In his Weekly Warm-up to investors, Morgan Stanley’s chief U.S. equity strategist, Mike Wilson, recently declared that “the bear market rally is over.”

Wilson explained his negative outlook by pointing to:

- reductions in consumer demand due to lack of the previous year’s fiscal stimulus and escalating prices, especially in essentials like food and gasoline, and

- increases in supply due to inventory builds during the past year. One indication of a slowdown in new orders is the decline in truckload freight, reflecting the high stock levels on site. Craig Fuller, CEO of FreightWaves, a global logistics research firm, writes, “Just three years after 2019’s trucking bloodbath, another is on the way.”

According to Wilson, the macroeconomic environment “eats away at corporate profits.”

The equity strategist is not the only Wall Street insider worried about the stock market’s future direction.

- Jamie Dimon, JPMorgan Chase CEO, noted in his 2021 letter to stockholders that “Our bank is prepared for drastically higher rates and more volatile markets.”

- Ed Yardeni, president of Yardeni Research, noted earlier in March 2022, “For the U.S. economy, we now see stagflation with persistently higher inflation and less economic growth than expected before the war… A recession can no longer be ruled out.”

- Forbes magazine reported that “The majority of professional investors see rising recession risks ahead once more, with 60% predicting a bear market in 2022 and over 50% expecting that high inflation will be ‘permanent.'”

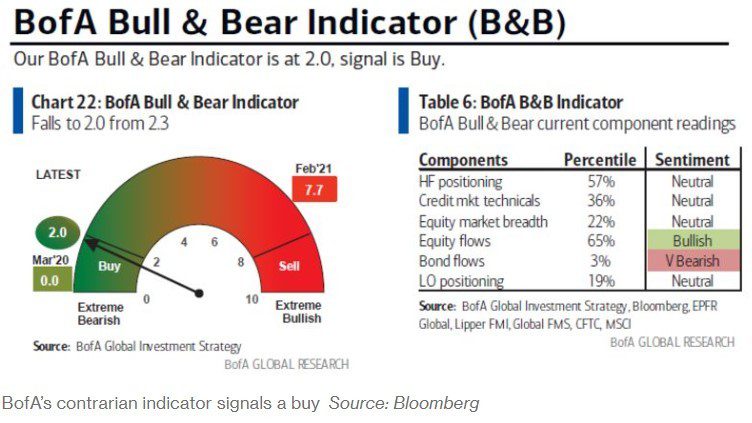

Other Wall Street analysts look at the data and project a continuation of the bull market that began in 2020. Bank of America’s Michael Hartnett claims their Bull & Bear Indicator is signaling “Buy” for the first time since March 2020.

Marko Kolanovic, an analyst at JPMorgan Chase & Co., sees “great opportunities in high-beta, beaten-down segments that now include innovation, tech, biotech, emerging markets.”

However, as Burton Crane, a reporter for The New York Times, writing A Review of Expert Market Opinion – No Two Forecasts Exactly Alike, advised in 1958, “The market always declines at some time. Thus far, no tree has grown to heaven – and stayed there.”

When considering any analyst’s position on the direction of the market, readers should remember that stock prices at a particular moment reflect the consensus of investor expectations for the future.

In other words, the price of a stock could fall even when the most recent earnings are higher and vice versa. No one knows the future, so predictions are opinions based on an interpretation of available data.

The truth of investing has always been, “You pays your money, and you takes your choice.”