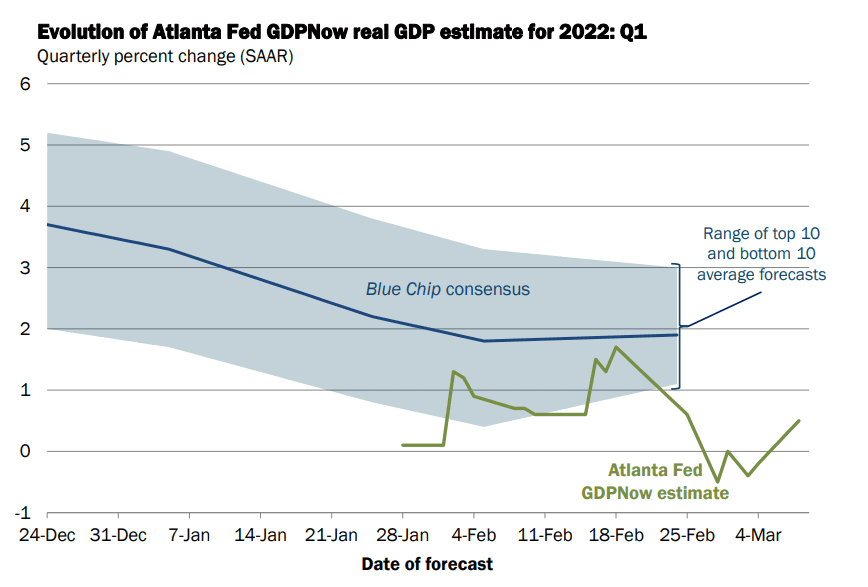

A “perfect storm” — persistently sky-high inflation and potentially stalled economic growth — is reportedly brewing in the American economy, the likes of which have not been seen since the 1970s. The one-two punch has led to a looming threat of stagflation, a phenomenon that occurs when consumer prices are rising, but the economy has all but come to a screeching halt. Further exacerbating these precarious conditions is a high unemployment rate, leading to an apparent nosedive in consumer sentiment. According to SUNY Old Westbury economics professor Veronika Dolar, cited by “The Conversation,” all the key economic indicators are flashing red with no good news to offset them. As a result, investors are facing a shifting landscape, one in which everything that worked for the past decade will no longer produce the desired results, according to Peter Schiff, economic forecaster and chairman of SchiffGold. Inflation soared to 7.9% in February, a level it had not reached in 40 years, and it could just be the tip of the iceberg. Soaring oil and gas prices in the wake of Russia’s invasion of Ukraine were, for the most part, not factored into last month’s results considering the war began on February 24. Adding insult to injury, the Atlanta Fed recently slashed its first-quarter 2022 U.S. GDP forecast to zero, the latest in a series of cuts around economic growth. The estimate has since been revised to 0.5% but, at mid-month, remains fluid; if history is any indication, the economic pendulum could swing in either direction.  Source: AtlantaFed.org Back to the Future for Energy Prices In the meantime, the economy could be dangerously close to revisiting the stagflation scenario that plagued Americans in the 1970s, when oil prices quadrupled amid an OPEC-fueled embargo against the U.S., panic set in, and a gas shortage ensued. Those events are not too far in the rearview mirror. Based on Google Trends data, Americans are increasingly aware of the possibility that stagflation could creep back into the economy, with searches for the term growing about fivefold in March. In an attempt to stem unruly inflation, the Federal Reserve decided during its mid-March meeting to raise interest rates. The 0.25 percentage point increase puts in motion a plan by Federal officials for rates to approach 2% by December 2022, up from near zero since early in the pandemic. Before March’s meeting, policymakers had not increased interest rates in more than three years. After lifting rates in December 2018, the Federal Reserve reversed course and began lowering them the following summer. Due to the rising rate environment, borrowing money became more expensive for consumers. As a result, the Fed predicts that economic growth will take a hit this year, with inflation projections having worsened since the outlook at year-end 2021. The Federal Open Market Committee is bracing for a 4.1% increase in consumer prices for things like food in 2022, up from a previous forecast of 2.7%. Back in the 70s, stagflation “fundamentally altered” the way of life for Americans, introducing the most severe period of “fuel conservation and rationing” since WWII, Dolar noted. The U.S. economy may still have a chance to avoid a repeat of history — but apparently not without some pain along the way. Mark Zandi, chief economist at Moody’s Analytics, predicts that the Fed’s answer to impending stagflation could be to induce a recession. “They’d rather push us into a recession sooner than get into the stagflation scenario and a much worse recession later,” Zandi said. Fed Chairman Jerome Powell, however, has a more glass-half-full view of the situation, and is not worried about the economy tipping into recession in the near term. “All signs are that this is a strong economy,” Powell said. “Household and business balance sheets are strong.”

Source: AtlantaFed.org Back to the Future for Energy Prices In the meantime, the economy could be dangerously close to revisiting the stagflation scenario that plagued Americans in the 1970s, when oil prices quadrupled amid an OPEC-fueled embargo against the U.S., panic set in, and a gas shortage ensued. Those events are not too far in the rearview mirror. Based on Google Trends data, Americans are increasingly aware of the possibility that stagflation could creep back into the economy, with searches for the term growing about fivefold in March. In an attempt to stem unruly inflation, the Federal Reserve decided during its mid-March meeting to raise interest rates. The 0.25 percentage point increase puts in motion a plan by Federal officials for rates to approach 2% by December 2022, up from near zero since early in the pandemic. Before March’s meeting, policymakers had not increased interest rates in more than three years. After lifting rates in December 2018, the Federal Reserve reversed course and began lowering them the following summer. Due to the rising rate environment, borrowing money became more expensive for consumers. As a result, the Fed predicts that economic growth will take a hit this year, with inflation projections having worsened since the outlook at year-end 2021. The Federal Open Market Committee is bracing for a 4.1% increase in consumer prices for things like food in 2022, up from a previous forecast of 2.7%. Back in the 70s, stagflation “fundamentally altered” the way of life for Americans, introducing the most severe period of “fuel conservation and rationing” since WWII, Dolar noted. The U.S. economy may still have a chance to avoid a repeat of history — but apparently not without some pain along the way. Mark Zandi, chief economist at Moody’s Analytics, predicts that the Fed’s answer to impending stagflation could be to induce a recession. “They’d rather push us into a recession sooner than get into the stagflation scenario and a much worse recession later,” Zandi said. Fed Chairman Jerome Powell, however, has a more glass-half-full view of the situation, and is not worried about the economy tipping into recession in the near term. “All signs are that this is a strong economy,” Powell said. “Household and business balance sheets are strong.”

U.S. Economy Could Be in Danger of Stagflation

Articles like this one are available completely free, 365 days a year.

Your support ensures Dallas Express remains an alternative to legacy media — independent, fearless, and paywall-free.

Give now