TOP STORIES

MORE NEWS

City of Dallas Murder Victims*

| YTD 04/03/24 |

% of Total |

|

| Black | 35 | 66.1% |

| Hispanic White | 14 | 26.4% |

| Non-Hispanic White | 4 | 7.5% |

| Other | 0 | 0% |

| Total | 53 | 100% |

Other Crime Statistics

• Alleged Hate Crimes to Total Crimes YTD: 0.02%

• YTD avg police response time to reported random gunfire: 168.2 min. **

* Includes murder and non-negligent manslaughter.

** This is just one category of the response times that the city reports on daily.

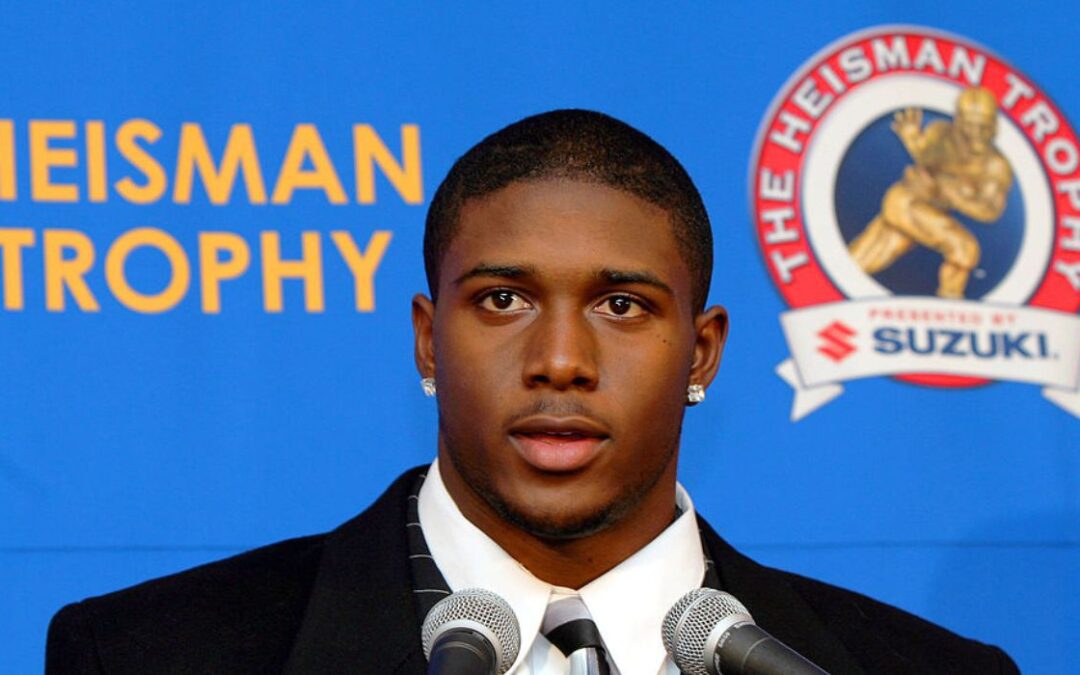

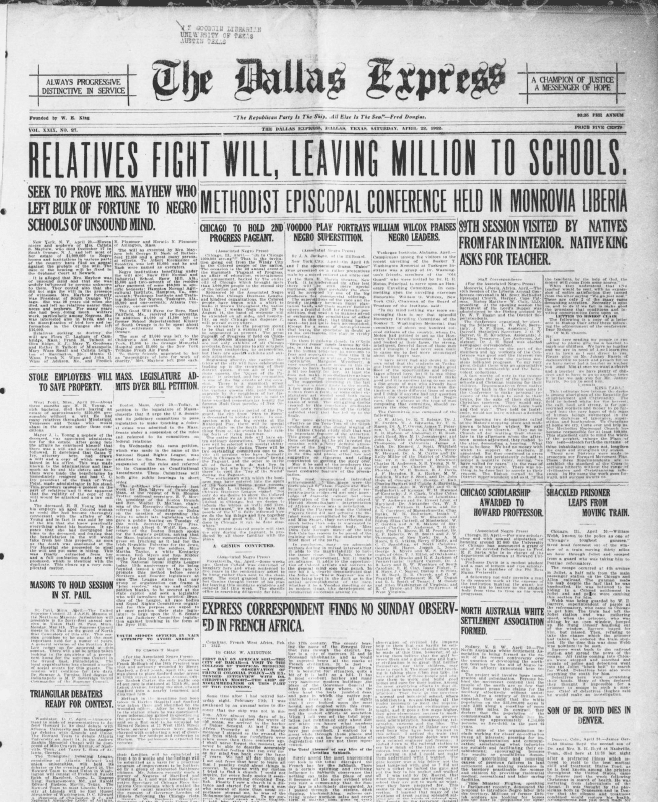

THIS WEEK IN

DX HISTORY

MOST READ

-

Patients Want Body Parts 'Put Back On' Post-Trans Surgery

8.5k views

Patients Want Body Parts 'Put Back On' Post-Trans Surgery

8.5k views

- Disney-Themed Drag Show Devolves Into Protest at Local Bar 8.4k views

- 15 Arrests Made in Sting Targeting Online Child Predators 5.5k views

- Broadnax's Permit Department Under Fire After Office Blunder 4.4k views

- Biden Admin Has Made It Harder To Deport Criminal Migrants 3.1k views