U.S. government-issued debt is reportedly signaling investors that the U.S. economy could be on shaky ground. The U.S. yield curve, which charts the course of interest rates for various government-issued debt, flattened last week. This repricing in the markets comes amid a shift toward aggressive monetary policy by the Federal Reserve in the face of soaring inflation exacerbated by war in Ukraine.

Traders and economists alike look to the yield curve as a sign of the economy’s health. As policymakers have sought to rein in inflation without disturbing economic growth, a flattening yield curve suggests that their efforts could be futile.

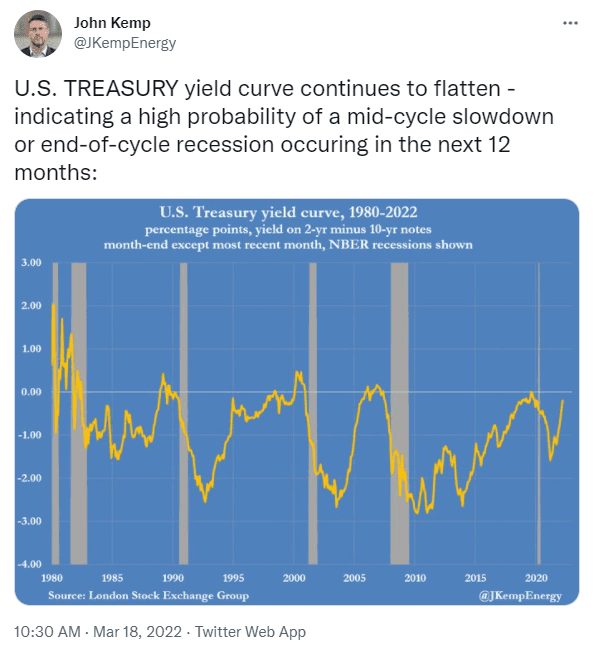

Energy analyst John Kemp tweeted that a flattening of the U.S. yield curve indicates a “high probability” of either a “mid-cycle slowdown” or an “end-of-cycle recession” in the coming 12 months.

The bond markets have been in a tailspin since the Fed indicated that an interest rate cut in the 50-basis point range could be ahead. The U.S. bond market has not been in such a state since 2016.

Last week, the yield curve spread on 2- and 10-Year Treasury notes displayed a gap of 24.5 basis points, 60 points lower than year-end 2021 levels.

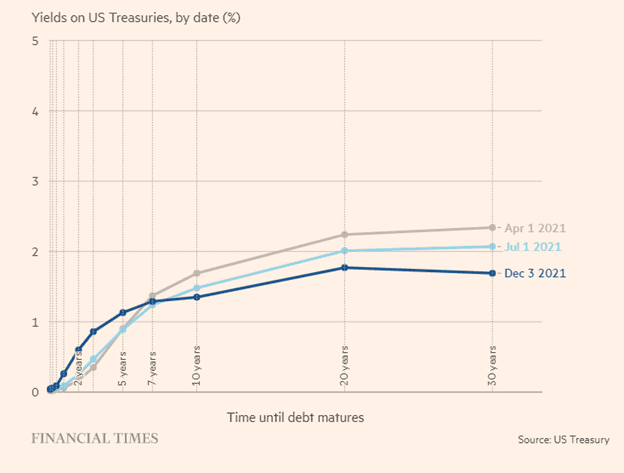

Generally, the yield curve’s default shape is an upward slope, illustrating the gamble investors are willing to take that inflation and interest rates will not diminish their returns on longer-term debt securities.

Shorter-term yields, meanwhile, reflect investors’ expectations for the tone of monetary policy in the foreseeable future.

Image by Financial Times

If things worsen and the yield curve begins to point downward or become inverted, it serves as a sign that a recession could be up ahead. This scenario unfolded in 2019, before the pandemic-fueled downturn of 2020.

In fact, an inverted yield curve has reared its head before each of the economic recessions that the U.S. economy has suffered in the past 50 years.

Bond issuing is currently a tale of two markets. Short-term yields are climbing steadily higher as investors brace for tighter monetary policy in which multiple interest rate hikes are in the cards. The yield on the 2-Year Treasury note, for example, is hovering at 1.94%, up more than 160% compared to year-end 2021 levels.

On the other hand, the yields on long-term government bonds have been moving at a snail’s pace amid the belief that a more aggressive Fed will translate to an economic slowdown. The result is a flattening Treasury yield curve.

As traders hope to stave off an inverted yield curve, the U.S. economy remains in the woods, with the threat of short-term yields surpassing long-term yields before year-end still looming.