The price of Bitcoin dipped below $20,000 on Monday and continues to hover in that area, significantly down from the start of the year.

The dip below this threshold is a sign that investors are still in no mood for risk as the U.S. Federal Reserve continues down its path of monetary tightening.

Monday’s Bitcoin sell-off and dip put pressure on other coins in the cryptocurrency market, including the likes of Ethereum, the second-biggest digital asset based on market cap, and popular meme coin, Dogecoin, which were down 7% and 10%, respectively, as of Tuesday.

As the most significant cryptocurrency with a market share of 39%, Bitcoin has sway over the performance of other coins.

The decline began late last week after Fed chairman Jerome Powell revealed that the central bank was not finished raising interest rates yet in its ongoing fight against high inflation.

Powell did not hold back, stating that the Fed’s approach would cause “some pain” in the economy, triggering an exodus of investors from stock and crypto markets alike.

For example, the Dow Jones Industrial Average dropped 1,000 points in response to Powell’s warning. And Bloomberg reported that the wealthiest Americans saw their wealth diminish by $78 billion in the markets in response to Powell’s speech last Friday in Jackson Hole.

While one of Bitcoin’s primary use cases is supposed to be as a hedge against inflation, investors have been treating it more like a high-growth technology stock.

As a result, bitcoin got caught up in the downdraft as investors took a risk-off posture in every market.

Edward Moya, the chief market strategist at forex trading firm OANDA, stated:

“Bitcoin weakened after Fed Chair Powell didn’t blink with his reiteration that the Fed will tighten policy to bring down inflation. Risky assets are struggling as Powell’s fight against inflation will remain aggressive even as it will trigger an economic slowdown.”

Bitcoin’s Roller Coaster Ride

While it is no secret that Bitcoin has been under pressure, alongside the broader financial markets in 2022, the flagship cryptocurrency had managed to hold above the $20,000 level since mid-July.

After its price rallied to above $25,000 in mid-August, investors were hopeful that the market downturn had reversed, but the current dip below $20,000 is just another sign that the bears are still in control.

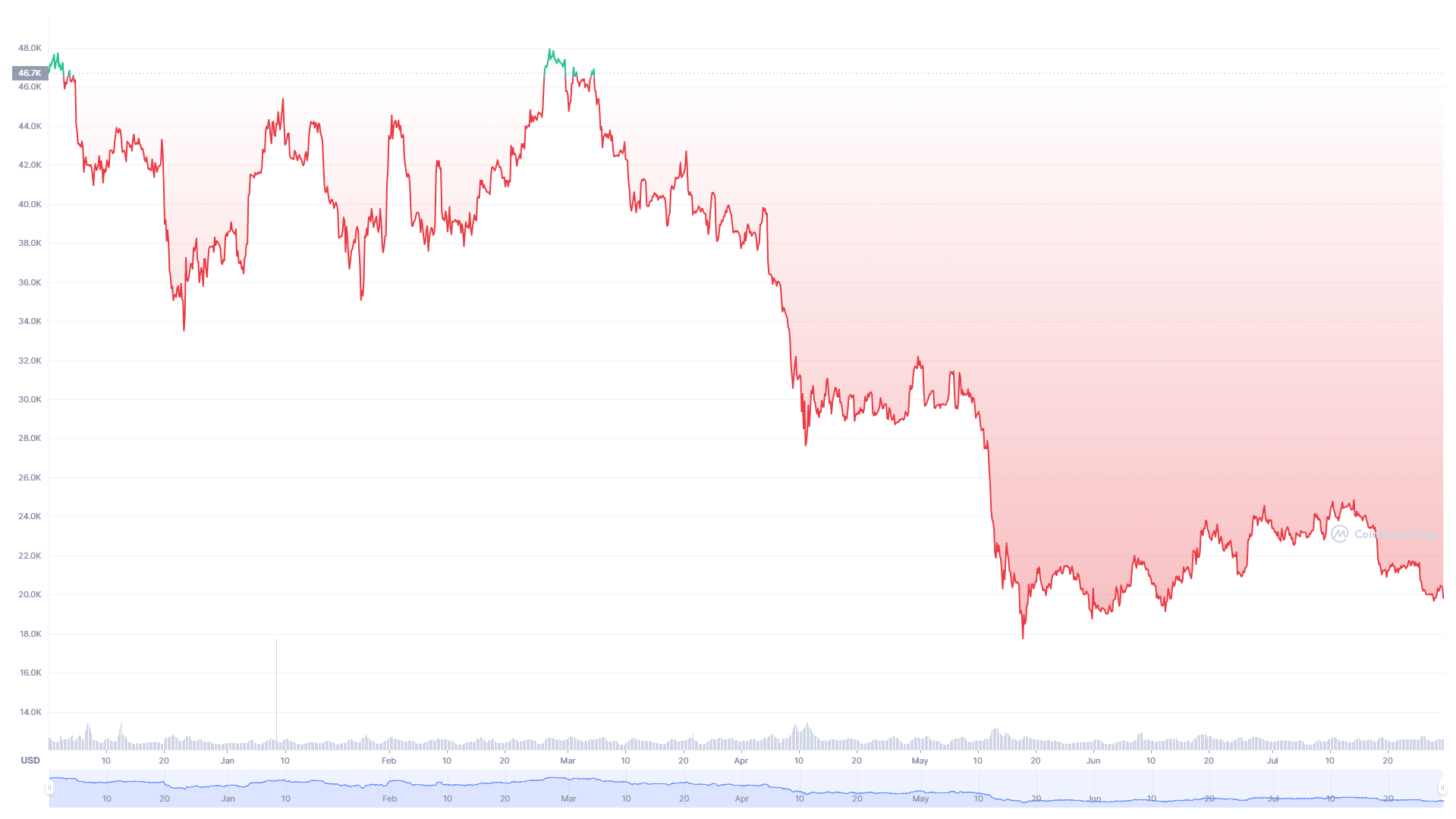

Below is a chart illustrating Bitcoin’s plight so far in 2022. The price has been more than halved from approximately $46,000 at the start of the year to roughly $19,750 Tuesday.

Bitcoin Price YTD / Image by CoinMarketCap

While it is not unusual for Bitcoin to exhibit volatility, last year’s rally in the cryptocurrency markets, in which its price neared $70,000 per coin, attracted new investors – both retail and institutional.

While some investors caught Bitcoin fever amid fears of missing out on the crypto market’s gains at the time, people who bought high are now experiencing what seasoned Bitcoin investors call a crypto winter.

A Bitcoin turnaround can be a difficult thing to predict.

Last year, experts were convinced that the leading cryptocurrency was headed toward $100,000 sooner than later, a milestone it has yet to achieve.

Meanwhile, one crypto influencer and YouTuber, Ben Armstrong, claimed that the Bitcoin price has not yet reached a bottom, forecasting that it would not do so for “another month” or longer.