TOP STORIES

MORE NEWS

City of Dallas Murder Victims*

| YTD 04/03/24 |

% of Total |

|

| Black | 35 | 66.1% |

| Hispanic White | 14 | 26.4% |

| Non-Hispanic White | 4 | 7.5% |

| Other | 0 | 0% |

| Total | 53 | 100% |

Other Crime Statistics

• Alleged Hate Crimes to Total Crimes YTD: 0.02%

• YTD avg police response time to reported random gunfire: 168.2 min. **

* Includes murder and non-negligent manslaughter.

** This is just one category of the response times that the city reports on daily.

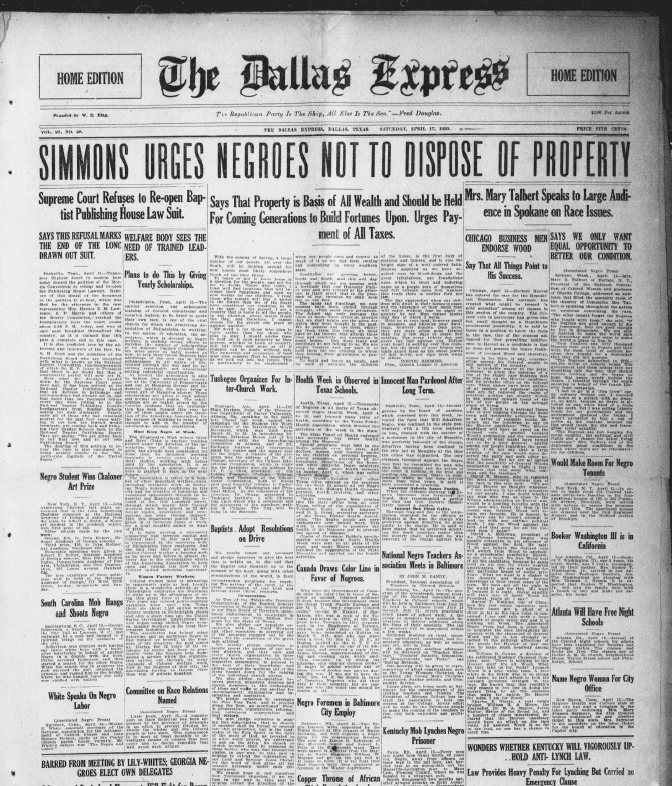

THIS WEEK IN

DX HISTORY

MOST READ

-

Dallas Migration Panel: ‘Parts of America We Have To Destroy’

6.7k views

Dallas Migration Panel: ‘Parts of America We Have To Destroy’

6.7k views

- California Mom Wants Child Castrated Without Father's Consent 6.0k views

- Iran Pushes World to Brink of War With Attack on Israel 4.9k views

- Boot Scootin' Larceny: DX Witnesses Thefts 3.8k views

- TX Lawmaker Worked for Anti-School Choice Lobbying Firm 3.7k views