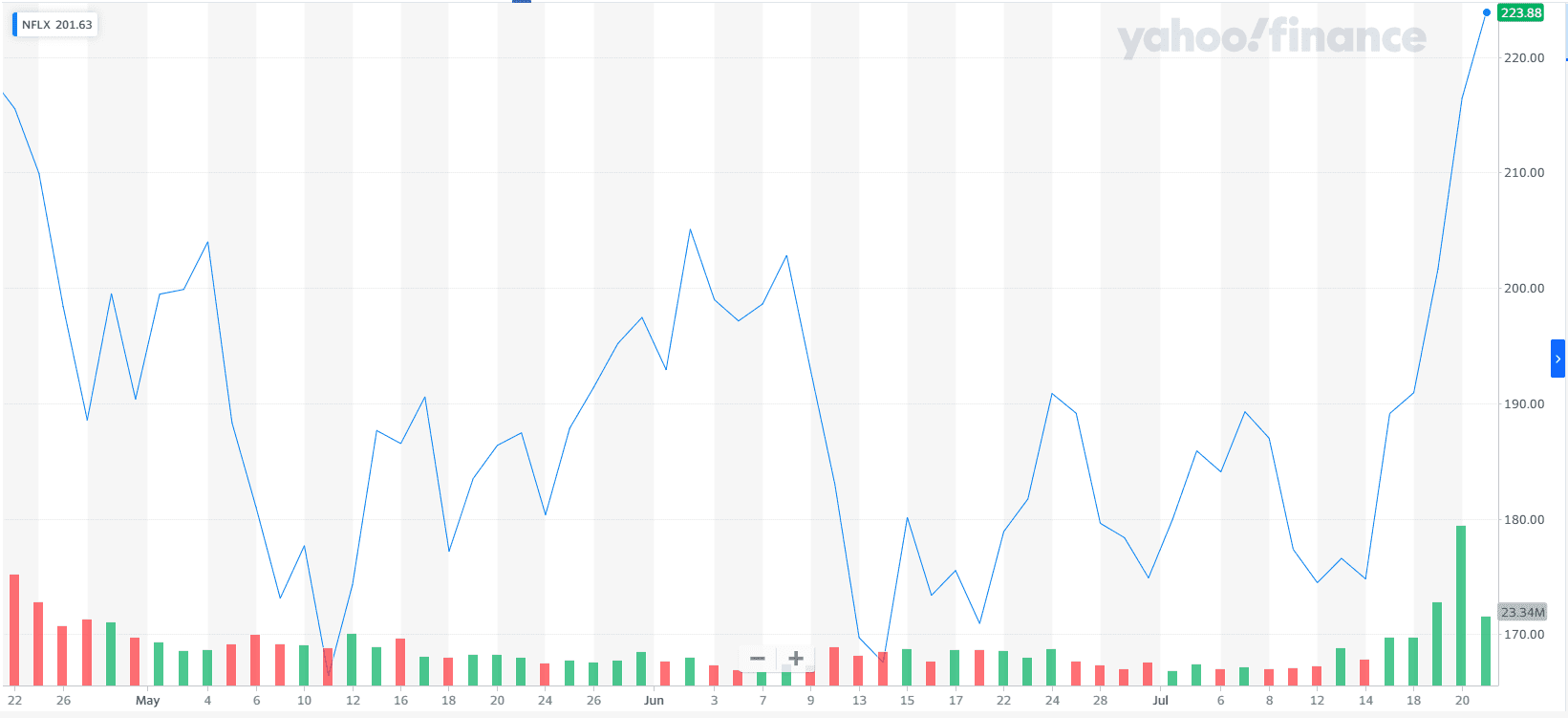

Netflix shareholders have been on a roller coaster ride this year and, most recently, are feeling the wind at their backs. The content-streaming giant’s second-quarter results may have been lackluster, but they were not as bad as expected, giving investors an incentive to reward the stock.

Since before Netflix (NFLX) reported its results on July 19, shares had climbed 17% higher, catapulting the stock to end above the $200 level for the first time since early June. The rally could not have come soon enough, with the stock shaving off nearly three-quarters of its value year-to-date headed into earnings.

Netflix Stock

Source: Yahoo Finance

Netflix shares are very sensitive to subscriber numbers and tend to rise and fall based on these results even more than earnings and revenue. Investors breathed a sigh of relief that Netflix was able to stem the outflow of paying users.

The streaming platform lost close to 1 million subscribers in Q2, less severe than an estimated 2 million but more lost subscribers than any other quarter on record. It was also the second straight quarter that Netflix lost rather than gained subscribers.

A major problem for Netflix, whose shows include science fiction thriller Stranger Things, is the loss of users in the North American region, its most lucrative area, in three out of the most recent five quarters.

Now that the content streaming cat is out of the bag, Netflix is up against some stiff competition, including the likes of Amazon Prime, HBO Max, and Disney+, to name a few.

With inflation at a multi-decade high, Americans are looking to cut costs, and multiple streaming providers might not be in the budget.

On the bright side, the company predicts that the bleeding will stop, expecting that in Q3, it will start growing again and add 1 million subscribers to the content streaming platform. While it would be a step in the right direction for the company, that pace would still be below that of Wall Street estimates, which hover at 1.8 million for the period.

Analysts had predicted that for the first three quarters of the year, Netflix would gain close to 20 million subscribers. At the current pace, the company is poised to lose subscribers over the period instead. The company must go head-to-head with the likes of Amazon Prime, whose streaming platform increasingly resembles that of Netflix.

Netflix chief Reed Hastings sees the glass half full, suggesting on an earnings call with analysts that traditional TV could go the way of the dinosaur before the decade’s end, saying:

“Streaming is working everywhere. Everyone is pouring in.”

Hastings also explained how the company is trying to right the ship through marketing efforts as well as enhancing its services and merchandising. Netflix is eyeing 2023 to see the fruits of its efforts when it plans to unveil a cheaper, advertising-supported subscription option.

Netflix is also among the employers in corporate America to have shrunk its staff in 2022, with the company laying off hundreds of employees across Q2. The company suffered a blow in its executive suite when Todd Yellin, whose career at the company spans close to two decades and who spearheads Netflix’s product teams, revealed he would be resigning to pursue a career in filmmaking.