Tech giant Amazon completed its purchase of movie studio MGM after U.S. regulators decided to look the other way, for now. Amazon’s $8.5 billion blockbuster purchase of MGM, underway since last May, bolsters its entertainment catalog by 25,000 hours across 4,000-plus movies and 17,000 television episodes.

Amazon hasn’t made an acquisition of this magnitude since its 2017 purchase of Whole Foods. The company’s mode of operation is generally to scoop up smaller businesses, like shoe retailer Zappos in 2009 and gaming platform Twitch in 2014, before they could pose a more serious threat of competition. Amazon needed to make a bold statement in the burgeoning streaming market this time.

MGM’s Academy Award-winning films will likely attract more subscribers to Amazon’s Prime platform. MGM boasts content like James Bond and Rocky (along with its many sequels), not to mention classics such as Thelma & Louise or Silence of the Lambs, among others.

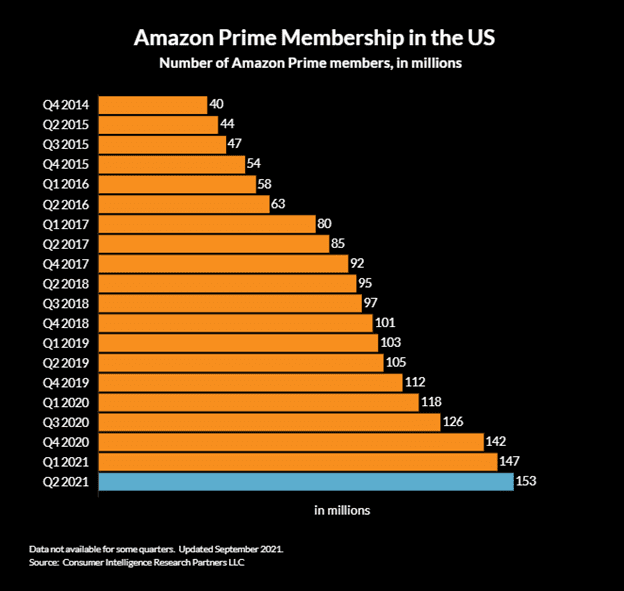

Bloomberg predicts that the content could also be used on Amazon’s ad-based IMDb TV platform. CIRP estimates there are 153 million U.S. Amazon Prime members, a number that has been steadily climbing over the years.

- Image by Digital Commerce 360

Amazon had to clear two regulatory hurdles for the deal: the European Commission and the U.S. Federal Trade Commission (FTC). After regulators across the pond gave Amazon the green light on March 15, declaring that a merger with the nearly century-old movie house would not stifle competition, the antitrust ball was in the court of their U.S. counterparts.

The FTC had until mid-March to stop the deal, in which case it would sue Amazon. So far, the U.S. regulator has opted to stay out of it, but they could change their minds if they decide the merger violates the law, per Reuters.

Amazon Disruption

Big Tech has a history of reportedly disrupting sectors that it targets, including retail, grocery, and even financial services.

Amazon Founder Jeff Bezos once said, “Your margin is my opportunity.”

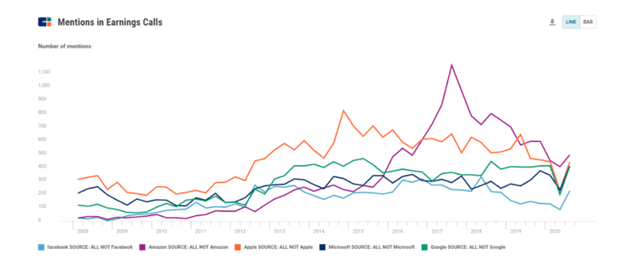

He was not kidding — Amazon is mentioned by name more than any other tech leader on the earnings calls of U.S.-based publicly traded companies, including Facebook, Microsoft, Apple, and Google.

The list of sectors ripe for disruption continues to grow as Amazon wraps up the first-ever acquisition of a media play by a technology company.

- Image by CBInsights

Competitive Landscape

Amazon’s acquisition ups the ante in an already fiercely competitive streaming content segment. Netflix, Hulu, Disney+, Apple TV, and others are all vying for a bigger slice of the pie.

Throughout the pandemic, demand for streaming has soared, with the number of online subscriptions globally hitting 1.1 billion in 2020. In the United States alone, subscriptions to digital content climbed 32% higher in that year to surpass 308 million, per Motion Picture Association data.

Amazon’s streaming content is already the crown jewel of its Prime service, the price of which increased last month for both monthly and annual memberships. Meanwhile, the e-commerce giant has doled out $24 billion for content and music streaming platforms in the past two years.

Streaming giant Netflix is undoubtedly feeling the heat.

According to Needham analyst Laura Martin on CNBC, the “streaming wars,” as they’re known, are in the “seventh inning,” and Netflix is falling short as competitors offer bundled services and lower price tiers.

As Amazon absorbs MGM, the movie studio is not expected to suffer any layoffs.