Elon Musk has been busy. According to a regulatory filing, the billionaire entrepreneur has offered to acquire social media giant Twitter in a $43 billion cash deal in which he would take the company private.

I made an offer https://t.co/VvreuPMeLu

— Elon Musk (@elonmusk) April 14, 2022

Musk touted his move on the very platform he seeks to buy after a tug-of-war in which he and the Twitter board have been vying for control.

Leading up to this moment, Musk has engaged with and polled his 81.7 million Twitter followers about free speech and user features, as previously reported by The Dallas Express.

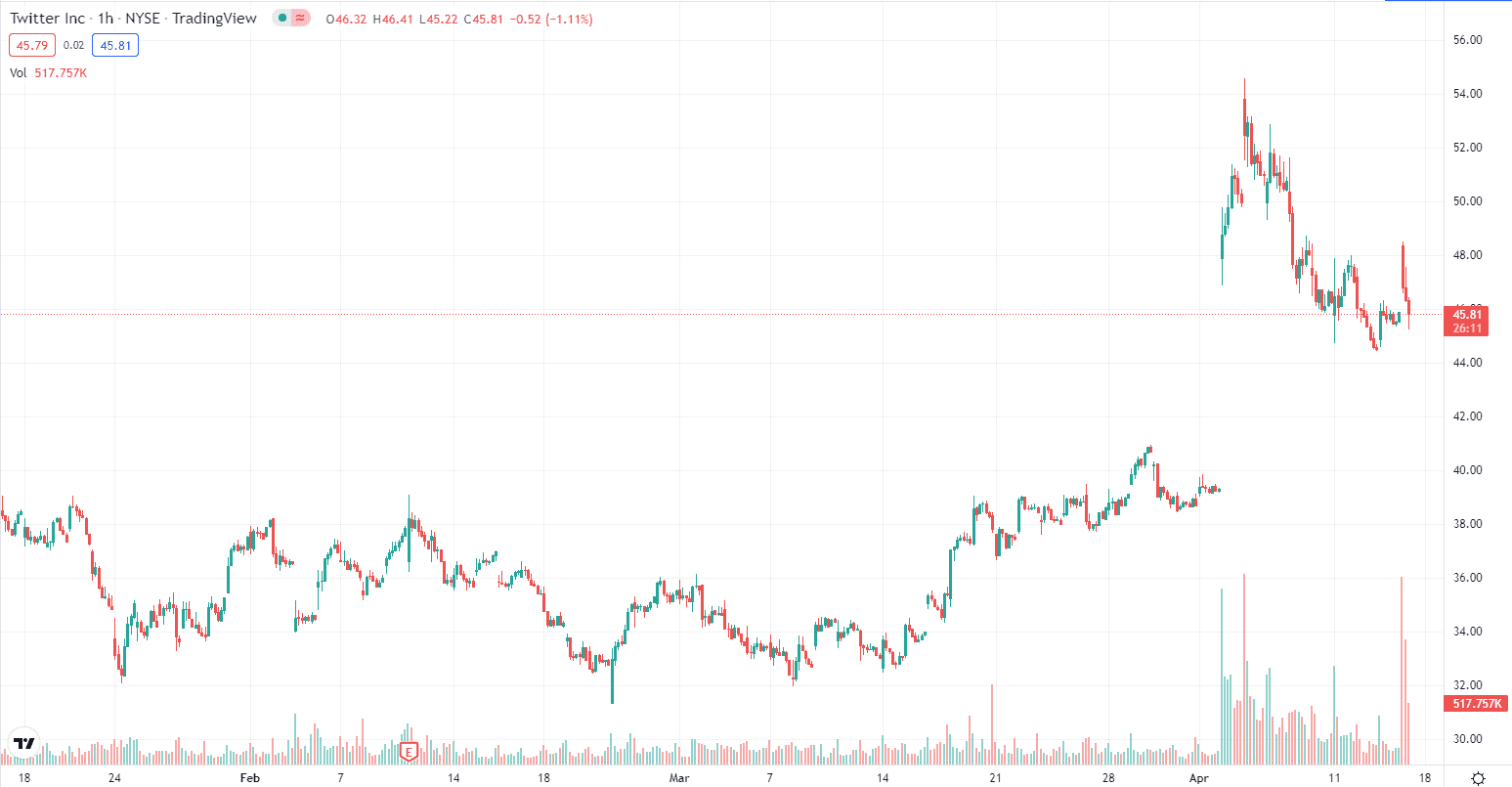

Earlier this month, Musk refused a seat on Twitter’s board after amassing a stake of over 9%, catapulting him into the position of biggest shareholder. Now he is offering $54.20 per share — representing a premium of more than 50% on the pricepoint where the stock hovered before he took a stake — to own the company. The per-share price is 38% above where the stock traded before Musk’s initial Twitter investment was made public on April 4.

Musk calls for Twitter to reach its potential as a free-speech platform, a First Amendment right he calls “a societal imperative for a functioning democracy.” The tech pioneer believes that for Twitter to reach its potential, the company must exit the stock market and “be transformed as a private company.”

The deal will turn into a pumpkin after the first pass. In a letter to Twitter Chairman Bret Taylor, Musk stated that he was “not playing the back-and-forth game.” If Twitter balks at the offer, the price for which Musk says is high, all bets are off, at which time the Tesla chief has pledged to “reconsider [his] position as a shareholder.”

Musk has influenced stock and cryptocurrency prices alike, and Twitter has been no exception.

Fellow tech billionaire Mark Cuban has his theory of how the Twitter drama will unfold. Cuban, who attained billionaire status after selling his startup Broadcast.com before the dot-com bubble burst, has tipped his hand to what he thinks is going on behind the scenes.

Cuban said on Twitter that Big Tech companies like Google and Facebook are probably in the midst of talking to their legal teams about whether they could get the regulatory green light to buy Twitter should a Musk deal fall through.

Meanwhile, Twitter’s management is likely having conversations about which buyer could serve as the company’s “white knight,” Cuban said.

Every major tech company , Google, fb, et al is on the phone with their anti trust lawyers asking if they can buy Twitter and get it approved. And Twitter is on the phone with their lawyers asking which can be their white knight. Gonna be interesting https://t.co/khCVPzuGiM

— Mark Cuban (@mcuban) April 14, 2022

The Dallas Mavericks owner said that, while Musk may have gotten the ball rolling, he might not be the one at the helm when the ordeal ends.

If Twitter refuses Musk’s offer and the Tesla CEO makes good on his promise to sell his TWTR stake, it would pressure shares, paving the way for Mark Zuckerberg and friends to swoop in and influence or buy Twitter at a rock-bottom price. Musk, meanwhile, will “smile all the way to the bank,” Cuban said.

Elon may have started this, but his threat to sell his shares ,if twitter says no, opened the door for those tech giants to walk in for relatively "little" money and grab huge influence at Twitter or possibly a direct path to acquisition. Elon will smile all the way to the bank

— Mark Cuban (@mcuban) April 14, 2022

Since Musk showed his hand, Twitter’s stock has been meandering between positive and negative ground as uncertainty strikes. Musk is No.1 on Bloomberg’s Billionaire Index with a net worth of $259 billion.