The economic outlook for delivery behemoth FedEx remains cloudy for the foreseeable future, signifying stormy conditions for the entire transportation sector.

According to FedEx CEO Raj Subramaniam, the global economy will not be able to stave off a recession. He told CNBC he believes a recession is coming, pointing to numbers that “don’t portend very well.”

While the FedEx chief’s outlook may be doom and gloom, some of it may be attributed to the company’s worse-than-expected performance in this slowing economy.

FedEx warned that its first-quarter profit would come in at $3.44 per share, missing analyst estimates of $5.10 per share by approximately 33%. The delivery company said the global-macro situation has “significantly worsened,” causing the company to scuttle its performance outlook for 2023.

Deutsche Bank analysts did not mince words, saying that FedEx’s preannouncement amounted to the “weakest set of results we’ve seen relative to expectations in our ~20 years of analyzing companies.”

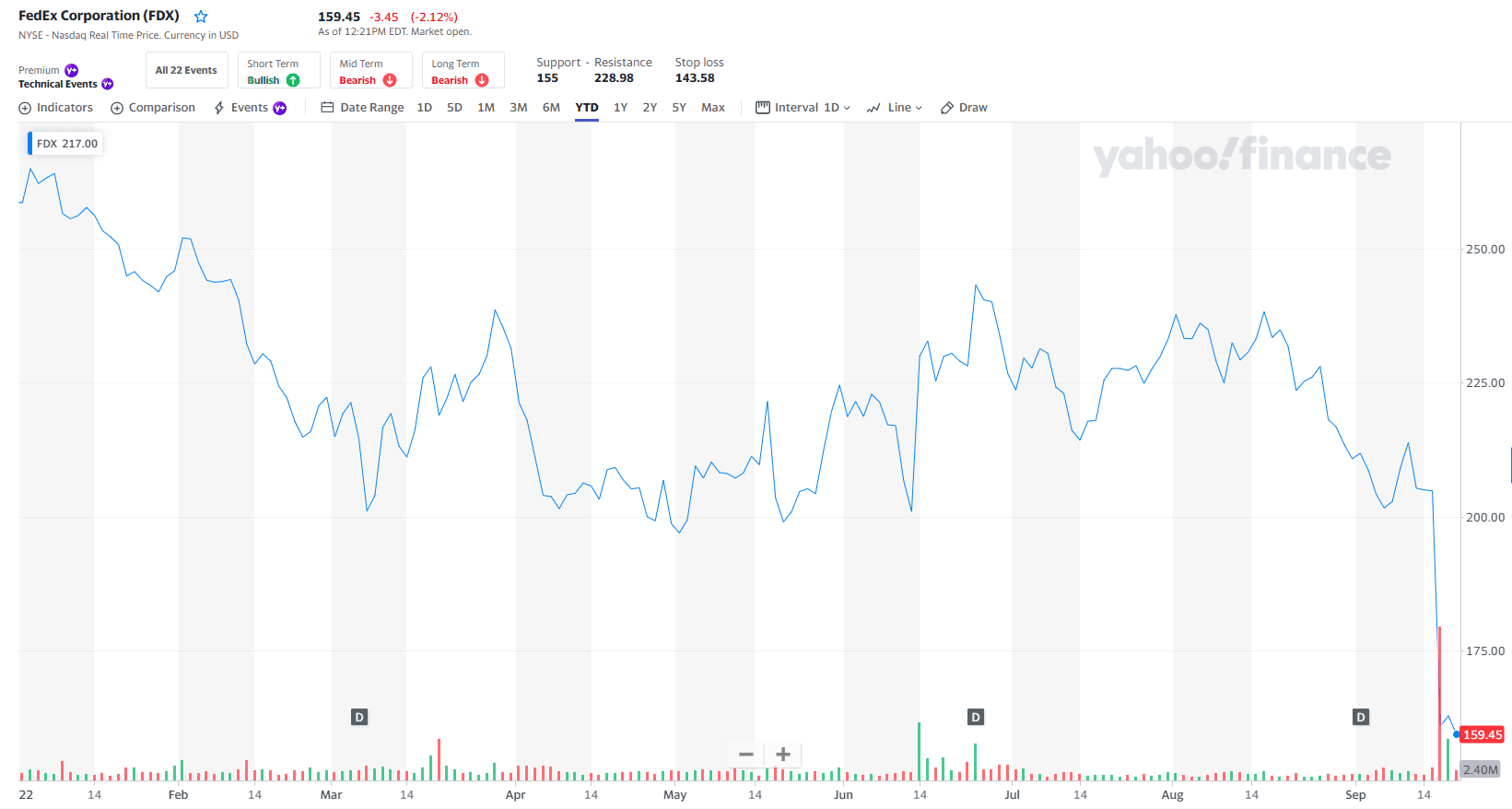

Since September 15, when FedEx issued its warning, the stock has sunk 22% to below the $200 threshold. Investors have fled FedEx shares in droves, as the below image illustrates.

Image by Yahoo Finance

However, a Bloomberg Opinion article suggests that FedEx is projecting its problems onto the world. Opinion writer Thomas Black argued that FedEx’s issues are its own, not the global economy’s.

Instead, Black blames “festering operational issues” at the company’s Memphis, Tennessee, headquarters over any “sudden global macroeconomic calamity.”

FedEx’s Subramaniam has only been at the company’s helm since March of this year. He stepped into a situation where his employer had not been able to shake loose operational challenges that emerged during the pandemic.

Black also pointed out that FedEx has been known to err on the side of caution with its outlook and has a pattern of misfiring.

Investors will not know for sure until FedEx unveils its quarterly results on September 22. Meanwhile, FedEx is not alone.

Ford has issued an ominous outlook of its own. The automaker warned that it faces a perfect storm of inflation, parts shortages, and higher supplier costs. In fact, Ford will have to dole out $1 billion more than expected in the third quarter due to challenges around the supply chain.

As a result, the company will have more vehicles in inventory missing parts at the close of Q3 than anticipated. Ford’s stock has been falling, shedding 35% year-to-date.