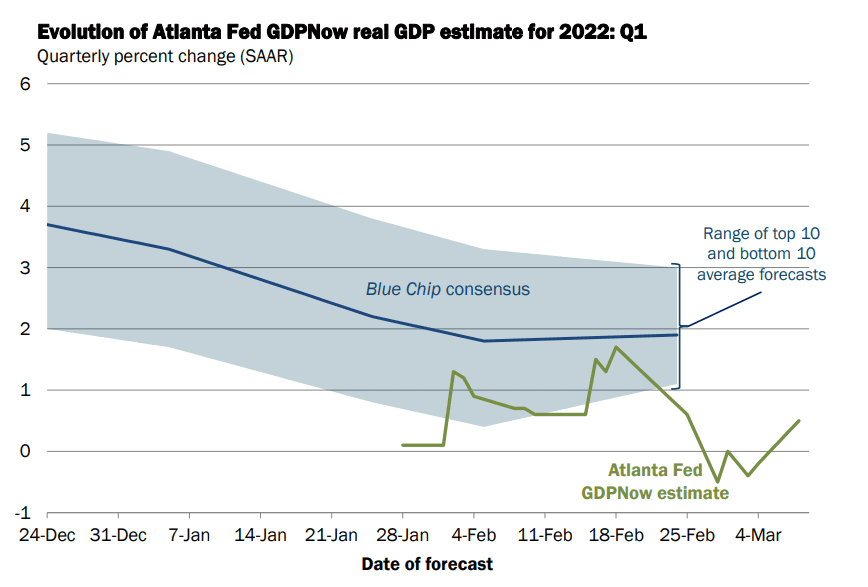

A “perfect storm” — persistently sky-high inflation and potentially stalled economic growth — is reportedly brewing in the American economy, the likes of which have not been seen since the 1970s. The one-two punch has led to a looming threat of stagflation, a phenomenon that occurs when consumer prices are rising, but the economy has all but come to a screeching halt. Further exacerbating these precarious conditions is a high unemployment rate, leading to an apparent nosedive in consumer sentiment. According to SUNY Old Westbury economics professor Veronika Dolar, cited by “The Conversation,” all the key economic indicators are flashing red with no good news to offset them. As a result, investors are facing a shifting landscape, one in which everything that worked for the past decade will no longer produce the desired results, according to Peter Schiff, economic forecaster and chairman of SchiffGold. Inflation soared to 7.9% in February, a level it had not reached in 40 years, and it could just be the tip of the iceberg. Soaring oil and gas prices in the wake of Russia’s invasion of Ukraine were, for the most part, not factored into last month’s results considering the war began on February 24. Adding insult to injury, the Atlanta Fed recently slashed its first-quarter 2022 U.S. GDP forecast to zero, the latest in a series of cuts around economic growth. The estimate has since been revised to 0.5% but, at mid-month, remains fluid; if history is any indication, the economic pendulum could swing in either direction.

Support our non-profit journalism

Most Read

-

Patients Want Body Parts 'Put Back On' Post-Trans Surgery 8.5k views

- Disney-Themed Drag Show Devolves Into Protest at Local Bar 8.4k views

- 15 Arrests Made in Sting Targeting Online Child Predators 5.5k views

- Broadnax's Permit Department Under Fire After Office Blunder 4.4k views

- Biden Admin Has Made It Harder To Deport Criminal Migrants 3.1k views