BlackRock holds partial ownership of the company that made the highest bid for the Biden administration’s planned offshore wind farm near Port Arthur, according to an investigation by The Dallas Express.

RWE Offshore US Gulf LLC’s largest investors are Qatar Holding (9.1%) and BlackRock (6.3%), per the company’s shareholder structure webpage. This upcoming 102,480-acre wind farm will allegedly produce 1.24 gigawatts of energy for thousands of homes, the Department of Interior (DOI) claimed last year.

Although the physical location of this planned construction is entirely on the Louisiana side of the Texas-Louisiana border, the closest city is Port Arthur, Texas. The project will draw Port Arthur and Lake Charles, Louisiana, which are both serviced by Gulf States Utility, closer together. It will be one of several efforts that increase the connectivity of energy production infrastructure in East Texas and Louisiana.

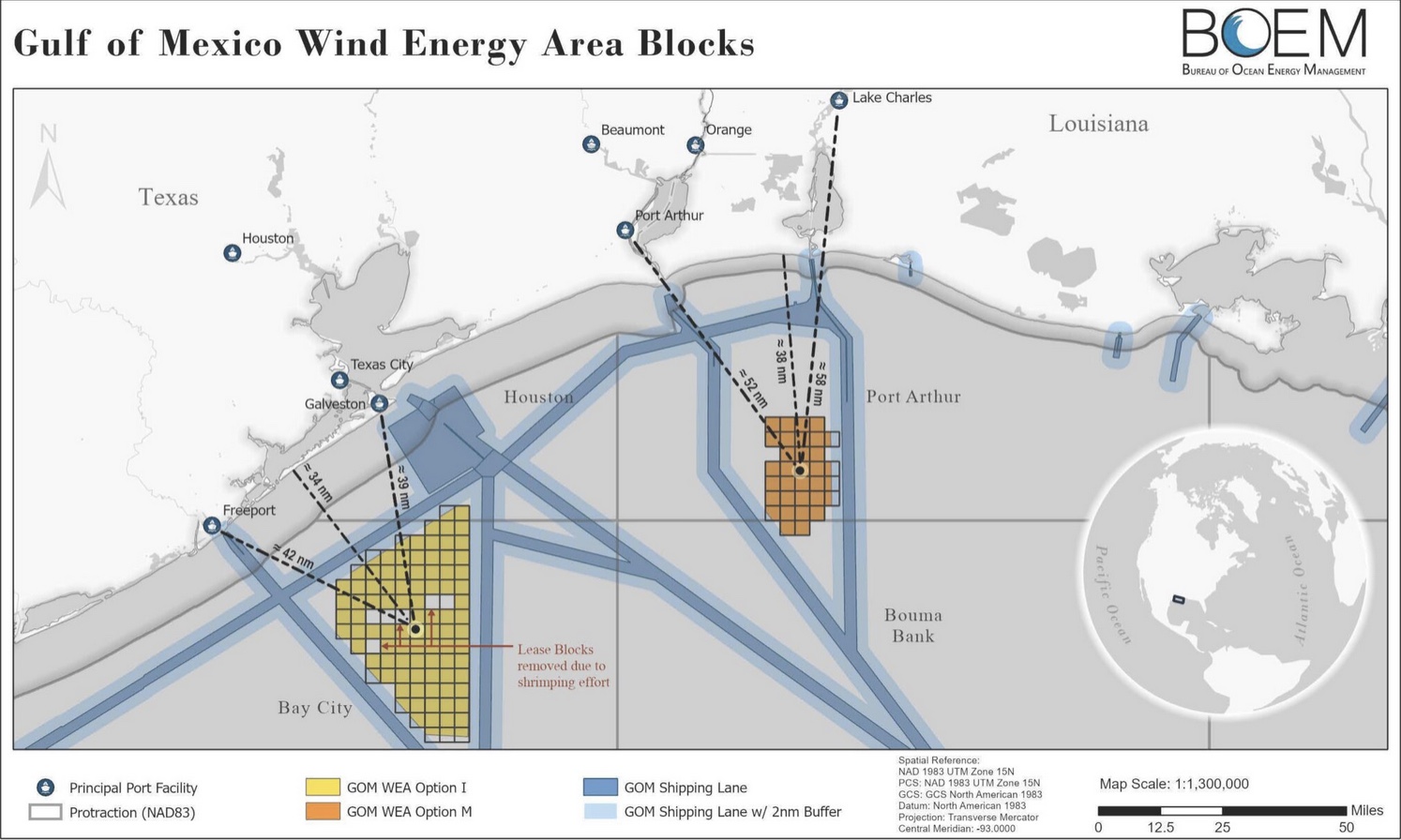

This wind farm is part of a larger Biden administration plan to develop 730,000 aquatic acres into a power system that will produce 30 yearly gigawatts by 2030, according to the National Oceanic and Atmospheric Administration. However, it is unclear whether this project will be realized. So far, there has been little interest from industry in Gulf Coast wind farms. Two similar federal projects outside of Galveston received zero bidders.

In an ominous sign for East Texas’ fishing industry, DOI granted RWE a bidding credit because of the company’s efforts at “establishing and contributing to a fisheries compensatory mitigation fund or contributing to an existing fund to mitigate potential negative impacts to commercial and for-hire recreational fisheries caused by offshore wind energy development in the Gulf of Mexico.”

The statement appeared to foreshadow the potential disruption or destruction of traditional fishing areas.

Nevertheless, the Biden administration has largely promoted the project, known in official documents as GOM WEA Option M, as a jobs creator and part of a transition to “clean energy.” Given Port Arthur’s placement as the nearest port and the likelihood that a significant portion of the construction force will come from there, some environmental activists, like those with the Sierra Club, have already begun pushing for minority groups to receive the construction contracts, according to the Texas Observer.

Option M is the latest twist in an increasingly complicated plot involving emerging BlackRock-backed business ventures in the Lone Star State and Texas officials. TXSE, a Texas-based competitor to the New York Stock Exchange, was recently announced to great acclaim from the highest echelons of the Texas government. However, one of TXSE’s largest financiers is BlackRock, The Dallas Express previously reported.

Gov. Greg Abbott and Texas Comptroller Glenn Hegar were among the first to cheer on a Texas stock exchange, even though they both had previously led the charge against BlackRock because of the company’s ESG policies.

Environmental, social, and governance (ESG) policies are a type of activist investing that considers social change, like promoting “diversity,” along with making a profit for shareholders. BlackRock’s iteration of ESG was apparent from the company’s Climate 100+ agenda, which was intended to pivot the company’s investment away from fossil fuels toward alternative energy sources before the program was scaled back.

This corporate policy was widely perceived in Texas as a threat to the state’s crucial oil and gas industry. Abbott responded by signing SB 13, also known as the Investment Protection Act, into law in 2021. The law forbids several state entities, including some sovereign wealth funds, from doing business with any company that discriminates against Texas energy producers in the oil and gas industry.

SB 13 also mandated that the state comptroller compile a list identifying any company that might be in violation. Eventually, BlackRock and nine other companies appeared on Hegar’s list.

This conflict had an intensely public element. When BlackRock posted on Twitter last spring that it was “proud to invest in the future of Texas,” Abbott continued his campaign against the firm.

“I signed laws that banned BlackRock from participating in the Texas financial system because of its ESG policies that were hostile to the oil and gas industry. It cut them out [of] the multi-billion dollar public finance system in Texas. They’re losing money because of it,” the governor responded.

Yet, just a few months after this, when TXSE was announced, the governor’s tone was completely different.

“Texas Poised for Its Own Stock Exchange: Promising Less Red Tape Than NYSE or Nasdaq. A place where the only agenda is capitalism,” Abbott wrote on X.

Hegar concurred.

“With the Texas Stock Exchange headquarters in the works, backed by $120M from investors, it’s a strong signal that Texas remains welcoming to business. This move could attract more companies and jobs to the city,” he posted.

DX contacted both officials to ask what prompted their change of heart.

Abbott’s office relayed a Squawk Box interview wherein the governor answered a similar question on CNBC. The governor told the program that the ESG movement was “changing rapidly,” and he believed the TXSE would help companies avoid ESG.

Hegar’s office saw no connection between SB 13 divestment and TXSE. His spokesman offered a previous statement from Hegar that read in part: “I welcome [BlackRock’s] support for Texas, but this is not part of the criteria for identifying candidates for listing.”

The comptroller’s comment seems to indicate that while he accepted BlackRock’s investment in Texas, he did not believe that this particular project was connected to his SB 13 list.

The statement continued, “BlackRock will be removed from the list of companies boycotting oil and gas as defined by state statute when they stop boycotting oil and gas as defined by state statute. Please see our FAQ document for more information on the listing process and criteria.”