On Wednesday, the markets were a sea of green with stocks, oil prices, and key bond yields headed higher in lockstep. The latest round of economic data soothed investors’ fears about the state of the economy. Nevertheless, according to one Wall Street CEO, investors might want to buckle up because more market volatility is ahead.

Runaway Stocks

After three straight days of declines in the S&P 500, investors see the glass as half full at the moment. The Dow Jones Industrial Average, tech-heavy Nasdaq, and S&P 500 all flashed green on April 13.

While inflation rose an eye-popping 8.5% in March, its most significant jump since the early eighties, market experts are cautiously optimistic that the worst may be over.

The seasonally adjusted Consumer Price Index (CPI) advanced 1.2% in March, fueled by higher gasoline, grocery, and real estate prices. Experts are eyeing the core CPI, which excludes food and energy from its equation. Based on these criteria, consumer prices climbed 6.5% higher in Q1 2022, worse than the 6.4% pace through the first 2 months of the year.

However, the silver lining is a slowdown in the monthly results, in which the core prices rose 0.3% in March versus 0.5% in February. Economists and Federal Reserve officials alike are considering whether consumer prices could be starting to ease.

Meanwhile, earnings season is officially underway, and so far, investors like what they see from corporate America. Delta revealed that Americans are taking to the skies once again. Technology stocks were the unlikely heroes, sending the Nasdaq more than 2% higher as investors flocked back toward names they avoided for months.

Bond Yields

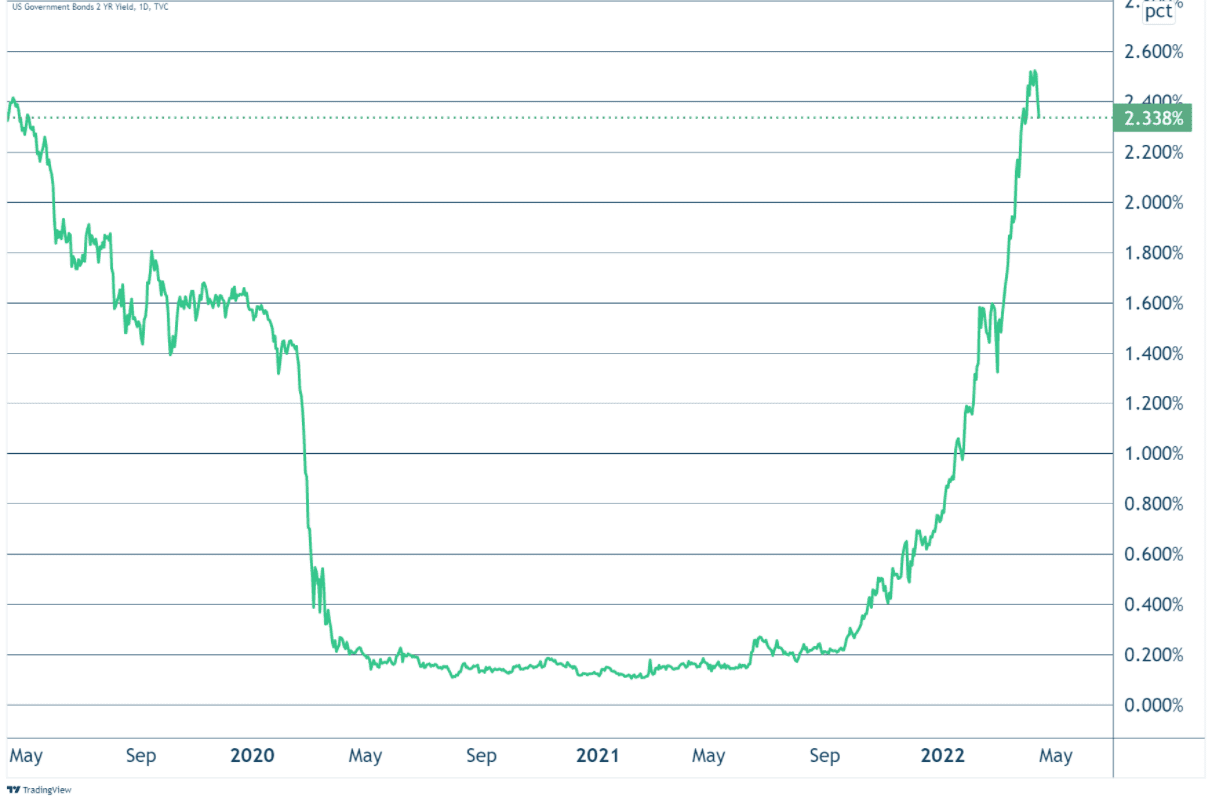

The yield on the 2-year Treasury has fallen about 20 basis points (bps) this week, including a nearly 10-bps drop to below 2.30% on April 12. According to the Securities and Exchange Commission, yields and prices “generally move in opposite directions.” Traders are taking their cue from the latest economic data, surmising that the Fed will lessen its rate hike ambitions this year amid the newest core CPI results.

Image by True Insights Founder Jeroen Blokland on Twitter

Subadra Rajappa, head of U.S. rates strategy at Société Générale, is quoted by MarketWatch as saying the abrupt reversal in Treasury yields strengthens the argument that the economy has reached peak inflation. However, she added that “it is hard to read too much into one print.”

Nevertheless, after recently inverting, the yield curve is now steepening.

Oil Price

Not to be outdone, oil prices are also inching higher. Worries of a global shortage overshadowed the uptick in U.S. crude inventories.

Brent crude oil settled 4% higher at slightly below $109 per barrel, while West Texas Intermediate crude futures advanced 3.7% to over $104 per barrel. The gains are being tacked on to Tuesday’s rally, in which oil prices soared 6%.

Russia has declared its intention to sell its oil to “friendly countries” and “at any price range” as India and China take Moscow up on its offer. Meanwhile, the cost of Russia’s daily oil exports in the wake of its invasion of Ukraine hovers at 1 million-3 million barrels daily, traders assess.

JPMorgan CEO Jamie Dimon warned during the company’s earnings conference call that he expects a great deal of market volatility. And while he’s not banking on a recession, one is “absolutely” possible, so the economy may not be out of the woods yet.