Homebuilder activity is the latest area to feel the pain from the current headwinds in the real estate market. According to the National Association of Home Builders (NAHB), homebuilder sentiment declined in October for the 10th consecutive month amid a perfect storm of rising interest rates, supply chain issues around building materials, and falling home prices that took their toll on construction.

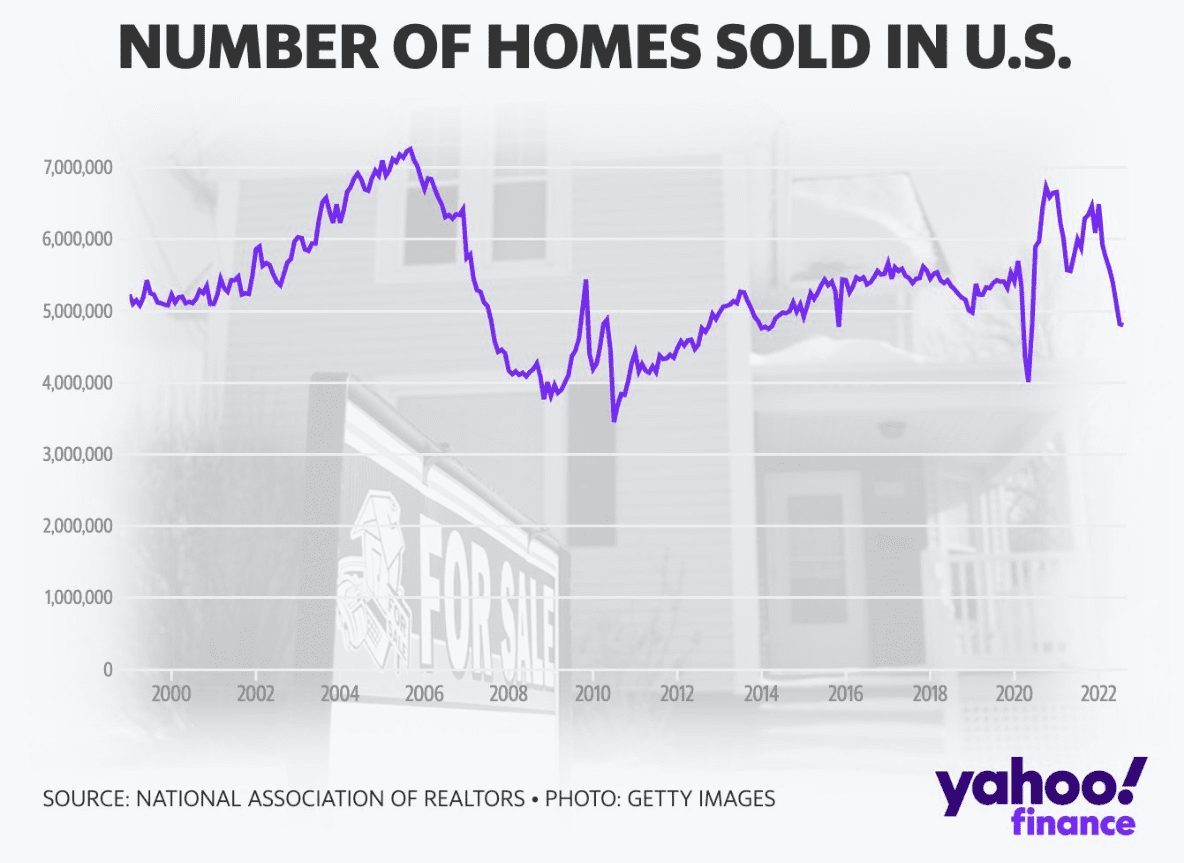

Another catalyst for the pullback in homebuilding has been a slowdown in the number of potential homebuyers in the real estate market, which fell to its weakest point in a decade, excluding the early pandemic months, as home prices become unaffordable for many Americans.

In October, the NAHB/Wells Fargo Housing Market Index (HMI) plummeted eight points to a reading of 38. The index was halved from where it hovered six short months ago, reflecting a drop in homebuilder confidence for new single-family dwellings. The regional breakdown of the HMI is as follows:

- The Northeast declined by three points to 48

- The Midwest region fell by three points to 41

- The Southern region declined seven points to 49

- The Western region dropped seven points to 34

With the exception of early in the pandemic, homebuilder confidence has not been this bad in over 10 years. NAHB Chairman Jerry Konter, who is also a homebuilder and developer in the state of Georgia, blamed high mortgage rates, with the 30-year fixed rate having crept up beyond 7% compared to 3% at the beginning of the year, for falling demand. First-time homebuyers especially have been deterred by the rising interest rate environment, he noted.

According to Konter, conditions in the housing market are “unhealthy and unsustainable,” and policymakers should provide relief in the crisis.

The real estate downturn has also materialized in existing home sales, which in September dropped to their lowest level in a decade. According to the National Association of Realtors, sales of homes that were previously owned declined 1.5% last month compared to August, seeing a seasonally adjusted result of 4.71 million units. Three out of the four leading U.S. regions suffered declines, including the Northeast (down 1.6%), Midwest (down 1.7%), and South (down 1.9%), while the West held steady in September compared to August levels.

Unfortunately, there is no apparent light at the end of the tunnel, with the U.S. Federal Reserve widely expected to stick to its path of hawkish monetary policy by combatting high inflation with rising interest rates. As a result, “2023 is forecasted to see additional single-family building declines as the housing contraction continues,” NAHB Chief Economist Robert Dietz said.

Dietz expects that homeownership rates will continue to move lower in the upcoming quarters due to the one-two punch of rising interest rates and higher construction costs, causing potential homebuyers to remain on the sidelines.