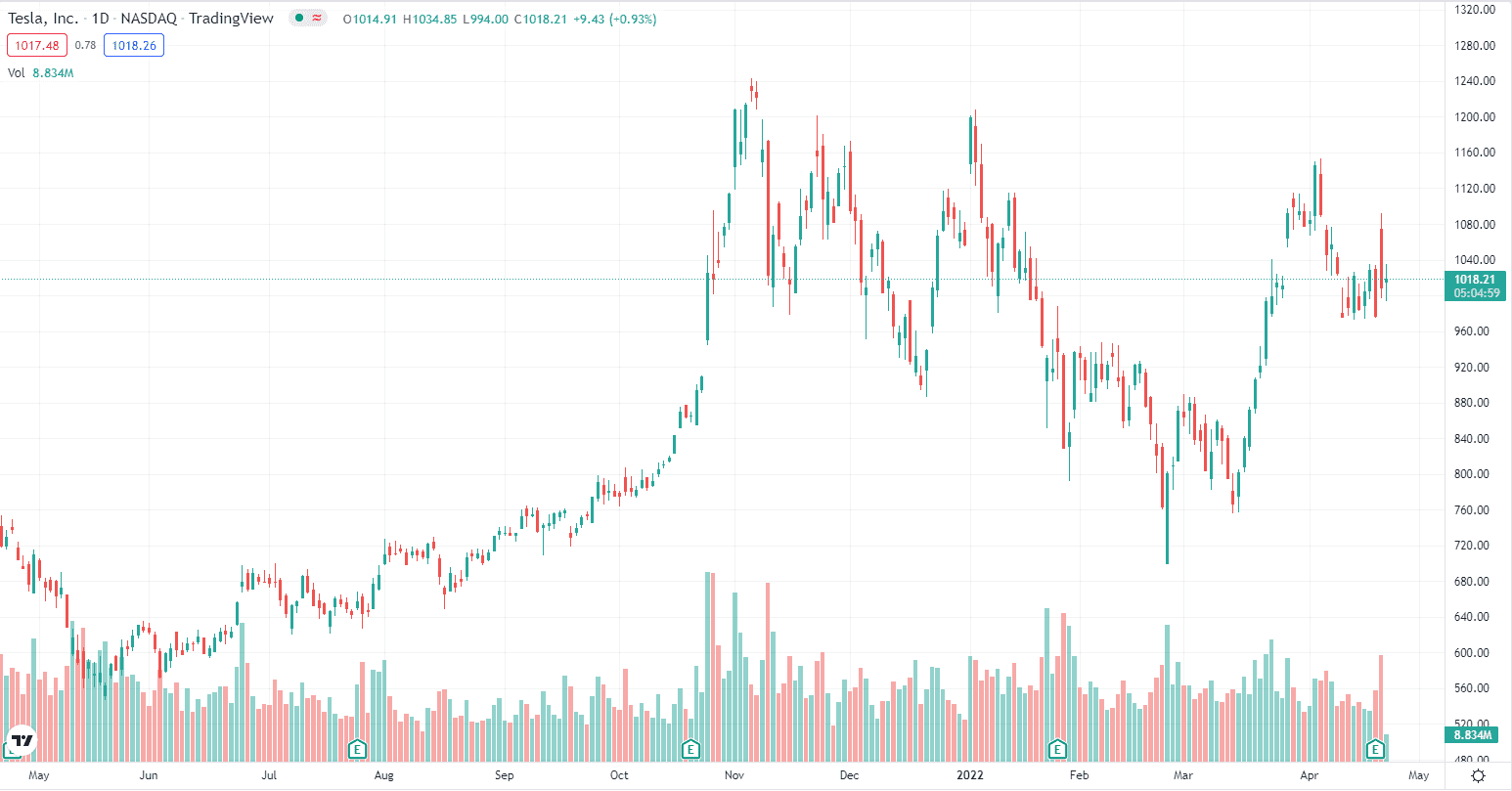

Tesla shares are currently hovering at $1,025 and have advanced approximately 45% in the last 12 months. The gains include a 7% jump on the heels of the company’s impressive quarterly report.

TSLA 12-Month Chart by TradingView

Tesla bull Cathie Wood, CEO of ARK Invest, whose flagship ETF counts TSLA its top holding, has placed a price target of $4,600 on the EV maker’s stock by 2026, representing a 350% increase from where it is trading today. In the firm’s bear case outlook, which it considers 25% likely, the stock will be worth no more than $2,900 in four years.

Nevertheless, ARK Invest has taken some profits off the table regarding Tesla, offloading close to $100 million in shares in the wake of the company’s quarterly results.

Deutsche Bank, which has a buy rating on TSLA stock, raised its price target to $1,250 from $1,200.

Tesla’s quarter comes amid a heated battle that Musk is waging to take control of social media giant Twitter. In addition to Tesla, Musk is also the boss at SpaceX and the founder of The Boring Company, so Twitter would be yet another feather in his cap.

After the Twitter board showed little interest in his initial offer of $54.20 per share, Musk moved on to Plan B, in which he is seeking to use a tender offer aimed straight at shareholders to acquire the company. He has gathered over $46 billion in both debt and equity financing to make such an offer.