The price of the cryptocurrency Bitcoin (BTC) is barely holding onto the psychologically sensitive $20,000 level as economic numbers are released this month. The latest inflation data is out, with the Consumer Price Index climbing a higher-than-expected 0.4% in September versus estimates for 0.3%. For the year, the economy is looking at an inflation rate of 8.2%.

At first, in response to the CPI, the BTC price initially fell over 3%. This came as a surprise since this is a digital asset designed to protect investors from inflation. Unlike the U.S. dollar, whose supply can be manipulated by monetary policy, Bitcoin has a finite supply of 21 million coins. Most recently, Bitcoin has since moved slightly in the green, up 1%, but not enough to erase this week’s 5% decline.

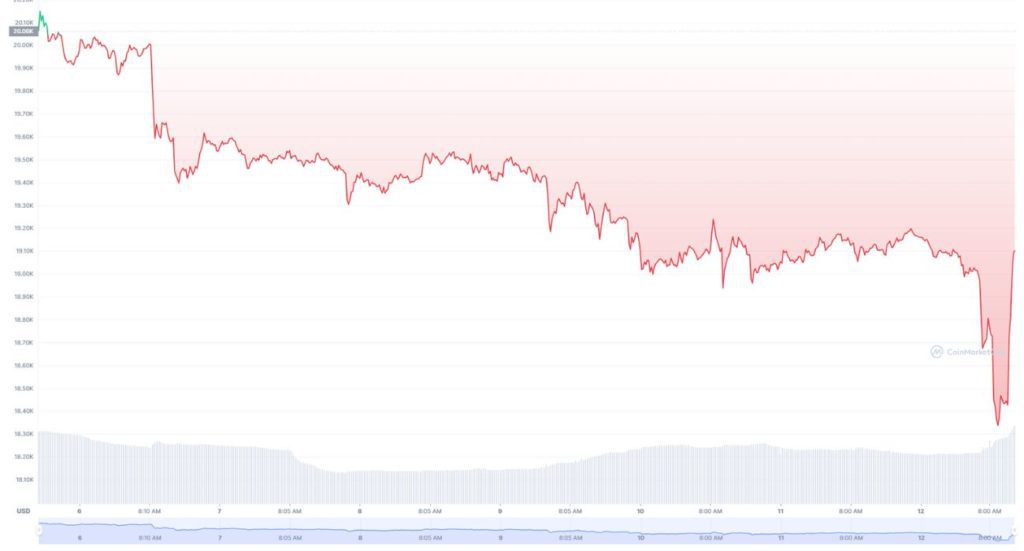

Below is a chart of Bitcoin’s plight over the past five days despite hopes that the market bulls would wrestle back control from the bears after the latest inflation data.

-

Bitcoin Seven-Day Chart | Image by CoinMarketCap

After Bitcoin came close to breaching $70,000 last November, the market has been stuck in what is known as crypto winter. The price has tumbled nearly 60% so far this year. Adding insult to injury for investors is the fact that inflation is running hot in the economy, brewing conditions that are ripe for an inflationary hedge like BTC to thrive.

However, as investors have seen, the markets are treating Bitcoin more like a technology stock than a safe-haven asset, which has been its downfall in the current risk environment.

With inflation running hot, the indication is that the Federal Reserve will continue to increase short-term interest rates. Investors appear to be interpreting this to mean that consumer prices cannot increase forever and, therefore, must be nearing a peak.

Charles Schwab Chief Investment Strategist Liz Ann Sonders made this point when she told CNBC, “We get this last gasp higher in inflation and from here we start to decelerate.”

With the negative sentiment around digital assets lately, Bitcoin has taken some crypto-related stocks down with it. These include crypto exchange company Coinbase (down 11%), MicroStrategy, a tech company with billions of dollars worth of BTC on its balance sheet, down 5%, and blockchain-friendly Block/formerly Square, down 6%.

Pierre Rochard, vice president of research at Riot Blockchain, argues that Bitcoin is doing what one should expect from a “revolutionary technology” — trading in a volatile manner. Bitcoin is revolutionary in that it can be sent peer-to-peer and in nearly real-time without the need for a traditional trusted intermediary, such as a bank, to facilitate the transaction.