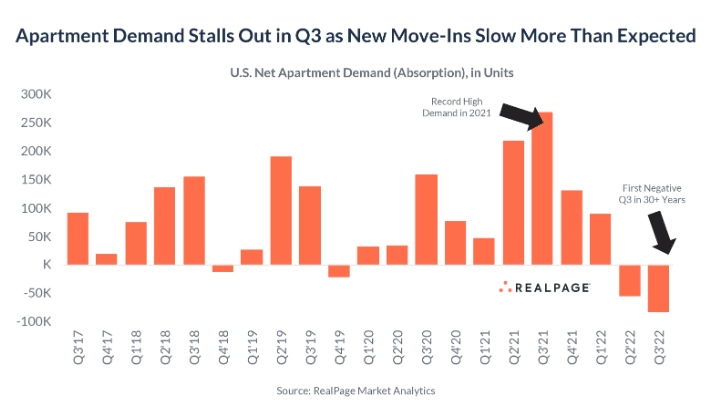

Peak apartment demand could be in the rearview mirror following a significant drop in apartment demand in the third quarter, typically the busiest season for new apartment leases.

Apartment demand fell in Q3 2022 by more than 82,000 units across the United States, according to RealPage, a property management software firm. RealPage described a “freeze in new household formation.”

Weaker demand did not discriminate across price points or regions of the country.

The downturn in the apartment leasing market resembles what is also playing out in the for-sale real estate market. With fewer Americans on the hunt for a new home, potential homebuyers and prospective renters could have more negotiating power.

Apartment demand in Q3 had not flipped into the negative in the three decades RealPage has been recording the data.

The change in demand represents a paradigm shift from the market dynamics during the COVID-19 pandemic between 2020 and the early part of this year when there was not enough apartment supply to meet demand.

Image by RealPage

As apartment demand waned in Q3, vacancies climbed by a single percentage point in the quarter. Still, they remained below the 5% level, which despite a softening market, does not yet signal an emergency, according to Real Page.

CNBC cites RealPage head of economics and industry principals Jay Parsons as saying that consumer confidence is low, evidenced by a one-two punch of declining leasing numbers and lower home sales. With inflation still punishing Americans, consumers will likely remain on the sidelines of the housing market until greater certainty materializes, Parsons suggested.

Renters are seeing some relief in these conditions, with asking rents falling by 0.2% in September — something they have not done since year-end 2020. However, these conditions are not expected to last forever, considering other economic indicators suggest that consumers are in a decent financial position despite low confidence.

For example, through the first eight months of this year, household incomes for people who signed new leases rose 13% since last year, resulting in a rent-to-income ratio of over 23%. Meanwhile, rent collection levels rose to 95.4% in August compared to just under 95% in August 2021.

In addition, Parsons said that if jobs and wages continue to hold steady and consumer prices ease, apartment rental demand could be unleashed in time for the spring 2023 rental season.

A wildcard is a potential glut in the apartment unit supply, with apartment construction hovering at its highest level in four decades. If demand continues to fall, the apartment leasing market could see some real pain ahead.