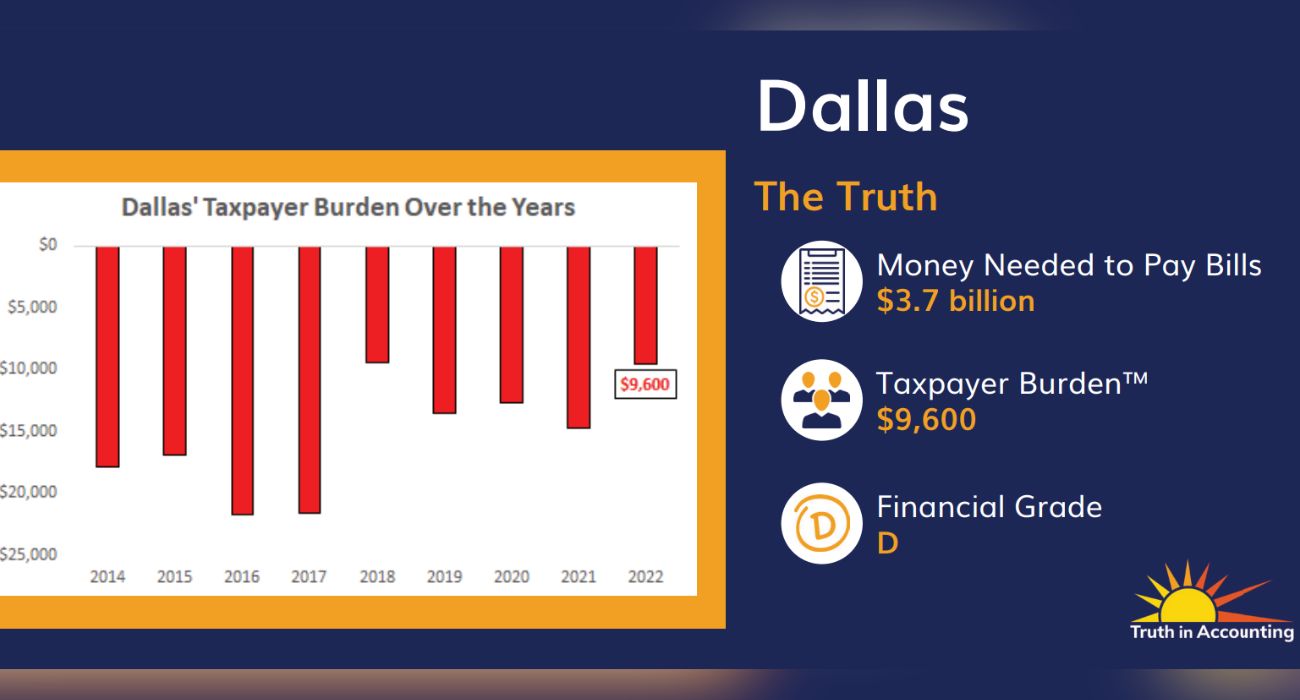

The City of Dallas is in a $3.7 billion financial hole, largely due to officials shorting the City’s pension plans for employees.

The nonprofit Truth in Accounting released its annual report earlier this year on the financial state of cities across the United States, which concluded that Dallas is $3.7 billion behind on its bills, resulting in a $9,600 burden to each City taxpayer on average and a financial grade of “D” for the City.

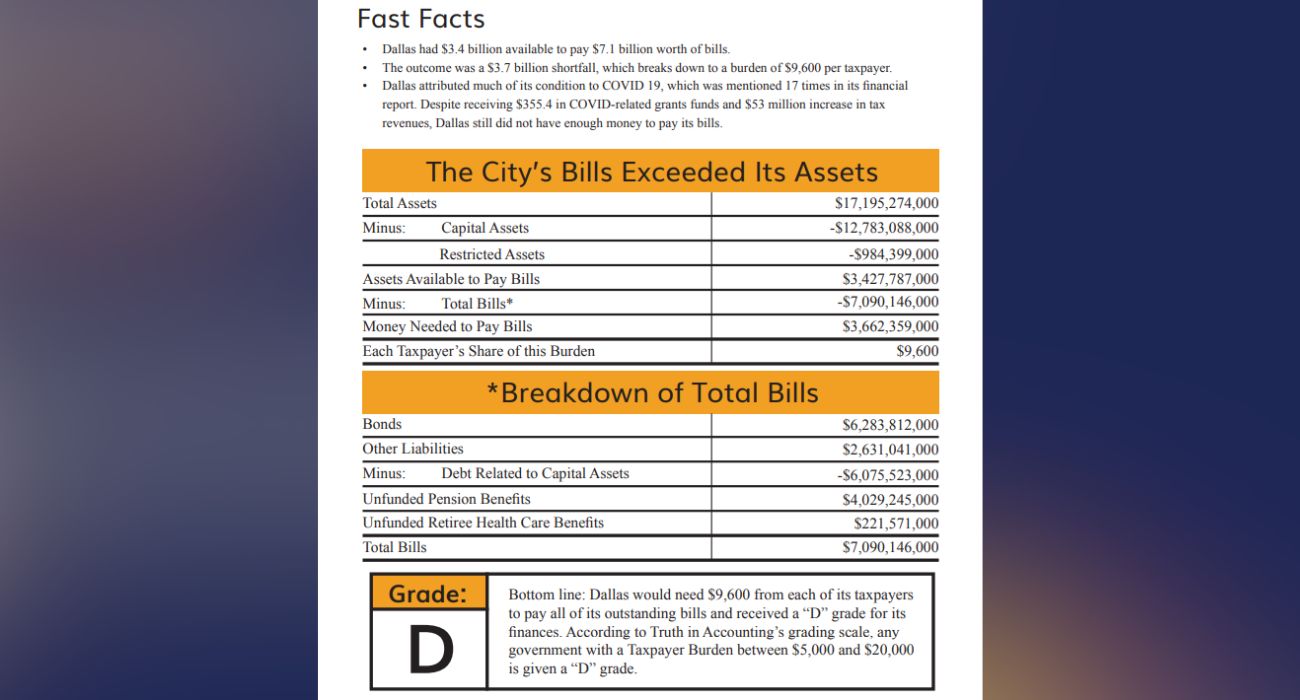

“Dallas had $3.4 billion available to pay $7.1 billion worth of bills,” the report reads.

Truth in Accounting founder and CEO Sheila Weinberg explained to The Dallas Express what this means for local taxpayers.

“The money needed to pay bills can be looked at like a credit card,” she said. “This is the money that the elected officials have put on the taxpayer’s credit card. It’s like handing every single taxpayer an additional credit card balance of $9,600, which will have to be paid off over time.”

Weinberg noted that this means City taxpayers will be paying for services rendered to prior residents. “Those services and benefits were used by prior taxpayers, and the future taxpayers are stuck with paying that balance off,” she said.

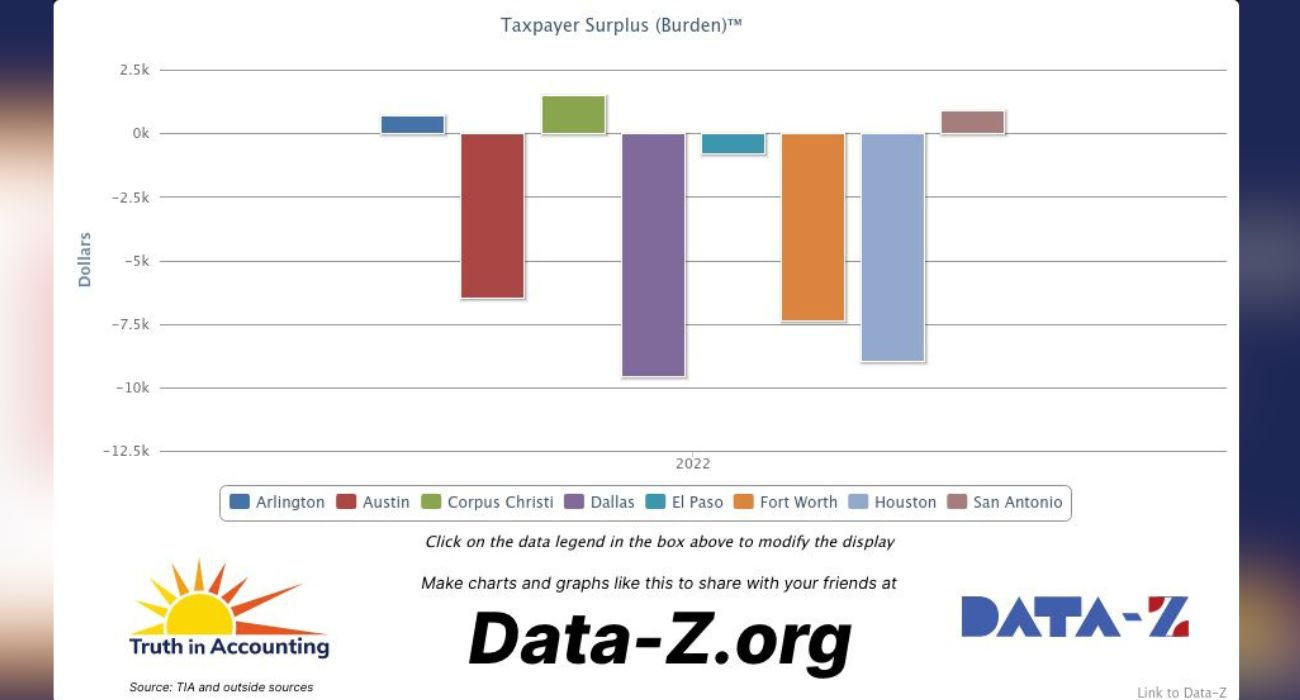

Dallas has the highest taxpayer burden of any major Texas city, according to Truth in Accounting.

Weinberg explained that Truth in Accounting analysts reached their findings by reviewing the City of Dallas’ financial reports.

“We [looked at] the total assets that are reported on the audited financial statements, [then] we subtracted their capital assets because you shouldn’t be selling your house to pay off your credit card debt,” she said. “And we [subtracted] some restricted assets, which are restricted by law or contract, to come up with that $3.4 billion available to pay bills.”

“We subtracted the bills — $7.1 billion, [including] bond debt, other debt, pension debt, and retiree healthcare debt,” she continued. “It does not include the debt related to capital assets because that would be equivalent to the mortgage on your house. If we’re not including your house, then we are not including the mortgage related to that house.”

Weinberg said “most” of the City’s $3.7 billion deficit is from its pension system. As previously covered by The Dallas Express, the Dallas Police & Fire Pension System has been estimated by an independent actuary as having $3.5 billion in unfunded liabilities.

The City of Dallas is required to pass a balanced budget every year, according to state law. However, Weinberg said officials have functionally skirted this requirement by shorting their employee pension plans — both the police and fire pension and the Employees’ Retirement Fund.

Such shorting of the pension funds comes as the Dallas Police Department continues to labor under a serious staffing shortage, coming in roughly 1,000 officers fewer than what has been advised by a previous City analysis that approximately 4,000 are necessary to properly ensure public safety and bring down police response times.

“They offered employees pensions as part of their compensation cost but then did not properly fund those pension benefits in the period that the employee earned those benefits,” said Weinberg.

In 2022, an actuary recommended the City contribute around $107,167,000 to the Employees’ Retirement Fund and around $228,658,000 to the Dallas Police & Fire Pension. However, the City only contributed roughly $68,492,000 and $169,910,000 to those plans, respectively, shorting the Employees’ Retirement Fund by 36% and the Dallas Police & Fire Pension System by 25%.

“Those costs were pushed off onto future taxpayers,” Weinberg said.

“If you had credit card debt and you were trying to keep your personal budget balanced, would you consider your budget balanced if you didn’t pay the minimum on your credit card debt?” she added. “You would say, ‘No, I should be paying at least the minimum.’ They’re not even paying the minimum.”

Weinberg explained that while most private businesses budget on an “accrual basis,” many governments use a “cash basis.”

“In governments, they use the cash basis to calculate their budget. So if they get a bill, and then they don’t pay the bill until next budget year, they don’t have to include that in their budget,” she said. “It’s only the cash going in and the cash going out.”

“So they can pretend that they balance their budget because they chose not to fully fund [the pensions],” Weinberg added.

General concerns about taxpayer spending have been a hot topic at Dallas City Hall as of late, regarding both the current City budget of $4.6 billion and the 2024 Bond Program that the Dallas City Council recently approved with a total capacity of $1.25 billion.

Council Member Cara Mendelsohn (District 12) has been the loudest voice on the council speaking against the ever-increasing City spending. When asked for comment, she directed The Dallas Express to a memo she wrote last August while the council was determining the FY23-24 budget in which she warned of an upcoming “financial cliff” within the next few years.

The current budget notes a “structural deficit” that the City will face in three to five years if “responsible budget decisions” are not made.

“The exercise of creating a five-year forecast is to remain alert and vigilant of challenges and ‘financial cliffs’ ahead,” Mendelsohn wrote. “It is deeply concerning that we are aware of a significant, impending challenge to our city’s fiscal health and that there is not a proposed course correction before we come to the edge of the cliff.”

As previously reported by The Dallas Express, Mendelsohn proposed adopting a no-new-revenue budget amendment to rein in City spending and provide relief to Dallas taxpayers. This effort was vocally supported by Mayor Eric Johnson but not adopted as the majority of the council voted against it.