The yuan could soon muscle the dollar out of the way in Saudi Arabia’s crude exports to China. According to a report in The Wall Street Journal, the two countries are in talks about the possibility of selling oil to Beijing in yuan instead of the U.S. dollar. Such a shift by the world’s biggest oil exporter would deliver a blow to the U.S. dollar, weakening its influence in the global oil markets while simultaneously emboldening Asia. Talks between Saudi and Chinese officials on this topic have been on-again, off-again for the better part of a decade, the WSJ reports, but negotiations ramped up as the Arab nation’s frustration with the United States came to a head in recent months. Now discussions are back on as officials from the capital cities of Riyadh and Beijing hash out a plan to potentially begin pricing a portion of oil sales to China in yuan, according to Fox News. China buys more than one-quarter of Saudi Arabia’s oil exports, prompting the kingdom to consider pricing over 25% of its approximately 6.2 million barrels per day of oil exports in yuan instead of the dollar. Doing so could bolster the yuan’s status globally as demand for China’s currency strengthens. A shift away from the dollar would add insult to injury to the United States, considering more than three-quarters of oil sales worldwide are currently settled in dollars, per the WSJ. The United States has just banned oil exports from Russia and may unwind sanctions on Venezuela for a cut of its oil production. If the kingdom follows through with its plans, such a shift would be a change of historic proportions. Fox Business reports Saudi Arabia, the world’s leading exporter of crude oil, has been pricing its contracts in the U.S. dollar since the early 1970s when then-President Richard Nixon struck an agreement with the country amid soaring oil prices. In exchange for doing so, the Saudis received security guarantees for their military, paving the way for better relations between the West and the Arab nation. According to Fox Business, the Saudis are upset by the United States’ lack of backing for their engagement in Yemen’s civil war, as well as the Biden administration’s attempt to reach an agreement with Iran over its nuclear program. Saudi officials claimed they were taken aback by the United States’ abrupt pullout from Afghanistan last year. However, this is not the first time that Saudi Arabia has considered pricing oil exports in yuan over the dollar; so far, it has never proven to be more than talk. Currency strategists cited by Bloomberg are skeptical that the Saudis are serious and instead suspect that they are crying wolf during the heightened geopolitical uncertainty.

- Image by Bloomberg

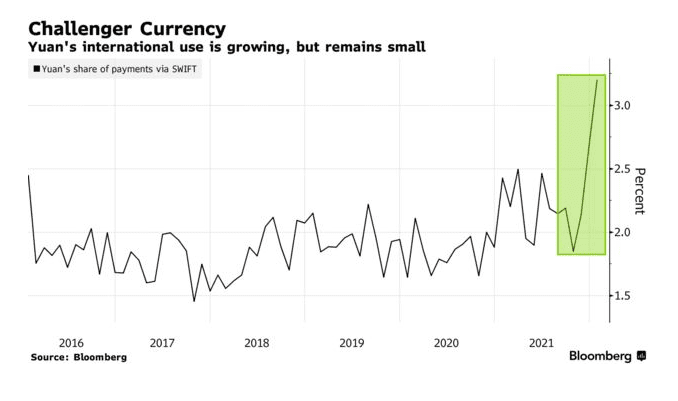

Guillaume Tresca, the senior emerging markets strategist at Generali, told Bloomberg the Saudis are trying to get President Biden’s attention. Forex.com’s Matthew Weller said that there could be “two parallel financial systems globally” eventually but added, “This is not the game-changer.” In addition, the Saudi riyal is tied to the U.S. dollar. As a result, if the kingdom were to compromise the dollar’s influence, it would likely backfire. Nordea senior macro strategist Witold Bahrke chalks the drama up to another failed attempt to “call the demise of the dollar.” If such experts are correct, the dollar’s reputation as the global reserve currency is not under siege, especially considering the yuan’s minor role on the worldwide stage. Meanwhile, WTI (West Texas Intermediate, a type of crude oil) prices have been beyond volatile of late, as, according to Morgan Stanley analysts, meandering above and below the $100 level during the week.