Monetary policymakers have higher interest rates on their minds.

The Federal Reserve has already implemented one interest rate hike this year, an increase of 25 basis points (bps) — the equivalent of one-quarter of a percentage point — that bolstered the short-term borrowing rate from close to zero.

It was a stark shift to hawkish policy compared to that of the looser pandemic era. And while the Fed may just be getting warmed up, the end to cheap money is already reflected in rates on everything from mortgages to auto loans to credit cards.

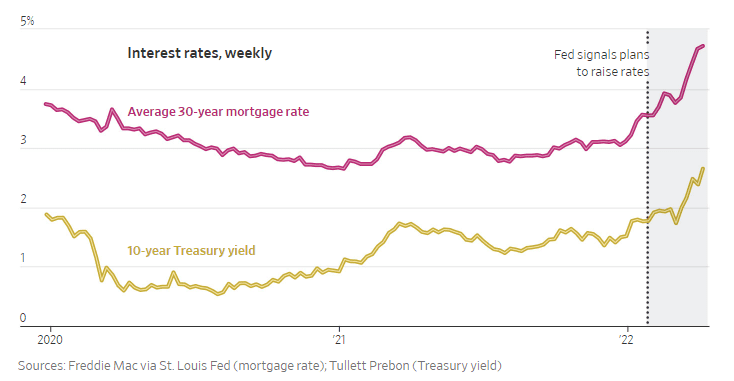

According to The Wall Street Journal, mortgage rates on a 30-year loan have climbed from 3% at the start of 2022 to 4.72% as of early April, and the new rate cycle has only just begun.

Borrowers are getting hit with a double whammy.

On the one hand, the rate on the 30-year mortgage is tied to that of the 10-year Treasury, the latter of which tends to increase during times of hawkish monetary policy like we are seeing now.

On the other, with the Fed exiting its pandemic-era positions in mortgage bonds, issuers are offering higher yields to entice investors, resulting in higher lender costs that spill over to borrower interest rates.

Image by the WSJ

The WSJ spotlighted one homebuyer, Jennifer Osorio, who set out to buy a new property in Houston, Texas, in 2022. When she started her journey, this homebuyer was facing rates of roughly 3.5%. However, she could not lock in a rate below 4.99% when all was said and done.

The higher rate shows up in her monthly mortgage payment, which ballooned by a couple of hundred dollars. In addition, instead of house hunting for a property worth $230,000, the buyer had to lower her listing-price range to $180,000 to afford it, placing her in the market for a condo instead of a house.

A similar dynamic is unfolding in the auto industry. The average interest rate on an auto loan for a new vehicle has risen from 3.86% in January to 4.21% this month.

At the same time, inflation is running rampant in the economy, soaring to a 40-year high of 8.5% in March. Americans are finding it more expensive to borrow money, and due to inflation, the dollar’s purchasing power has diminished.

Meanwhile, Greg McBride, the senior vice president and chief analyst of Bankrate, said in a tweet that the average credit card interest rate is hovering at 16.4%, its highest level since 2020.

McBride commented, “With [the] Fed poised to boost rates in bigger chunks, there’s a lot more where that came from.”

Latest @Bankrate survey shows average credit card rate rising to 2-year high of 16.43%. With Fed poised to boost rates in bigger chunks, there's a lot more where that came from

— Greg McBride, CFA (@BankrateGreg) April 13, 2022

Americans could be experiencing whiplash from the rising rates considering that borrowing costs have been low for the better part of the past two decades. Interest rates have been hovering in the low-single-digit range for the past 15 years, paving the way for cheap money, as it is known, for borrowers.

However, with inflation rearing its head in the economy, the Fed has been trumpeting the end of the low-rate environment as it looks to combat rising consumer prices with higher interest rates.

The next Fed meeting is planned for early May. Federal Reserve Bank of Chicago President Charles Evans predicts that a 50 bps rate hike could be in the cards.